When designing and/or thinking about any research journey you have to start somewhere. First steps usually begin with making baseline assumptions and decisions … but what if your starting point—your thinking—is inaccurate. In other words, if you start the research relying on a GPS coordinates that are way off base, you’ll end up going in the wrong direction. So what steps can we take to avoid this?

3 Stages of Research,

In search of an actionable solution, we broke down the research process into three main stages: Conceptual, Executional, and Analytical. The Executional and Analytical stages have the current spotlight, with focus on agile, technological platforms, data scrubbing software, and AI. But not enough attention is being paid to the upfront Conceptual stage—which we are calling Contextual Intelligence—which helps inform the research process and expected outcomes.

In most research studies, the Conceptual stage consists of reverting to and accepting “givens”—namely, using previous research findings, existing/historical demographic segments, and accompanying stereotypes as the foundation for baseline assumptions. But before we begin, it makes sense to always be re-examining the what/who/where to verify to avoid bias and reset baseline assumptions. In the Contextual Intelligence stage of research there are three main components:

- What: Objectives to be laid out

- Who: Demographics of who to talk to

- Where: Areas the research should cover and how the conversation should begin/flow

What: It is all about starting with accurate context

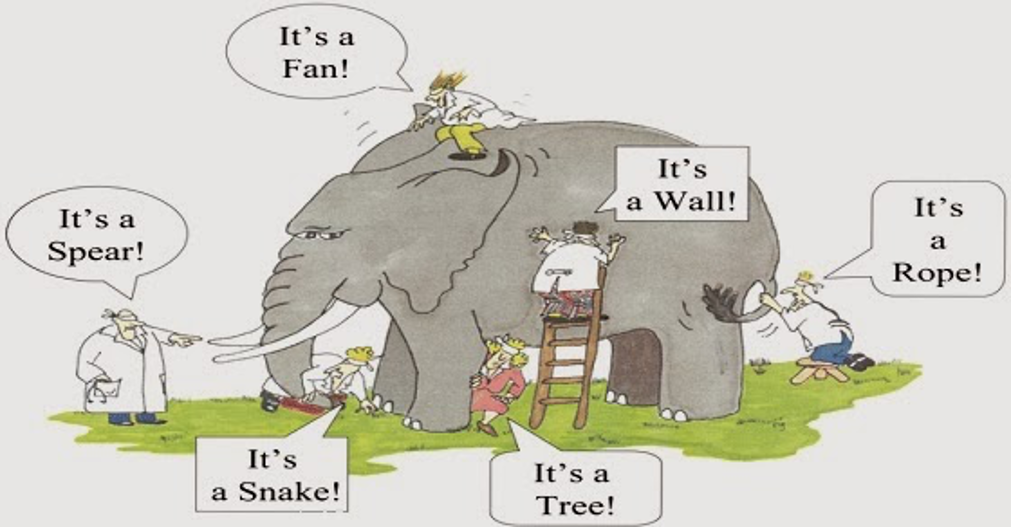

Starting research without taking Contextual Intelligence into account is behaving like the Five Blind Men who in the parable did a field study where each only touched a specific part of the elephant and thus came to very different and wildly inaccurate conclusions.

Contextual Intelligence is the flashlight that will give you the needed perspective to see the whole elephant. Context is not static and it changes constantly. Change is usually slow and not always obvious, and the impact of that change can be easily overlooked. Rarely do we see a contextual change in real time as we have during COVID when, for example, many companies who had previously felt that online research was not acceptable, quickly embraced it.

In research, we are trying to uncover peoples’ inner thoughts and emotions. Without a clear understanding of the psychological and cultural contexts in which people create these thoughts, it is as if we are confronting a closed safe, where people are protecting what they hold most dear from prying and judgmental eyes. Using Contextual Intelligence gives us the combination code to crack that safe.

Who: Need to change how we approach categorization

The life changing impacts of COVID, in addition to rising global social movements, has taught us that in order to move forward, we, as researchers, need to be more open to letting go of old-school methodological thinking.

As researchers, we like to think we are curious and open minded; however, if we don’t understand complex context of emotions/thoughts/perceptions/experiences that shape people’s thoughts, actions, decisions, and impressions then it’s quite possible we may be making inaccurate baseline assumptions.

We categorize to give meaning to seemingly random occurrences and people. We generally default standard guidelines—in place since the 1960s—focusing on traditional demographics (age, gender, income, education, relationship status, kids, sexual orientation, etc …) with overlays of product/service product and usage. Sometimes “attitudinal” questions are added—but they tend not to be more fluff than code breakers, e.g., “My friends look to me for advice.”

When it comes to Who we recruit for research we need to incorporate:

- Cognitive Demographics

- Micro-culturism

“Cognitive Demographics,” is about incorporating how people self-define versus putting people into marketer/researcher defined demographics categories. Using Cognitive Demographics, would show that while the traditional demographic approach would identify two mothers as being the same because they share the same traditional demographic measures—age, number and age of kids, HHI—the moms have very different perspective and will make purchase decisions accordingly. One has a mom motto of “I go with the flow,” while the other is more of a helicopter mom in that her motto is “I will do anything for my kids.” Without taking in account how they self-define, the research could be wrongly interpreted.

Micro-culturalism — culture and its impact plays a crucial role in cognitive demographics. Without having a rudimentary understanding of heritage, culture, and its impact, we are dooming ourselves to repeat and get the same “insights” for whole swathes of the population that are different, yet appear similar on the surface. In the U.S., we often fail to look beyond race and ethnicity categorization to see the outsized role that culture and heritage play. For example, a Black native-born American may not share the same views as a Black naturalized citizen of immigrant heritage from the Caribbean or from Africa.

Going beyond standard demographics, to examine the influences of a micro-culture–a culture within a culture– is critical. Researchers need to provide questions and look closer at self-selected psychographic categories (i.e. heritage, environment, economic influencers, communities, etc., prior to fielding research. so as to secure a more accurate understanding of context.

Micro- culturalism also extends to self-selected opt-in groups that may have nothing to do with race, e.g., United States Marine Corps – whose culture is ‘once a marine always a marine’ even if you are no longer active duty. While all other U.S. military services refer to no longer being active duty as being ‘ex’, a marine is always a marine, and never an ‘ex.’

Where: Sometimes taking steps backward is a better way to start the conversation

Too often the amount of material the research study needs to cover overflows the discussion or questionnaire time frame so there is strong temptation to say “we already know the answers from past research, so don’t need to include any probing around this in it this research study.” But just because you—the researcher/company—knows something from past research, doesn’t mean it is top of mind to consumers, or still relevant/important as you may think. Even your most frequent users may not have your product or service top of mind, as was the case with a new product/concept study with heavy, loyal users of fabric softener.

The week prior to the discussion, participants were asked to self-observe themselves doing laundry (the world fabric softener resides in) and then share their likes and don’t like stories about laundry prior to showing concepts. Clients were very surprised that a number of stories didn’t even mention fabric softener. Well, if you are doing a research study on new fabric softener concepts and you start with the assumption that fabric softener is top of mind because they are heavy users, your concept/new product discussion will probably lead you to different conclusions than if you started with the realization that for many fabric softener was not top of mind.

Conclusion

Consider incorporating Contextual Intelligence approach as your starting point before you rush into the Executional and Analytical stages. Contextual Intelligence is the new sharp drilling tool that should be part of your safe cracking research toolbox, especially for getting more informed understanding of and insights post Covid as consumer fragmentation become even more fraught with road bumps and economic casualties.