By Tessa Brayford and Dr Pamela Walker

By 2019, over 5bn people are expected to own mobile phones – 65% of the world’s population[i]. Given we Brits are spending an average of 24 hours a week online[ii], it’s clear to see why it’s no longer just whizzy technology firms harnessing opportunities created by digital technology.

325,000 mobile health apps were developed in 2017[iii]. That said, for the majority of digital ‘kit’ developed, only a few stick. The main issue is that despite the high use of technology, the longevity of individual tools is short. To put this into context, a 2018 study[iv] found one fifth of users abandon an app after one use.

With £22 billion estimated to be unlocked by pharma through harnessing digital technologies[v] and 75% of people seeing technology as important when managing their health[vi], pharma companies are no longer just competing in a therapeutics-based market. The industry focus follows a wider drive to leverage digital for the improvement of health outcomes. Only last month in the UK did we see £37.5 million being invested to create Digital Innovation Hubs with the aim of connecting health data to enable faster development of new treatments for diseases like cancer, heart disease and asthma, and to improve health services.[vii]

As digital health tools revolutionise healthcare, pharma companies are no longer able to sit back and rely on the fact that a successful drug will continue to thrive, without considering the value of health tech within this space. It’s more important than ever for pharma to identify where to play and how to win in the digital world.

A recent survey by Incite carried out in the UK and USA amongst 280 physicians, unearthed some fascinating insights relating to digital health tech needs. Within the context of current offers from the pharma world, the key findings from this provide a useful framework for decoding whether a new tool will be up to scratch.

Is your digital health tech up to scratch?

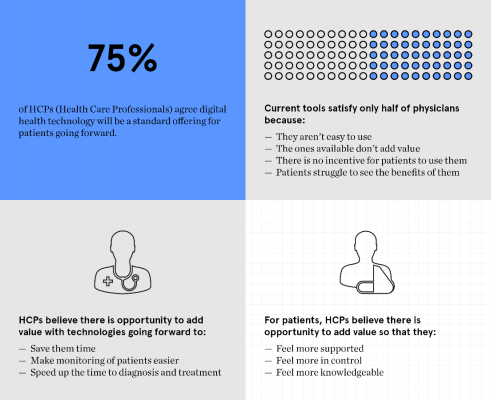

In-line with global trends described above, physicians reported a significant appetite for digital tools: 75% agreed that digital health tech will become a standard offering for patients going forward. That said, current tools satisfy only half of physicians. At present, there are some clear barriers to use, primarily in terms of difficulty in use, lack of added value, and lack of patient incentive to use them.

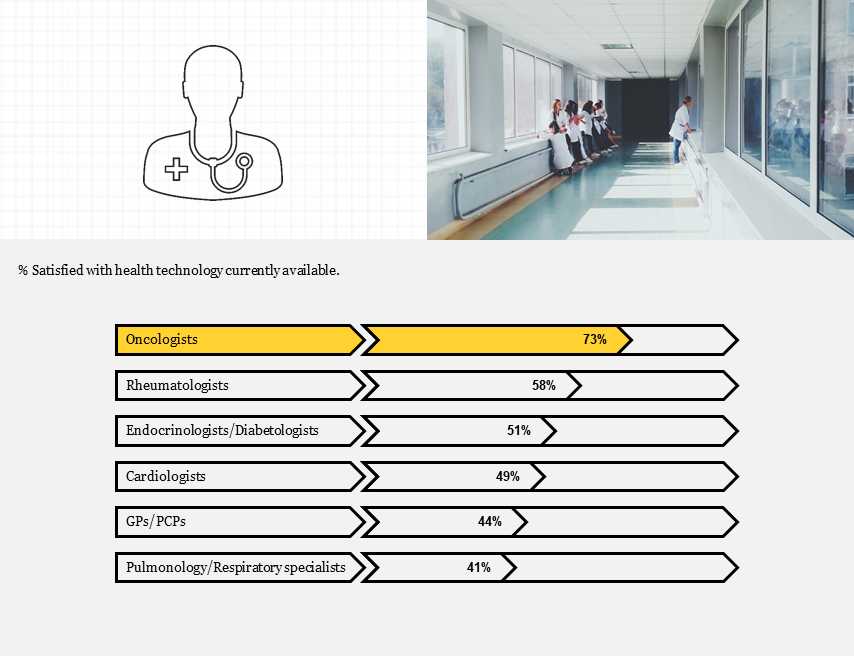

What is most fascinating looking at this data, is pulling apart trends at a speciality level. By doing this we can see the oncology (prevention, diagnosis and treatment of cancer) market is close to saturation, with 73% of Oncologists satisfied with current offerings. This may, in part, be explained by large investments in digital technology within areas such as oncology, offering both physicians and patients an array of benefits. Conversely, in respiratory there is a larger opportunity for pharma to improve satisfaction with digital health offerings; with only 41% of Pulmonologists satisfied with current digital health tools.

The Right Fit

Such differences by specialty highlight two critical issues a pharma company must consider when entering the digital health tech space:

- In a heavily saturated therapeutic area (digitally-speaking), how can new kit win ‘share of fingertips’?

For example: there is little unmet need in oncology – so how can new tools add value?

- In a digitally quiet therapeutic area, how can pharma find out what really makes HCPs and patients tick as well as creating a new behaviour around the use of technology?

For example: GPs and Respiratory Specialists have more limited experience with digital health tools and the behaviour of using digital tools has not yet being embedded in how HCPs or patients operate.

Tessa Brayford, Associate and Dr Pamela Walker, Head of Health, Incite

_______________________________________________________________________

[i] https://www.statista.com/statistics/274774/forecast-of-mobile-phone-users-worldwide/

[ii] https://www.ofcom.org.uk/research-and-data/multi-sector-research/cmr/cmr-2018/interactive

[iii] https://research2guidance.com/product/mhealth-economics-2017-current-status-and-future-trends-in-mobile-health

[iv] http://info.localytics.com/blog/21-percent-of-users-abandon-apps-after-one-use

[v] https://www.accenture.com/gb-en/new-applied-now

[vi] https://www.accenture.com/t20180306T103559Z__w__/us-en/_acnmedia/PDF-71/accenture-health-2018-consumer-survey-digital-health.pdf

[vii] http://digitalhealthage.com/digital-innovation-hubs-to-tackle-uks-biggest-health-issues/