By David Pritchard

The goal of Brand Tracking has always been to provide a robust platform and structure for benchmarking brand health, a critical measure of business performance. Brand Tracking studies are routinely used as a barometer for measuring the impact of business activity – be that advertising, reputation or service. As a result of this, many such programmes have morphed into a bloated ‘jack of all trades’, often lacking sufficient detail from which to draw sensible conclusions.

Often, organisations place excessive scrutiny on brand outcome measures, without sufficient structure to understand what is driving these perceptions. We feel that the opportunity exists to make Brand Tracking more focused, actionable and influential. The traditional consumer brand model has suggested that advertising spend was the primary driver of brand awareness, which in turn laddered to increased consideration and usage. This straightforward model allowed for the development of the advertising effectiveness tools and methodologies now considered common currency. Once on-board, consumers were offered a limited choice of direct communication channels, which utilised structured customer handling models and were monitored for effectiveness. As a result, understanding the customer experience took on an operational, tactical focus, neglecting the wider influence of the brand.

Recently there has been some conjecture about the relative strength of the relationship between brand perceptions and overall business health. Many consumer experts are coming around to a way of thinking which suggests that it may be more relevant to create the link between business health strength of customer relationships, created by virtue of a delivered ‘brand experience’.

It’s hard to consider the modern customer experience in the context of ‘old school’ thinking. With the significant reach of ‘new’ media channels, the opportunity for non-customers to connect with brand touchpoints is a notable distinction. With much of the digital experience being hard to monitor effectively with a traditional Brand Tracking model, brands which focus their efforts here may wish to re-evaluate how they measure the outcomes. Thus, it’s important that we understand that our traditional customer experience model must evolve to incorporate a wider scope of audience – something akin to a ‘brand experience’.

Brand experience is fast becoming a new frontier, particularly in industries such as automotive, where small gains in differentiation can mean a significant impact of the bottom line. Customer, or brand experience is also being considerably championed by analysts such as Forrester and Gartner, with a recent Gartner report claiming that 89% of companies plan to compete primarily on the basis of customer experience by 2016. Brands must clearly set consumers’ expectations to create differentiation, it’s critical that businesses measure and monitor to what extent this promise is delivered upon, and market research agencies must evolve their Brand Tracking programmes to meet this demand. In the past, Brand Tracking has suffered through performing dual roles of monitoring both brand positioning and delivery, resulting in long, overly-complex questionnaires which did little to illuminate real insight on either topic. With experienced researchers typically tending to eschew long, laborious questionnaires in favour of wider and varied data sources, this offers businesses the opportunities to really focus brand research in a way that is organisationally meaningful.

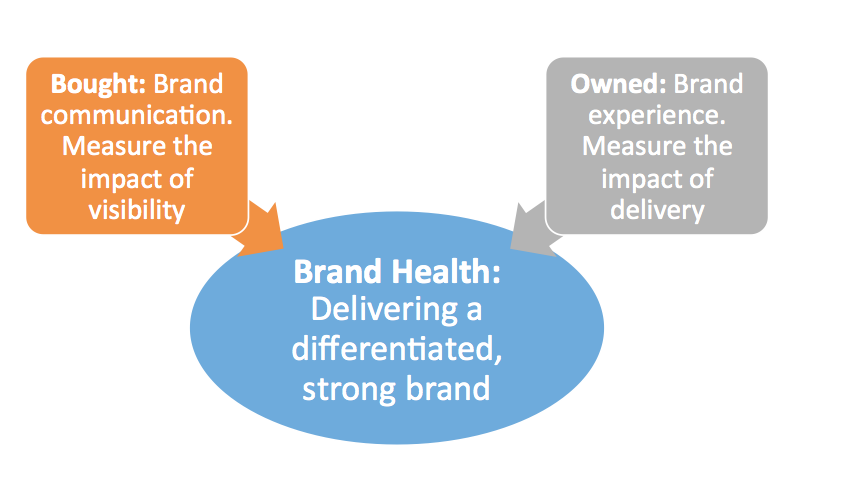

Using the traditional model of advertising effectiveness, brand health can be ascribed to two main influences:

- Bought: Brand communication; a measure of perceptions. Evaluating the impact of advertising on perceptions of the brand. This would cover advertising effectiveness (reach, frequency) and the effects of advertising exposure on key brand measures.

- Owned: Brand experience; a measure of connections. Evaluating the impact of how the brand is delivered. This would reveal how the brand’s touchpoints are performing, and how connections (both for customers and non-customers) change brand perceptions.

For this two-sided insight framework to function effectively, there are a number of important criteria:

- There must be a common framework for evaluating brand performance across each area of measurement. In practical terms, this means that brands must be confident in the measures that they consider to be important health indicators – whether they be image factors, consideration or differentiation.

- Once brand health and success criteria are clarified, they must be replicated across each study area as outcome measures. This exercise not only ensures that comparably structured insights can be derived from each study, but that through statistical modelling we are able to understand the proportional impacts of each area on brand health.

- A clear demarcation of coverage between the two programmes is important to ensure that they deliver organisationally-relevant insights. These specific coverages are used to create tactical actions, while the wider view developed from considering both areas can be used to develop strategic guidance.

The idea of demarcation is an important one in the ‘brand experience’ economy, particularly as the coverage of each programme is inextricably linked with different business units. In doing this, we go some way to addressing a failing of traditional Brand Tracking. Historically, it has been difficult to assign organisational ownership of “Brand” as a holistic concept, with aspects falling into inter-departmental cracks.

The idea of separating measurement and action into “Bought” and “Owned” creates clear designation of ownership.

- “Bought” is allocated to marketing teams, delivering competitively benchmarked insights on campaign performance and impact on brand equity.

- “Owned” is targeted towards customer experience and operational functions, highlighting the competitive and comparative strengths of the customer experience, and their influence on brand equity.

This structure is not only different in its ability to involve and enable the right stakeholders, but it also allows insight teams to focus on getting actions to the right places.

David Pritchard is Client Development Director Network Research. He will also be blogging for ESOMAR at the upcoming ESOMAR Congress in Dublin. So stay tuned for more from him!