Robert Heeg

First published in Research World June 2010

Globally, the rise of social media research has been spectacular. Is this also the case in Germany, where the internet is still mistrusted?

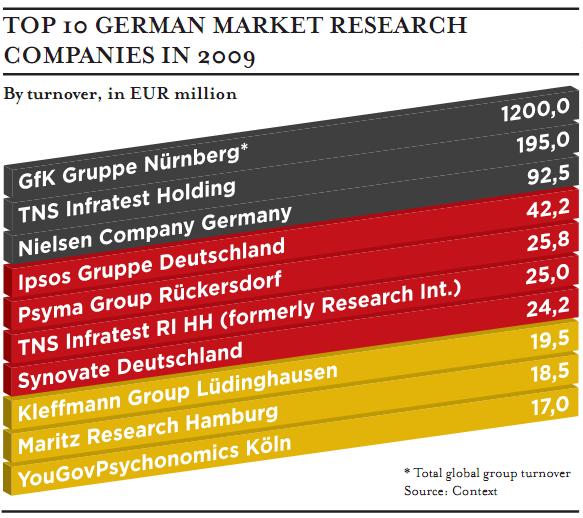

As social media continues its advance, the web keeps offering new research opportunities. Big brands embrace tools ranging from web trackers to branded research communities. In the German industry the phenomenon can no longer be branded a niche, says Hartmut Scheffler, chairman of the ADM association. “We see a substantial growth in interest from clients for building online market research communities.” Christian Jarchow, head of online research at GfK SE Online Research, knows why: “One reason for this trend is the quality problems in traditional online panels.”

Even though Germans were not early adopters of web 2.0 tools, Michael Bartl, CEO of co-creation specialists Hyve, sees the interest in new approaches increasing by the day. What he finds most promising is that interest is no longer restricted to brand advertising and monetisation of user-generated content. “Market research, product management, sales and especially R&D are triggering more and more requests to get further connected with consumers.”

Unrealistic

Not all new explorations are very well-directed, observes Martin Oetting, Research Director of leading word-of-mouth marketing company trnd. For years he saw a growing interest in branded communities without companies knowing what to do with them or how to run them. The same is currently happening with Facebook and Twitter. Web monitoring is a slightly different animal he says. “The benefits are almost immediately clear, and there does not seem to be too much risk involved when using it.”

Jarchow also registers an increased demand for services like web mining of content, although he adds: “Compared with traditional online surveys, this kind of market research business is not yet seen as important.” In his opinion this is mainly caused by the unrealistic expectations raised by many (often small scale) agencies. “One could question the validity of the data extrapolated for the general market audience of a company. This is currently one of the barriers to success for this approach.” Scheffler says that early vendors often exaggerated their proposition to get a foot in the door. “Niche suppliers promise complete, final answers using the new tools. But clients still need valid and reliable data, and this is what these tools by definition do not deliver.”

Better equipped

Despite the rapid developments, Frank Knapp, Psyma’s head of e-business research activities and vice-chairman of the German Association of Market and Social Research (BVM) believes that thinking in target groups hasn’t become obsolete. “You still have to know who actually says something and then check whether this really is your target group.” Scheffler believes that social media research represents a growth opportunity for the established agencies, rather than a threat. Even so, Jarchow finds that “generally the big market research agencies are more reserved with regards the long-term success of these tools.”

Many web trackers seem to be smaller, boutique, agencies or fully automated DIY software solutions. Germany is the same, observes Knapp, although, due to their relevance, he expects these methods to be adopted by the big research providers over the course of time. Already, he adds, established agencies are doing much of the data interpretation. “Researchers are better equipped to place this data in the context of other information.” Scheffler explains that some of the research communities are adding additional monetary value to the industry. In time, some new tools will be combined with more ‘traditional’ research methods, but, he also predicts, others will simply take budget away from the industry.

Years behind

The German consumer has been called slow in adopting social media. Marcel Weiß, editor of the leading Netzwertig.com blog, once described Germany as being ‘at least five years behind the US when it comes to social media and its adoption by a larger part of society’. Oetting believes this assessment to be correct, but adds: “Different cultures develop differently, without necessarily ending up in the same place. I believe, for instance, that in Germany the blogosphere may never attain the importance that it has gained in the US.”

Bartls agrees that Germany may simply be on a different web track from most Western countries. “Traditionally a few powerful publishing houses and newspapers determine the German media landscape. Their clear objective was to maintain their strong and influential position rather than jeopardising the status quo by following a progressive new media strategy. Hence, the success of the industry over the last few decades has caused an innovation delay.” Furthermore, Oetting feels that in Germany the debate around the web predominantly focuses on the negative aspects, like pornography or identity theft. “That is a pressing problem which may hinder Germany’s economic development for years to come.”

Ominous

Any delays in social media are inextricably linked with Germany’s perpetual privacy discussion, feels Bartl. “Social media on its own is still considered as ominous.” He explains that this discussion is not limited to the social web; it’s part of a wide range of privacy topics, from airport body-scanners to Google Street View. A service that still does not cover Germany.

For the research industry, this also rings true, but ADM’s managing director Erich Wiegand has seen no evidence that web trackers and other social media researchers don’t abide by the German industry’s comprehensive system of self-regulation. “In principle, the system is mandatory for everyone who conducts market, opinion and social research.” Knapp is similarly unconcerned. He hasn’t heard of any tools that analyse individual, non-anonymous data in a research context. “Above all, the German government is currently challenging Facebook on its privacy rules. So I don’t see unknown or neglected territory here.”

Booming

A recent European social media research study by the IAB (Interactive Advertising Bureau) showed that social media users in Germany were the most purchase-oriented (alongside the UK). Over 50% of German users utilize the social web to find and purchase products. This offers tremendous opportunities for brands, especially as the ‘long tail’ of German social media (web logs, forums, etc.) is as diverse as anywhere else, covering an incredible range of topics. Needless to say multinationals are keen to know what’s being said about them within these platforms. “This online dialogue can serve as a great source of consumer insights and innovation”, says Bartl. He describes German Web 2.0 as developing from “a playground for advertisement solutions to a diversified market with many players and stakeholders.”

At trnd Oetting describes business as ‘booming’, but he adds that across industries, word-of-mouth marketing deserves a lot of attention and is still underdeveloped. “We feel that WOM is really at the heart of marketing in the social media space. Anything else does not really make much sense.”

Backbone

Indicative of Germany’s extensive industry changes are the increasing number of conferences dedicated to topics like netnography, co-creation and web-monitoring. This year’s main BVM conference in Bonn (to be held in June) is entitled ‘More power to the consumer?’ and has ‘open innovation, co-creation and crowdsourcing’ as its main theme. “Anything that makes consumers more involved in feedback and product development is an opportunity for the research industry”, concludes Knapp.

Although German brands are still coming to grips with the new freedoms offered by social media, Bartl believes that non-bureaucratic interaction brings brands ever closer to the consumer. “It opens up so many new business opportunities – not only for the big brands, but especially for the thousands of small and medium-sized firms which shape the backbone of the German economy.”