Understanding the power of spontaneous reactions to develop stronger innovations

First impressions are important, and you get only one chance to make a good one. This is true in dating but also true when it comes to trying a new product. The first impressions consumers form of your innovation can determine whether they end up buying it or ignoring it completely. In this article, we share findings from our research and show how first impressions can provide insights into how to:

- Adapt your innovation

- Alter its communications to increase trial

- Refine the prediction of an innovation’s potential

Capturing First Impressions

In practice, many innovation testing approaches don’t capture first impressions. Closed-ended questions like purchase interest capture first impression’s general “outcome” but not first impressions itself. An agile approach is required as first impressions are formed instantaneously and are fleeting in nature.1

This could be best accomplished through an open-ended question by asking consumers for their thoughts immediately following concept exposure.

Code RED

We use three key metrics to predict an innovation’s trial potential: Relevance, Expensiveness and Differentiation (RED).

- Relevance measures how well the innovation meets consumers’ needs

- Expensiveness measures price perceptions of the innovation

- Differentiation measures how unique the innovation’s benefit is perceived

The RED metrics are asked in the context of consumers’ existing solutions: How well does the innovation compare to consumers most often purchased product on RED? An innovation will be adopted only if it has a relative advantage overexisting solutions (i.e., the actual product used).

For late stage concepts, consumers are additionally asked to shop from a shelf after exposure to an innovation. The selection or non-selection of an innovation serves as a behavioral trial measure.

Incremental Value of First Impressions

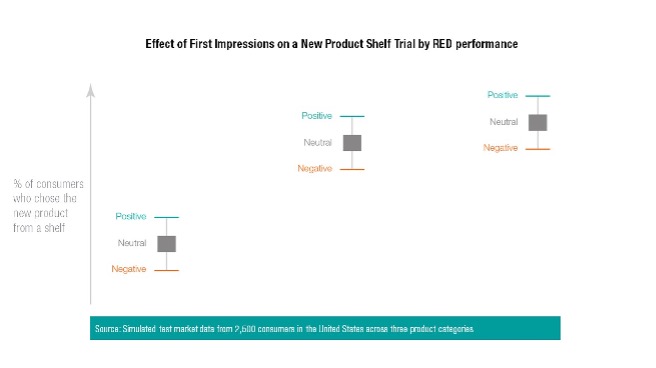

We wanted to see if first impressions add incremental predictive value to RED’s measures. To do so, we analyzed simulated test market data from 2,500 US consumers across three product categories. Innovations were grouped into three levels of trial potential (low/medium/high) using a composite RED score. First impressions verbatim were coded as positive, neutral, or negative using sentiment modeling.

The three levels of RED scores predicted trial of the new product. Consumers with positive first impressions, however, were more likely to select the innovation from the shelf than those with neutral or negative impressions. In short, while the RED metrics are predictive of an innovation’s potential, first impressions help refine that prediction.

What is in Consumers First Impressions?

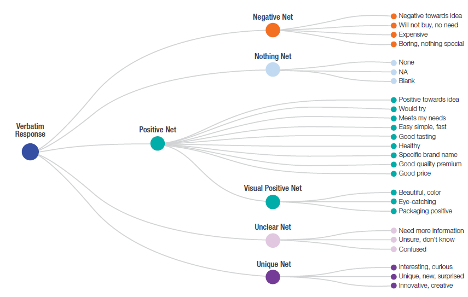

We text analyzed the verbatim response of 4,500 respondents from 13 countries to 300 concepts across 16 CPG product categories. To ensure the findings are applicable to a broad audience, we report only dimensions common across most product categories.

Consumers’ first impressions were generally positive or negative, sometimes both (e.g., “convenient, but may not be enough food to satisfy your appetite and expensive”), illustrating the complexity of first impressions (see Figure 2). First impressions also included visual, uniqueness, unclear, or no impressions at all.

| Source: 4,500 respondents to 300 concepts tested across a variety of product categories) from 13 countries |

First Impressions Impact on Relevance and Differentiation

While first impressions provide incremental prediction power, we expected that first impressions would also impact how people evaluate innovations on Relevance and Differentiation. We did not look at the impact of first impressions on Expensiveness as many concepts in this dataset were unpriced.

Innovations with positive first impressions were considered more relevant and differentiated. Negative first impressions, in contrast, were associated with decreased relevance but had no impact on differentiation. Most importantly, considering both positive and negative impressions simultaneously led to a stronger prediction of relevance. Many consumers feel positive and negative simultaneously (e.g., “Quick, convenient. Bad for you”).

Beyond the overall valence of first impressions, there were more granular findings that are worth mentioning. Innovations that left positive impressions of the packaging/product design (e.g., “packaging looks beautiful”), or the innovativeness of the benefit offered (e.g., “I think this is an original idea”), increased differentiation of the new product. We also found that if consumers’ first impressions of the innovation were unclear (e.g., “well, this might be good. I need more information”), relevance decreased. It is these specific impressions that can provide guidance to marketers on how to adapt their innovation or alter communications to increase trial.

Make a Good First Impression

First impressions matter for innovations and can be used to provide insights into innovation adoption as well as help refine the prediction of an innovation’s potential. Just as you would do everything possible to ensure you make a great impression on a first date, marketers should do the same for their innovations. We end by sharing five ways to form a good impression:

- Fulfill an unmet need – otherwise consumers’ impression will not be favorable

- Understand if there are any negative barriers – capturing “positives’ is only half the picture

- Dress for success – leverage your package/product design to differentiate yourself

- Be innovative –Meet an unmet need in a different way. It is not enough to be new, different, or interesting

- Be clear – insufficient information will lead consumers to stay with the status quo

1. Willis, J., & Toderov, A. (2006). First impressions: making up your mind after a 100-ms exposure to a face. Psychological Science, Vol 17, pp 592-598