A maturing market with fewer and larger transactions

By Simon Chadwick, managing partner of Cambiar

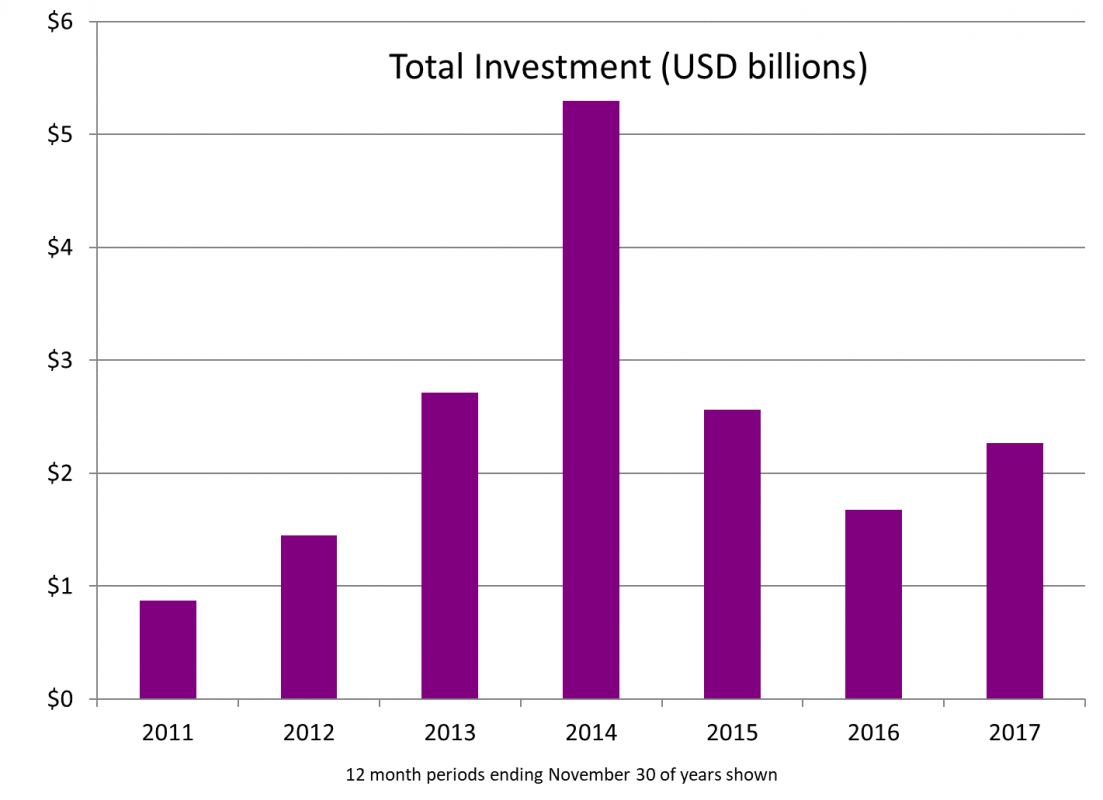

Inward investment into the market research and analytics industry rose slightly in 2017 in dollar terms, although this was characterised mainly through fewer, larger transactions. This is the main takeaway from the Cambiar Capital Funding Index in its 7th annual report on capital inflows into the industry.

In total, the Index logged 86 transactions (down from 106 in 2016 and a peak of 152 in 2014) totaling $2.27 billion – a 36% increase on last year. Since we believe that the Index only accounts for about 80% of all transactions (many go unannounced), this would equate to total inward investment into the industry of $2.84 billion.

What is happening?

Two data points go a long way to explain what is going on here: (1) the average transaction size rose 69% from $15.7 million to $26.4 million; and (2) just four transactions accounted for 51% of the total amount invested. Both point to the fact that this is a sector that is now primarily about reaping the benefits from, or doubling down on, those past investments that really worked, not investing in new ventures.

[…]

If you’re an ESOMAR member you can read the full article in MyESOMAR in the digital copy of Research World. If you are not a member of ESOMAR you can join and receive a free copy of Research World 6 times a year or alternatively you can sign up for a subscription of the magazine in our publications store.