Consumer habits tend to change over time, but the COVID-19 outbreak is forcing consumers to reconfigure their lives, their habits and their spending patterns at a speed and scale the world has never seen. Nielsen has created a global lens through which to analyse these changes and identified ways of prioritising what needs to get done, and when.

The COVID-19 outbreak has forced a recalibration of consumer habits that will see consumption patterns forever changed. With a large percentage of the world now in lockdown and experiencing what it means to have restricted movement, limited access to physical stores and an expanded reliance on digital connectivity, it is important to look beyond the day-to-day maelstrom and adjust for a new normal.

Early on in the COVID-19 cycle, Nielsen quickly began looking beyond the inevitable spikes in sales of products such as hand sanitizer and face masks. Why? Because it became apparent that purchase habits were being mirrored around the world as people began to be diagnosed with the disease at alarming rates. And, these purchase habits were predictable. As human beings, we sought out refuge in all the same places: thermometers, shelf stable foods, vitamins and the like.

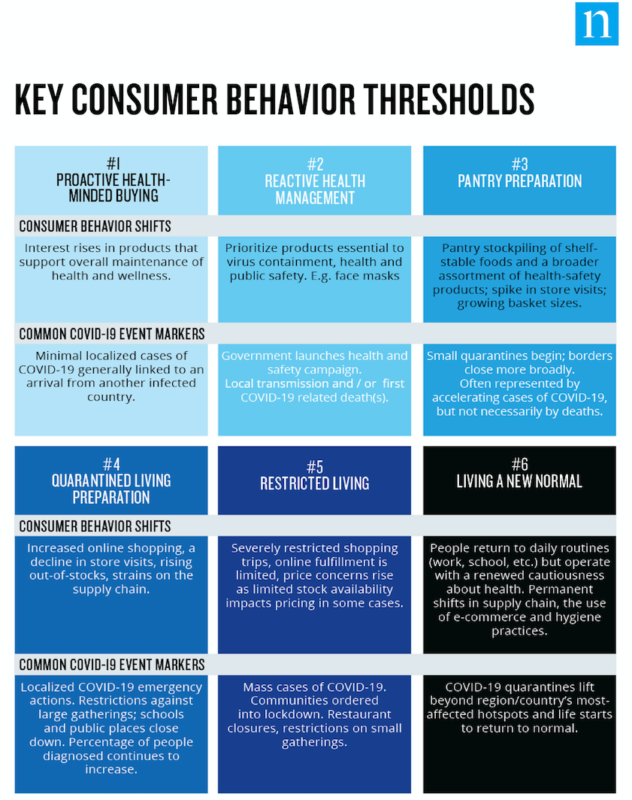

And that’s where it really got interesting. We were able to identify six key consumer threshold levels that tied directly to concerns around the COVID-19 outbreak. And those thresholds offered early signals of predictable spending patterns, particularly for emergency pantry items and health supplies, and we saw those patterns being mirrored across multiple markets.

The common denominator in many cases for shifts in spending was COVID-19 news events such as public health announcements and government press conferences. These marker points were then able to be mapped to the COVID-19 spread and helped provide a set of navigation beacons for packaged goods manufacturers and retailers to address issues they faced around supply chain and fulfilment.

The six threshold levels we identified are below:

As the world watches China in Level #6 and its emergence from weeks of restricted living, businesses are focused on how they can be ready to operate in a new era of consumption, where consumers try to go about their daily routines, but with a sense of cautiousness around second waves of the disease and concerns on timelines for a vaccine.

The other complicating factor already hitting countries around the world is the reality of millions of people who have been rendered out of work by COVID-19. That changed wealth dynamic will have meaningful implications and require businesses to focus on how to maintain sales in a difficult economic setting

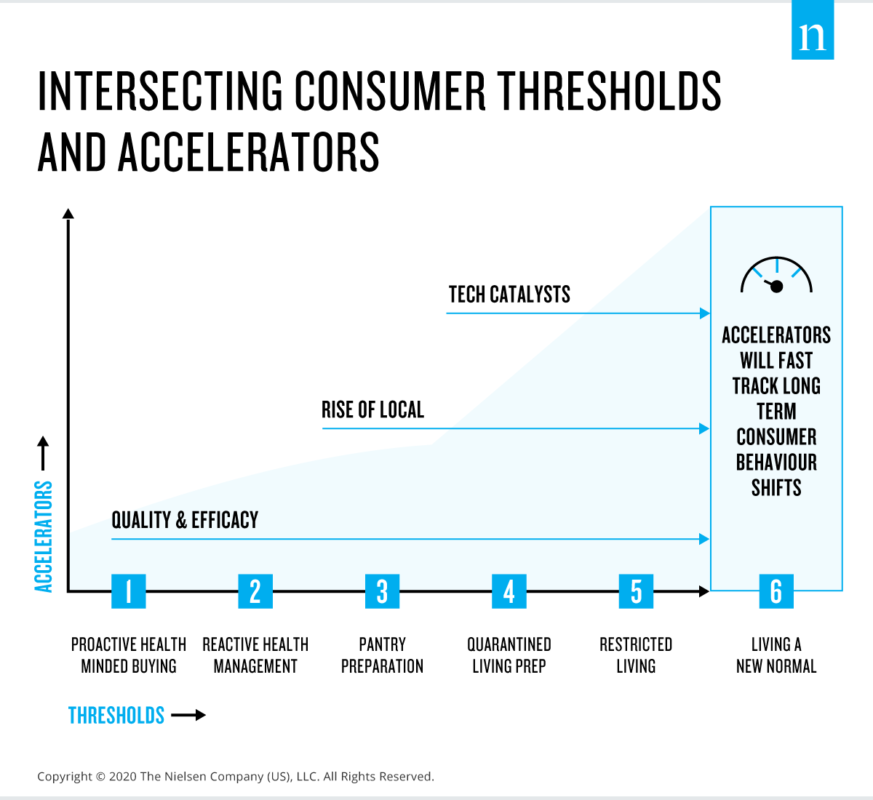

As Nielsen began talking to thousands of retailers and consumers around the world and marrying that sentiment with sales data, we started to see three critical accelerators intersecting with those six consumer thresholds. These accelerators are important to understand in the context of consumer demand as markets move through the six thresholds and come out the other side.

The first is on the technology front. With millions working from home and digital connectivity taking even more of a hold on everyday habits, consumers will have greater motivations and fewer perceived barriers to more actively seek technology-enabled solutions to assist in everyday tasks like shopping. Companies that can leverage technologies—by meeting changing consumer demands online, enabling seamless interactions through direct-to-consumer offerings and enhancing consumer experience with augmented and virtual realities—have the opportunity to earn consumer loyalty well after consumers’ concerns subside.

And we should expect retailers to be doubling down in their online offerings. Nielsen interviewed 10,000 retailers in China, a country that is already very mature in its ecommerce position and learned that 67% of them believe they need to quickly make bigger investments. If China sees that, then we should expect other markets to have even more of a need, since most markets trail China in online maturity. The implications of these are, of course, meaningful when we take into account the pressure to invest but recognise the profit margins tend to be slimmer than in brick and mortar environments for many retailers.

Another opportunity to give focus where consumers are showing demand is in the area of product efficacy and quality assurances. We are already seeing that consumers are seeking out more concrete guarantees when it comes to safety standards and efficacy, particularly with respect to cleaning products, antiseptics and food items.

In the short term, this intensified demand from consumers will require manufacturers, retailers and other related industry participants to clearly communicate why their products and supply chains should be trusted. In the longer term, and dependent on the eventual scale and impact that COVID-19 has on consumer markets, it may speed up a re-think on how shoppers evaluate purchases and the benefits that they see as the key factors to consider.

Thirdly, more than ever, shoppers want to understand the supply chain, with complete transparency from farm to factory to distribution, and they want details of the measures being taken to assure their safety. Promoting a product’s local origins could help manufacturers and retailers assuage some consumer concerns. Even before the COVID-19 outbreak, a Nielsen survey found that global consumers were heavily swayed by origin: 11% of global consumers said they only bought products manufactured in their country while an additional 54% “mostly” bought local products. We should expect those numbers to grow rapidly.

In the context of this change, it’s also important to remember that consumers are recalibrating how they consume media. With millions in lockdown, viewing across all screens is being reshaped. For example, the absence of live sport broadcasts means those sports fans are now forced to watch other programming. The implications for advertisers on this shift are significant and we’ve been deep in the middle of identifying how to move with those audiences.

These accelerants and trends are certainly not the only ones that will emerge from the need to change during and after this global health emergency, but they are looming large as consumer needs change on what has become a daily basis.