Réinitialiser. Resetten. Zurücksetzen. Reset.

This is the fourth and final article in this mini-series on post-2020 consumer trends, written exclusively for Research World. In previous weeks, we’ve looked in-depth at consumer trends in Asia and the US, based on our recently published 2021 Culture + Trends Report: Happiness Reset. In this article, we’ll focus on Europe, a seemingly harmonious region on the surface, which reveals unexpected cultural nuances when we dig a little deeper. Before we dive into the data, a quick recap on what it’s all about.

If you remember, our new report Happiness Reset is based on a three-part proprietary study conducted at the end of 2020:

- A macro environmental analysis to establish how the events of 2020 have shaped how consumers seek and attain happiness.

- Application of our Human Drivers Model (encompassing seven universal drivers of happiness) and qualitative exploration with 16 leading-edge consumer Illume Guides.

- Quantification of the 14 trends identified, amongst 15,000+ consumers in 16 markets (Australia, Belgium, Brazil, China, France, Germany, Hong Kong SAR, Indonesia, the Netherlands, the Philippines, Singapore, South Africa, South Korea, Thailand, the UK and the US).

Katia Pallini, our Content Marketing Director based in Belgium, explains what sets this approach apart from the many reports out there: “As researchers, we not only want to understand which trends are shaping and manifesting around the world, but also how this happens. By adding a quantitative layer to the approach through measuring consumers’ attitudes towards the trends, as well as how they are acting upon the trend when buying brands, we’re able to report trend scores and a global trend mapping.”

Our study concluded that the events of 2020 have undoubtedly shaped how consumers all over the world seek and attain happiness. With the pandemic acting as a catalyst for this ‘happiness reset’, we’ve witnessed slow-moving trends accelerating, as well as the emergence of entirely new trends. This is driving new behavior and expectations towards brands which we measured for each of the 14 trends identified in our report, allowing us to report a trend ‘score’ and trend mapping for each.

So, what characterizes the post-2020 consumer in the Europe?

Defining the post-2020 consumer in Europe

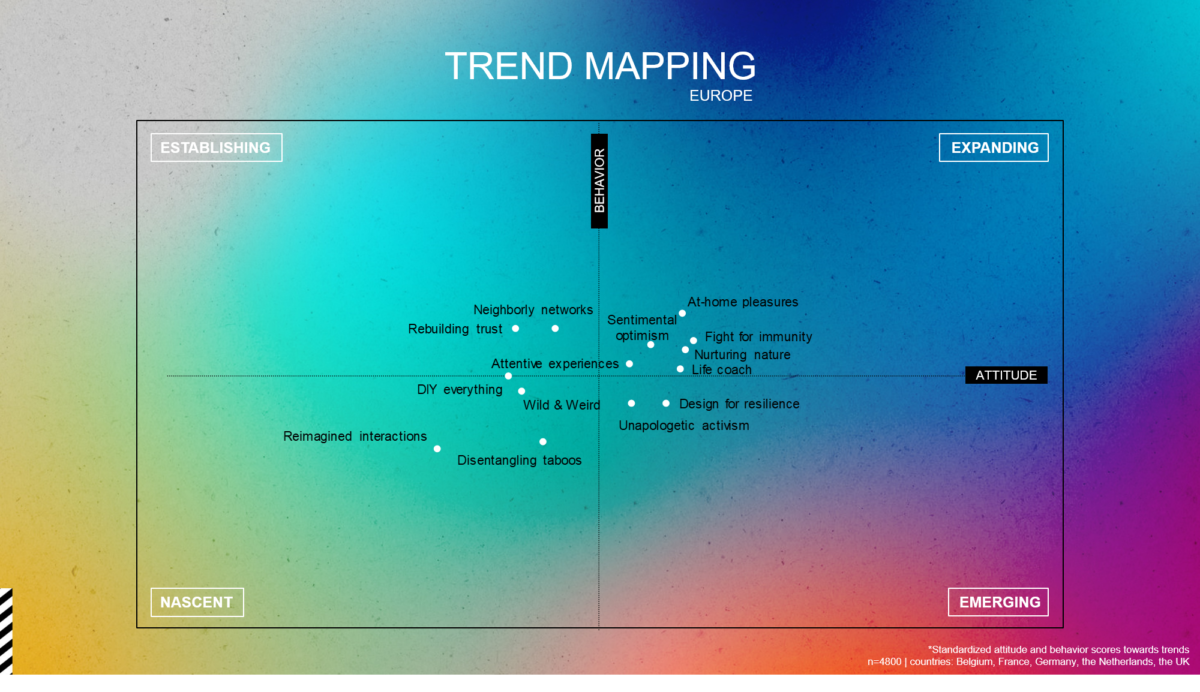

Compared to Asia and the US, we see that the trends in Europe, similar to the global picture, are fairly bunched in the center of the attitude and behavior mapping, but that’s not to say that the countries studied within Europe think and act alike.

Let’s take ‘Unapologetic Activism’, where we see that the exposure of consumers to visible systemic injustices has sparked them to act and drive social reform. Consumers that identify with this trend state that they “have a responsibility to call out injustice and discrimination”. The trend score for ‘Unapologetic Activism’ is interestingly much higher in the UK (74%) compared to Europe as a whole (68%) and the global perspective (72%). This trend hasn’t gone unnoticed by brands in the UK; in response to the Black Lives Matter movement, beauty brand Space NK made a commitment to only display testers for brands that include all skin shades and to provide testers and stock for all complexions in every store. Meanwhile, financial services company Santander pledged to support businesswomen across the UK through their Women Business Leaders’ Mentoring Programme. Andy Cumming, Managing Director in the UK, commented: “With 66% of UK consumers currently identifying with this trend, we expect to see a growing desire from them to act upon it in the near future by choosing to buy from brands that actively call out injustices in society. 41% of consumers surveyed globally reported that there were no sectors specifically answering this need, providing a significant opportunity for brands that are willing to break away from the group and speak up through their products and services.”

A second breakaway trend in Europe is that of ‘At-home Pleasure’, where we see that spending more time at home is making consumers crave highly pleasurable and sensorial experiences. Consumers that identify with this trend state that they “want to experience luxury and pleasurable moments at home”. For this trend, we see a slightly higher score for Europe (77%) than globally (75%), but the score is even higher in Germany (91%). “We’ve seen a huge offering from brands playing in this space over recent months. For example, the German newspaper Zeit organized an in-home wine tasting event to celebrate Beethoven’s 250th birthday back in November. Meanwhile, the German homewares brand Frankfurter Brett expanded their offering in 2020 thanks to the spike in demand for luxury, in-home cooking experiences. Global streaming platform Netflix experienced a 30% growth in Germany in 2020, with a German subscription increase from 6.5 million to 8.5 million by the end of the year,” added Anita Peerdeman, Managing Director of our German office.

Last but not least, we come to ‘Wild & Weird’, where we see consumers consciously creating time for spontaneous, silly moments to fight the relentless cycle of negativity in the world. Consumers that identify with this trend state that they “feel it is essential to let go of negativity by being silly and spontaneous”. Globally, the trend score for ‘Wild & Weird’ is 63% compared to 67% in Europe, but if we deep dive per country, we see France (78%), Belgium (72%) and the Netherlands (70%) above the European average, whilst Germany (66%) and the UK (50%) fall below it. In fact, for France and Belgium, we see the trend move quadrants, from Nascent at a regional level to Expanding at a local level. Despite the low global trend score, we see media and entertainment brands tapping into ‘Wild & Weird’, from TikTok’s Nuntok performances to The Masked Singer’s international success. “It’s clear that we Belgians wish to celebrate life in a joyous way. In a recent conversation with one of our personal care clients, we hypothesized that when lockdown restrictions ease, we’ll see ‘nude’ shades making way for bold colors in fashion and beauty… allowing us all to show our wild and weird sides!”, remarks Sophie Van Neck, Managing Director of our Belgian office.

The role of brands

Whilst the European trend score for ‘Unapologetic Activism’ is lower than the global average, there are still opportunities for brands that can positively impact a cause and call out deep-rooted discrimination in society. Interestingly, the lowest trend score in Europe came from the Netherlands (61%), yet just last month we saw Dutch consumers protesting against the newly imposed COVID-19 curfew and government restrictions. To succeed in this trend, brands must authentically call out relevant issues specific to local markets.

Needless to say, ‘At-home Pleasure’ is a direct consequence of the pandemic lockdown restrictions witnessed in Europe and around the world. Although the trend is expanding in Europe, the market isn’t necessarily saturated. Consumers identified brands in this space across consumer electronics, home improvements, and media and entertainment, yet there remain opportunities for brands in other sectors to bring rewarding and luxurious moments into the home. From perfectly crafted cocktails to high-end furniture, being at home is no longer a pleasure compromise. Brands must offer new ways to feel great in a familiar environment if they are to succeed.

Definitely one to watch in the coming months, brands can tap into ‘Wild & Weird’ by injecting playfulness and fun into consumers’ lives. Brands that embrace digitally-driven satire and social-media challenges, and celebrate the weird and wonderful in their campaigns, will be valued. It’s all about daring to be different!

Here we’ve very simply defined the post-2020 consumer in Europe, but of course there is much more data and many more insights available in our full report, including a view of consumers outside the regions we’ve explored, including Brazil, South Africa and Australia. Access your free report today at https://insites-consulting.com/bookzines/.