By Julie Patra, ESOMAR

In an era where everything is evolving so fast and shoppers are faced with an abundance of choices, how can brands stay ahead of the game and compete when everything is moving so fast? Some say big data is the holy grail. But big data comes with complexity. How can unstructured data from various sources be analysed and interpreted? What are the challenges faced by retailers and clients? These issues were discussed during the ESOMAR Shopping Experience seminar 6 June in Amsterdam.

Nick Bonney from Deep Blue, UK, gave an intriguing opening address. He highlighted that in order to avoid the retail apocalypse, given that a lot of products are purchased online, retailers should focus on creating a feel-good factor, make it theatrical and make it fun. Customers visit stores to get good retail experience not only to shop.

The first speaker of the day, Grant Wither, from ShopTing discussed several retail trends, and the now and the future of retails. He demonstrated how Tesco utilised the data gained from its club card to personalised offers to its customers. He also discussed how unstructured data from various sources can be structured, analysed and intepreted.

Next, Ludovic Depoortere, from Haystack International discussed innovations and technologies. Market researchers and agencies should be aware of these changes when drafting their marketing plans, as these can drastically impact the nature of the retail landscape. It was quite interesting to discover that, perhaps, in 2023 we all will be wearing AI powered contact lenses and able to shop online, look up information, or even judge our date’s hidden cues!

Bart Vandenreijt from Carrefour discussed the importance of personalised data and its impact on growth. AI was used to build predictive models and mapped out decision outcome of consumers, as a result of this, Carrefour was able to send out 700 personalised offers to customers and witnessed 75 million euros in ROI in just one year.

Keith Sleight, from Unilever UK discussed how the understanding of consumers journey throughout the store could yield better insights which lead to sales opportunity. Unilever discovered that 10% of customers fail to purchase the items despite having made the stop by the aisle to look for products. By identifying obstacles faced by consumers or distraction points, there could potentially be a 10% increase in sales.

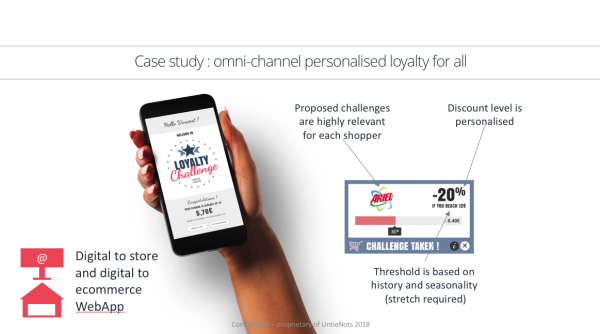

In the afternoon’s session Lindsay Cowan from Nepa discussed the how and the why of shopper insights and how to combine the two. For instance, what are the triggers and the barriers faced by consumers throughout the purchasing journey? Zyed Jamoussi, from Untienots discussed customer loyalty and how an element of gamification can be added to make personalised offers more engaging and fun. A sustainable rewarding scheme can be made based on growth – the more they spend the more rewards they earn. This scheme creates a win-win situation for customers and retailers.

In the later afternoon, attendees worked together in groups to discuss issues faced by retailers and clients and how to overcome them. From how to generate growth to how to incorporate big data into the marketing plan. It is clear that there is the need for better insights and tools, but would this extra layer of complexity be manageable? How can a market researcher deliver good insights yet practical? Which is the target audience research needs to focus on? Gen Z has been in the spotlight lately as this generation will account for 40% of consumers by 2020, however, they are known to not be brand loyal, so would investing on researching this tier be a sustainable approach? These are important issues that need to be considered.

As an ESOMAR member you have access to the recordings of the Shopping Experience seminar in MyESOMAR.