Kyle Findlay

Mobile technology is unlocking Africa. While it offers many challenges, Africa also presents many unique opportunities for business and research.

The continent of Africa is rainbow hued, consisting of over fifty countries. Nonetheless, it is still sometimes pejoratively referred to as the “dark continent”, a legacy of the 19th century tabloid-friendly adventures of explorers like Mungo Park and David Livingstone, and literary classics like Joseph Conrad’s Heart of Darkness.

For much of the 20th century, the continent struggled to extricate itself from its colonial past. Throw in confounding factors such as wide-spread disease and famine, and it is no wonder that Africa has been slow to find its feet. Recently, however, things have begun to change rapidly.

Africa is now a land of opportunity, with a billion people clamouring to be welcomed into the fold of 21st century business. There is a catch, though. Opportunities exist for those who can fulfil the new-found needs of African customers on their own terms, rather than imposing developed-world paradigms. As Gavin Marshall, head of innovation for Mxit, South Africa’s largest social network, puts it, “needs always create a vacuum [which] pulls the market in a direction. The trick is to find out where those vacuums are and to start creating stuff that fulfils the need”.

The African Challenge

While African countries represent a gleaming opportunity, there are significant hurdles that need to be overcome. These include a legacy of poor investments in power and telecommunications networks, low literacy levels, and less competitive business environments dominated by a few incumbent players.

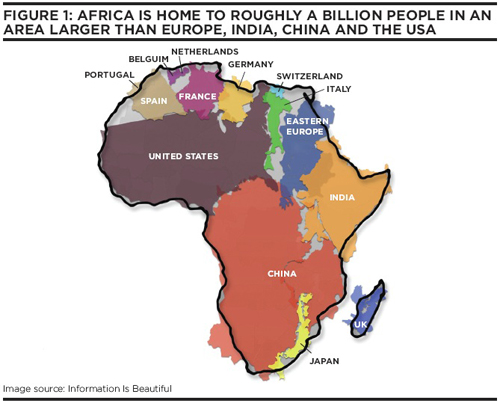

Further issues relate to the very nature of Africa itself. Considering that the African continent is larger than Europe, India, China and the USA combined, it should be no surprise that it is comprised of an incredibly diverse collection of cultures. This represents a challenge from a business perspective, as its many different regions rely on a vast array of languages and customs.

The Mobile Challenge

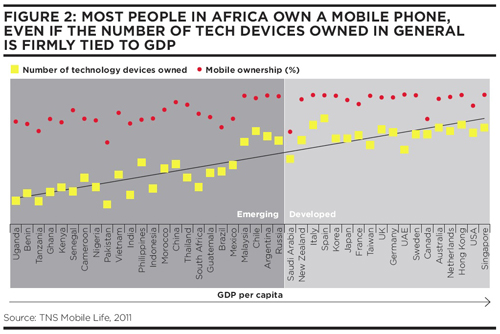

Mobile penetration rates in African countries are almost as high as those in developed countries, however the mobile channel comes with certain considerations. Foremost among these is the capabilities of the phones that the majority of customers own. Most own older feature phones. While some might be able to access the internet, this is not a feature that can be relied on. According to Dharmenda Jain, group head of data processing for TNS RMS West Africa, “[mobile] usage is limited to basics like voice and SMS. Only 9% of the total mobile penetration use mobile for internet or any other data services”.

“You have to assume that the majority of mobile devices are low spec,” agrees Rob Jones, head of information systems & technology for TNS Research Surveys in South Africa. “Blackberry, Apple and Android are not representative.”

The dominance of feature phones is by no means assured going forward, though. Bob Burgoyne, who focuses on the Kenyan technology sector for TNS RMS, says that while Nokia feature phones still dominate, they are witnessing an increase in the use of Chinese smartphone handsets, both legitimate versions and knock-offs.

Erik Hersman, the co-founder of Ushahidi, an open-source crowdsourcing platform that first came to global awareness for its key role in covering the 2008 Kenyan election crisis, expands on this point. “Up until now,” he explains, “it has been about the cheapest SMS/voice phones and the lower end feature phones. However, this looks to be changing where the new Huawei IDEOS $100 Android phones are coming on the market. There is finally a low enough price point on a smartphone that people are willing to spend more money on getting them. I believe this is an inflection point, though the real impact won’t be felt for another year or two, when these phones become second-hand and trickle even further down the consumer chain.”

Africa Leading the Way

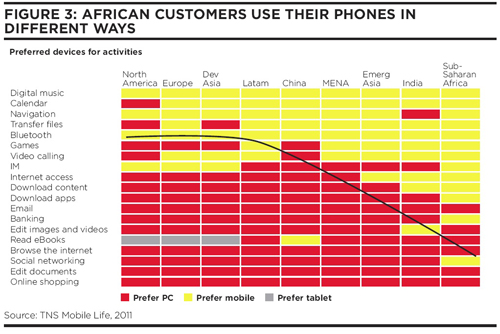

What has become clear in the African mobile space is that African customers in general use their mobile phones in a particular way. Based on his own experiences on the ground, Hersman observes that “people [in Africa] really use all the features on the phone, whereas (especially on feature phones) their Western counterparts tend to only use a few of the features”.

Indeed, TNS’s own research has highlighted the differences in usage patterns between developed and developing countries (see Figure 3), demonstrating that mobile phones are the preferred platform for a wider range of activities (especially banking and entertainment functions like gaming and music) in Sub-Saharan Africa.

The internet is still novel to the many Africans who have yet to gain access to desktop computers. Consequently, African mobile businesses are scrambling to make up for lost timeI. In some cases they are leap-frogging their developed-world counterparts, as in the case of M-PESA, a mobile banking platform that has given millions access to banking for the first time in their lives.

Services like MXit, Ushahidi and M-PESA have proven that Africa is a fertile product- development environment. Its extreme limitations force businesses to employ unprecedented creativity in designing their offerings. Such a climate promotes streamlined products that cater to the lowest common denominator. This has been a boon in Hersman’s eyes: “We know that if it works [in Africa] it will work anywhere.”

Market Research in Africa

The dearth of smartphone capabilities has been a significant stumbling block in the adoption of existing international mobile platforms in market research. Miloshen Pillay, a solutions developer for TNS Research International in South Africa, points out that it is often impossible to adopt existing mobile solutions because they tend to rely on a level of connectivity that is not consistently available in many African markets. The perfect solution, according to Pillay, needs to be capable of operating on any type of mobile device. This is a difficult goal, but one that offers much potential reward for those that can achieve it.

Face-to-face data collection is still common, according to Dharmendra Jain, partly due to a lack of infrastructure, and partly due to low literacy rates, which make self-completion tasks problematic. However, many research houses are taking tentative steps towards adopting mobile methodologies. There are a few uniquely African considerations that come into play with these approaches, though, such as telecommunications reliability, the increased importance of battery life in far-flung rural areas, and the safety of, for example, field workers walking through shanty towns with the latest iPad 2. Throw in a lack of easily available talent, high transportation costs and high call costs, and the challenges might initially appear insurmountable. However, these challenges are being overcome through smart design and innovative thinking.

Possibly the largest hurdle standing in the way of widespread adoption of mobile research methodologies is poor buy-in from businesses due to a lack of clear points of view and expert opinions on the subject. “Mobile growth has been recognised by everyone,” Jain says. “However, there have been few cases where clients asked for the mobile research. I believe the concept of mobile research is still being seen as nice to have at this point in time”.

Part of the difficulty involved in moving clients from a “nice-to-have” perception of mobile to full adoption relates to the term itself: “mobile” means different things to different people. According to Burgoyne, “I think we have to be careful in differentiating the medium and the methodology. In terms of the medium, for lots of [African] clients, mobile marketing is going to be important and they are already thinking about it. For the methodology, it is more a case of us just offering it to clients and highlighting the advantages. I don’t think they will necessarily have thought of it themselves, but when they see the advantages, [they] should be interested.”

Burgoyne’s points underscore the value of internal adoption of these methodologies, which comes with its own set of considerations, including the setup of IT and data infrastructure that is capable of reliably handling new types of data flow. Adopting mobile methodologies is not an overnight affair. As Jain points out, it requires change management and concept selling, both internally and to clients.

For mobile methodologies to truly penetrate the market research industry in Africa, they need to be thought of as the de facto standard that proposals are built around. This often requires an organisational rethink. However, the potential rewards are many, as companies move to unlock the birthplace of humanity for the first time. In the interim, the needs of African countries will continue to grow, as will the opportunities for meaningful research.

Kyle Findlay is senior research & development executive at TNS Global Brand Equity Centre

References

- “World Population Prospects: The 2008 Revision Population Database”. Esa.un.org. 2009-03-11. Retrieved 2010-12-29.

- The Real Size of Africa: http://www.informationisbeautiful.net/2010/the-true-size-of-africa/