Flavio Thome

Anyone who does market research in Brazil is very used to clients, or even us market researchers, suggesting or designing samples that cover São Paulo and Rio exclusively. Whenever the client needs to include information from other parts of country we promptly add one city from the South, usually Porto Alegre, and another one from the Northeast, usually Recife or Salvador. We then sit back, confident that we have solved the problem of geographical representativeness.

This mindset has several different origins. The most important being the fact that São Paulo, Rio, Porto Alegre, Recife and other capital cities represent the bulk of the consumption capacity of Brazil, with special emphasis in São Paulo and Rio. In addition, the cost of fieldwork outside these two major cities is in general more expensive.

In an age that everyone is trying to maximise their budgets and clients are putting a lot of pressure on cost, it can be very difficult to convince the client, and ourselves, to expand the coverage of the sample to include other markets because that will make the project more expensive and possibly out of reach for the client. But, the fact that in the past 10 years we’ve seen an enormous amount of economic and social growth outside São Paulo and Rio is, in itself, a justification. More and more marketers in Brazil are being pressured to look for inputs from other regions for their business plans and strategies as the risk of not doing so could be to alienate consumers with growing purchasing power from other regions.

Even when you consider a more developed state like São Paulo, with a per capita income equal to Poland’s, we seldom include consumers from markets outside the greater metropolitan area of São Paulo. That’s ignoring 20 million consumers, or half the state’s wealth.

Maybe, just a few years ago, we could develop and execute projects taking the risk of not including consumers outside these key markets, but in a modern, more competitive and diverse Brazil this option can be the difference between a project succeeding or failing.

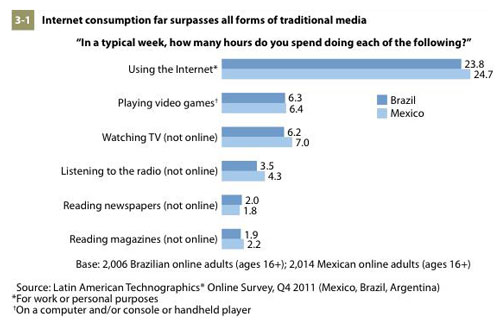

Coupled with this huge economic and social growth outside of São Paulo and Rio, is the growth in online access and use. A Forrester report from late 2011 says that online adoption in Brazil will reach 57% by 2016, up from 44% currently. To add to this, Brazil has had a national broadband plan in effect for several years, partnering with telecom companies with the goal of bringing access to remote areas of the country. According to the 2011 report, ‘Latin American Technographics Online Survey’, using the internet far surpasses all forms of traditional media in Brazil with an average of 23.8 hours per week spent on line (see chart below). We can tap into this. Online data collection is a fundamental tool in developing and executing projects that reflect the new reality in Brazil.

Online offers a more diverse and balanced geographical representativeness of Brazil at the cost, speed and quality required by clients. And of course, with results that go beyond the traditional Rio-Sao Paulo axis.

Recently a client approached us with a request to bid on a project that followed the traditional approach of limiting sample to the Greater São Paulo and Rio. When we questioned them about the sample design, they explained that the limitations were purely due to their budget and timing constraints. We then explored the objectives of the project a little bit more, and felt it would be important to include the countryside of São Paulo, as the product investigated had a high market share there.

A new sample was designed rebalancing the number of interviews from the greater São Paulo and the country side and presented to the client. Their biggest surprise was that, despite reaching markets from all over the state, the total cost of the project and the timing was the same.

Fortunately we have already started to see clients asking for bids that include other markets and results have been great. We are confident that as online evolves and everyone becomes more familiar with this tool, Brazil will follow the same path as other more mature markets where geographical diversity is a plus, not perceived as a potential drawback.

Flavio Thome is Director, Client Development, Research Now