Jo Bowman

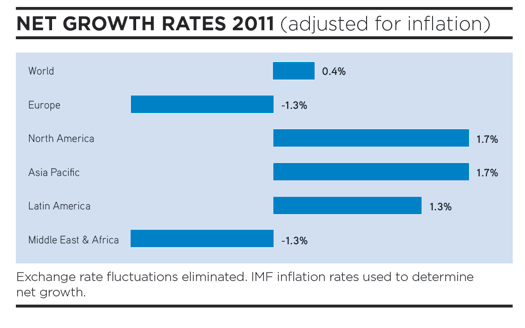

An overall picture of apparent stability in the global market research business emerges from ESOMAR’s just-released annual industry study, with total world turnover rising to US $33.5 billion, representing a year-to-year increase of 3.8% (0.4% after adjustment for inflation). Yet behind this headline figure of seeming steadiness are hugely disparate stories of massive gains in some markets and severe pain in others. This year’s Global Market Research report, to be launched at the ESOMAR Congress in Atlanta, goes behind the regional averages that give an overview of the market, explores the range of influences on the research business in different countries, and looks at the challenges and opportunities that researchers and research companies are grappling with.

The report is packed with industry data and analysis of the hottest growth markets, the fastest-growing companies, the most significant mergers and acquisitions, and the most promising signs of optimism. It also features interviews with respected industry figures on the changing shape of the research industry as advancing technology, economic flux and political upheaval transform the business landscape.

Top-line findings

- Market research turnover increases in 49 countries or sub-regions in 2011, and declines in 32.

- North America continues the journey to recovery begun last year, posting 4.9% year-to-year growth (1.7% after inflation), totalling US $11.2 billion. This puts it on a joint footing with Asia-Pacific, which grew 4.7% gross (1.7% after inflation), to US $5.8 billion, as the fastest-growing research region in the world.

- Europe, which accounts for 42% of the global research business, saw turnover of US $14.1 billion, an absolute growth of 1.9% but a 1.3% net decline, with growth in the Nordic markets, Latvia and outsourcing hub Bulgaria unable to balance out losses in the economically troubled British and southern European markets.

- Latin America, buoyed by massive gains in Brazil last year, showed 7.9% year-to-year growth (1.3% after inflation) to US $1.9 billion. This year, Peru and Nicaragua were the fastest-growing markets in this region. Brazil, hit by ill economic winds blowing from Europe, failed to make the top 10 fastest-growing markets in Latin America this year.

- The Middle East and Africa continued to grow at 4.8% year-to-year in 2011, but realised a 1.3% net decline after much higher gains a year earlier. The SADEC (Southern African Development Community) was behind much of the growth there.

Star gazing

There were plenty of surprises in the performances of individual markets, with some of the superstars of 2010 dropping right out of the ranks of the fastest-growing countries just 12 months later. At the same time, a number of markets which had braced for big falls because of broader economic instability were not as hard hit as might have been expected.

Brazil, which a year earlier rocketed up 26.5%, taking the entire Latin American region soaring with it, has vanished from the top 10 growth markets in its region, behind even 10th placed Venezuela, which grew just 0.7% after inflation in 2011. Peru, which had a national election in 2011 that boosted research investment, led growth in Latin America this year, with turnover rising 19.9% when inflation is factored in. Nicaragua, another nascent research market, recorded the second-fastest growth in the region, 18.7%, with a new government there providing a greater sense of stability in the business environment. Brazil and its BRIC cousin China maintain their presence in the 10 biggest research markets in the world, though China, another boom market in 2010, slipped down the list of top-performing Asian markets in the latest survey. The market there grew 5.8% during 2011 – strong by world standards, but well behind Bangladesh, which from its tiny base shot up 35.7%, and also behind Laos, Sri Lanka and Indonesia. India’s net growth rate slipped below 1%, and Vietnam, a booming market last year, saw a net decrease in its research industry this year. Japan, repeatedly knocked by economic troubles and natural disaster, managed to post 1.1% net growth in research turnover, buoyed by interest in “big data” analysis and social media studies.

Greece, a nation struggling with austerity budgets and real economic crisis, was not as hard hit as observers were expecting it to be. It was down 9.7% for the year, as an increase in retail audit studies cushioned falls in other areas. The Spanish market shrank 8.7%, and Italy lost 2.9%. Latvia, which has been on an economic roller-coaster ride for close to a decade, saw massive gains this year of almost 60%. The other rising star in Europe was Turkey, more than ten times the size of the Latvian research industry, and its 10.3% net growth puts its research turnover on par with that of Norway.

The US remains the largest single research market in the world, and posted net growth of 2.1% for the year, a massive lift in turnover given the size of this market. Growth in qualitative and survey work slowed, but the business was lifted overall by increased investment in syndicated research. The UK clings to second place in the world rankings by size of research market, despite a net decrease in turnover of 7.6%. The economic recovery expected there in 2011 failed to materialise, government spending on research declined, clients brought a greater proportion of research in house, and a greater share of what remained was done online, with a dampening effect on earnings.

As some of the excitement over the potential of the BRIC markets calms down, plenty of businesses and investors are starting to wonder: where next? The Global Market Research report looks at whether the BRIC markets really have gone off the boil, and where the biggest research buyers and suppliers are looking to move next. It looks at which of the so-called Next Eleven growth markets show the strongest growth potential. Turkey stands out, as do Mexico (which is recovering from tough economic times), Indonesia (which saw research turnover rise 9.1% in 2011), Bangladesh and Nigeria (which is seeing surging interest in concept testing and new methodologies).

New horizons

Research agencies naturally want to be where the big clients are going, but, as GfK consumer experiences COO and member of the management board Debbie Pruent explains, when money is tight, there needs to be a balance between investment in new markets and the scale of business that is available there. “In the past, we ran everywhere [clients] wanted us to be; now we have to be a little bit more careful. Companies are probably going to be a bit more conservative with respect to developing in the Next Eleven versus what they would have done a few years ago.”

In addition to having to get to grips with a new set of government regulations when entering a new market, there are also basic business questions about the rule of law and the movement of funds in and out that need answering. There are operational differences specifically related to research, too, given that developing markets are advancing at a far faster pace than the developed world did, leapfrogging technology, skipping over land lines and desktop computers, and going straight to mobile and mobile internet.

“We would never in a million years be setting up a CATI studio in a place like Nigeria,” Pruent says. “We would immediately be thinking that if it’s not face to face, it’ll be straight to mobile.” For an online-oriented supplier like BrainJuicer, low-tech markets like Bangladesh and much of Africa, while fast growing and exciting to many FMCG companies, are not yet on the expansion plan. “We don’t need to be first,” says Chief Juicer John Kearon. “You don’t want to spend more than half of your discussion time on whether it’s representative or not.”

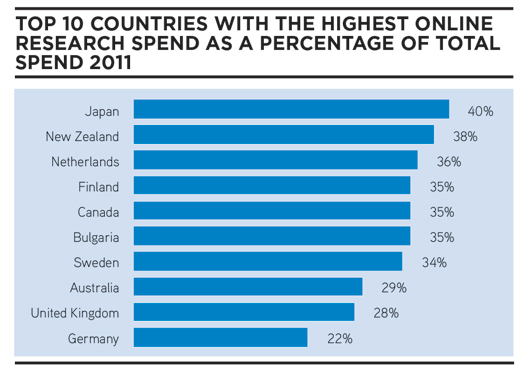

The GMR report shows how online has continued to secure its place in the researcher’s toolbox, and now accounts for 22% of total market research investment, well ahead of face-to-face studies, which are now only 11% of our work, telephone surveys (13%) and group discussions (also 13%). Quantitative research comprises 76% of total research worldwide. The relative role of online in different markets is hugely varied. Japan is the most deeply immersed in online, (40% of research done there), followed closely by New Zealand. Bulgaria features in the top 10 online markets because of its role as an outsourcing hub for work conducted in other countries.

While online research was once viewed with some scepticism by established research firms, the industry is coming to accept that it comprises a very different range of people and services than it did even a couple of years ago. Clients are demanding quicker, more actionable insights for the same money or less, and these new dynamics are challenging existing definitions of research and putting stress on guidelines and standards designed for another age. The GMR report explores changing attitudes to “non-traditional” ways of understanding consumers. “We can stay in our ivory tower and do everything purely and perfectly and defend our methodology and our holy ways,” says Kees de Jong, vice chairman of the board at SSI. “Or, we can embrace entrepreneurship and new ways of collecting and combining data. This is what our clients want, so this is the direction it will go.”

Change is indeed being driven by clients. Stan Sthanunathan, vice president of marketing strategy and insights at Coca-Cola, says that as markets develop and communication becomes less about announcing a new product than dealing with sophisticated consumers, research needs to provide deeper insights and forward-looking guidance “While it’s good to learn from the past, it doesn’t tell you what to do next,” he says. Research suppliers are usually willing and able, he adds, to offer more progressive research solutions that evolve with clients’ changing needs. “It’s exciting for them to do something different to the same old tracking and measurement, which can be a bit soul destroying. They get energised by it.”

People power

One of the biggest challenges for research firms looking to new markets is finding the right people to hire. Markets lacking a history in research are also likely to be lacking in trained talent, and flying in foreigners to start from scratch is an expensive strategy. “The crucial thing for us is finding a rather special person who can be the MD,” says John Kearon. “We’re looking for part great researcher, part entrepreneur and part wonderful leader; that’s not an easy combination to find. Market research isn’t exactly stocked with extroverts and entrepreneurs.”

Helen Russell, human resources director with Kantar, which employs 30,000 people, describes recession as a double-edged sword for people management. “There’s not a pool of talented unemployed people, definitely not,” she says. “Some of the uncertainty is making people cling on to their roles rather than looking for their next move, so you’ve got to be proactive in markets like the US and UK to court people, and entice them to come to you. At the same time, the people that will absolutely hang around in your business aren’t necessarily the top performers, so the mediocrity remains and the high potentials are courted by the competition.”

Agencies are still poaching staff from one another, and Karen Morgan, head of Morgan Search International, says job specs for those vacancies that do come up are more demanding of candidates than ever. She says pared-down research departments are often looking for one person to do what a year or two would have been the work of two people, meaning roles often need a combination of hands-on research skills, strategic thinking, creativity and a hard business head. “They’re looking for everything, essentially. As one person said to me recently, ‘they’re looking for a unicorn,’” she says. “So although, in theory, the pool of talent should be greater, it is, in fact, harder than ever to identify ‘qualified’ individuals because the profile is scarcer and companies are willing to wait for that ‘perfect’ candidate.”

The GMR report shows that some of the brightest minds from a diverse range of fields are making their way into research, but that public perceptions of what market research is are generally limited to blind soft-drink tastings and voting intention surveys. Jhonattan Martins studied aerospace engineering, but is now a quantitative researcher in São Paulo. “When I told my family that I wasn’t going to be working in the area I’d studied, and wouldn’t be doing engineering projects, they were a little frustrated,” he says. “A lot of people outside the industry have quite a simplistic view of what’s involved, and they think it’s all very easy.”

Becky Sandler is 23 and has been working in market research in New York for two years. She still finds herself explaining what her job is to friends and a broader public with little knowledge of research. “I usually say that when done well, market research helps companies better predict and understand consumer behaviour,” she says. “When people realise that it’s an industry that ranges from mall intercept surveys to research robots to measuring brainwaves, which are all used to help companies make products that they’ll enjoy, they think it’s really cool.”

Merges and Acquisitions

Activity in mergers and acquisitions was fairly quiet in 2011, with the acquisition of Synovate by Ipsos having only a minor impact on the relative performance of the biggest research firms, given that it came so late in the year. The total number of acquisitions by the biggest 25 firms was 24, and there were three divestitures. Most of the companies snapped up were small, as the groups look to fill in gaps in selected markets.

Growth for the biggest firms outstripped the overall performance of the industry, with the biggest 25 companies posting net growth after inflation of 2.7%. Sixteen firms in the top 25 grew faster than inflation, seven of them posting double-digit increases. Three of the top four firms – Kantar, Ipsos/Synovate and GfK – accounted for 42% of the total revenue of the top 25%.

Despite the lacklustre average growth figure for the market research industry globally in 2011, there’s strong feeling in the sector that things are looking up. An overwhelming majority of respondents to the GMR questionnaire see a stronger business year in 2012: 82% said there’d be growth this year, while 10% expect takings to be down, and 8% foresee no change.

As BuzzBack managing director Martin Oxley says, “The future is remarkably unclear. We live in interesting times.”

Jo Bowman is an independent journalist based in the UK

GLOBAL MARKET RESEARCH 2012

ESOMAR INDUSTRY REPORT, IN COOPERATION WITH KPMG ADVISORY

Now in its 24th year, the report includes:

- Global and regional highlights, and five-year trend data

- Breakdowns of sources of turnover, spend by research method and design

- Expert insights into the changing needs of research clients and agencies

- The voice of selected outstanding new entrants to research, on their experiences and expectations

You can preview and order the report in the ESOMAR Publications Store

GLOBAL MARKET RESEARCH 2012 is free to ESOMAR members in PDF format and can be downloaded in the MyESOMAR.

3 comments

[…] ESOMAR Global Market Research 2012: https://archive.researchworld.com/a-world-of-difference-esomar-global-market-research-2012/ […]

[…] ESOMAR Global Market Research 2012: https://archive.researchworld.com/a-world-of-difference-esomar-global-market-research-2012/ […]

[…] the latest 2012 ESOMAR Global Market Research 2012 report issued at the Atlanta Congress, US’s MR net growth was 2.1% (1011/1010) while Canada retracted […]