As ESOMAR marks its 70th anniversary, we are using our annual appraisal of the industry’s performance to look behind the headline growth figures at the forces that have shaped – and are shaping – both the work we do and the reasons we do it.

The GMR shows that global market research revenue grew by 1.8% in 2016, taking total global turnover to US$45.442 billion.

The slow growth of the industry worldwide in 2016 – 1.8% growth, after 2.2% in the previous year – reflects a slowdown in global GDP growth, and the times in which we are living. Growth is slower, but the pace of change seems to keep accelerating.

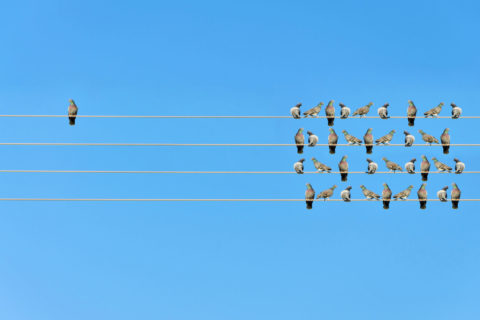

Jon Puleston, vice-president of innovation at Lightspeed Research, says in the GMR: “I am not sure if anyone has worked out a Moore’s law yet to map the rate of change of business innovation, but we can all observe through our own experiences how rapidly new disruptive business models are ripping through and shredding conventional businesses around the globe.

“Disruptive innovation cycles that once would take several years to take hold are happening in months. New tech-driven businesses are emerging out of nowhere to gain instant global domination.”

The effect of this on businesses is tremendous; not only are they facing competitive challenges on entirely new fronts, they are also faced with increasingly discerning consumers who want more from their relationship with a brand than a good product at a fair price.

“I think last year was a tumultuous year and I think the changes in the political systems both in the US and in Europe have meant that people are looking for more,” says Lindsay Pattison, chief transformation officer at Maxus. “They’re looking not only for their leaders to take a stand but they’re looking for brands to do something, almost to fill the void of leadership that we now see in the world.”

Around the world

The world in which we find ourselves is one that the founding members of ESOMAR would in many ways struggle to recognise. The rise of China, development in India, the emergence of Eastern Europe and much of Asia would have been hard to fathom back in 1947. This was, after all, a time of great post-war upheaval, and with air travel beyond the reach of so many, the global village felt like anything but. The idea that by 2017, Asia-Pacific would account for 14% of global research revenue, and Latin America would contribute 5%, would have seemed completely alien.

If you’re an ESOMAR member you can read the full article in MyESOMAR in the digital copy of Research World. If you are not a member of ESOMAR you can join and receive a free copy of Research World 6 times a year or alternatively you can sign up for a subscription of the magazine in our publications store.