Andy Kung and Grace Tse

First published in Research World March 2010

Business leaders need in-house researchers to play a greater role to cope with the changing business environment.

In-house research professionals can no longer just focus on managing projects and delivering findings. They are expected to consolidate, analyse and digest a wide range of business information and market knowledge, and to transform this into strategic insights for better decision-making.

Here we share a few key findings of an online opinion poll conducted by Oracle Added Value among in-house researchers from business organisations in Hong Kong and China (first presented at ESOMAR’s Asia Pacific Conference in 2009), to validate a number of hypotheses about the evolving role of in-house researchers.

96% indicated that they have multiple roles (ie, three or more) within their organisations, with an average of four other roles and responsibilities in addition to running traditional research projects. 91% were expected to monitor consumer and market trends, 86% to answer business questions from senior management, 82% to do data mining and deliver analytical insights, 79% to provide information to produce KPIs and business dashboards (percent referring to the frequency of mentions among respondents).

The respondents believed that in the coming 3-5 years, research suppliers would also be required to have multiple roles, including 88% as consumer trend providers, 86% as insight providers and 74% as analytical advisers.

How to succeed in the new role

The findings support that this transformation is an industry-wide phenomenon, at least in Hong Kong and China, if not globally. Let’s examine the changes required from in-house researchers to help practitioners better understand how to transform and succeed in this new role.

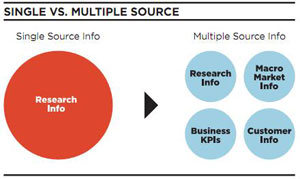

Single vs. multiple source information management

A fundamental change for in-house researchers is to expand their scope in collecting, managing and using information. The additional scope includes proactively tracking their industry’s market data (eg, visitor arrivals for tourism industry or number of new car registrations for automobile industry etc.), monitoring their organisation’s KPIs (eg, sales volume, revenue) and having access rights to extract information from their customer database (eg, membership data from loyalty programmes, transactional data from distribution channels).

Figure 2: Single vs. multiple source

This seems like a huge additional effort, but once in-house researchers can obtain this expanded scope of information, they will quickly understand the value it could add to interpreting research findings. For example, business users often ask about benchmarking with the industry norm – if they are already keeping track of this, they can easily include benchmarking measures in their research findings and address business users’ needs upfront.

Detailed findings vs. precise insights

With the expanded scope of information, in-house researchers are expected to consolidate, analyse, digest and communicate the key insights to business users and senior leaders who may not be interested in research methodology or even the details of research findings, but are eager to know the implications. As such, in house researchers should focus more on results interpretation rather than operational processes, such as monitoring quality or comparing different research methodologies, which in fact should be the role of the research supplier.

Moreover, instead of producing 50-page research reports, in-house researchers should consider short and precise insights with directional implications, such as a five-page insight summary or a one-page email alert to business users when business issues or risks are identified from research findings.

Research reports vs. business cases

In-house researchers should also consider changes to the deliverable format. With the ability to access and use different sources of business information, they could consider presenting findings in the form of business cases. This may sound as if they are stepping into business users’ territories, but it actually makes a lot of sense – a key advantage being that their role is usually more independent, enabling them to provide unbiased recommendations.

The format of a business case usually links research findings with financial indicators and provides various scenarios to support the recommendation. Whilst not requiring a lot of technical skill, forming a business case does require in-house researchers to acquire solid industry and business knowledge. The key success factors depend on the analysis and findings being on a factual basis and the recommendations being in the best interest of the business.

Marketing planning vs. business planning

Finally, in-house researchers are expected to create greater impact to the overall business. Typically, research findings are used mainly to formulate marketing plans but can be applied in many other areas such as: Assisting finance to set growth targets/financial goals via market tracking studies and PEST (Political, Economic, Social and Technological analysis, and describes a framework of macro-environmental factors used in strategic management analyses), Helping operations to define operational KPIs via customer satisfaction studies and supporting HR to formulate staff retention plans via employee satisfaction surveys.

This requires in-house researchers to be more proactive in establishing a close partnership with business users from different departments and to take more initiatives to identify critical issues from research findings and conduct deep-dive analysis for business users.

How research suppliers can help

As research suppliers realise the key changes in the transformation of in-house researchers, they should be aware that there are many opportunities to further develop their scope of services in supporting the evolution of their clients (the in-house researchers).

1. Information supply – passive vs. proactive

We have already seen that research information alone is not enough for the in-house researchers’ expanded role, which demands information ranging from the macro market and business environment to consumer insights. It is not difficult for them to access such information, but it is time-consuming to acquire information that is relevant and precise to their objectives.

Traditionally, suppliers are helpful in supplying information requested by clients, but by the time the client is aware of the missing information and requests it from suppliers, it is already at a late stage. How can research suppliers create more value? By being proactive, relevant and precise: proactively feeding clients with information on an ongoing basis, which is integrated and digested from multiple sources, relevant to clients’ businesses and precise to their business situations. This can build a good client relationship and involve them in clients’ operations and new projects at a much earlier stage to engage in a more solid partnership and create more business opportunities.

2. Professional services – client driven vs. carefree

With their new focus, in-house researchers seek to minimise time spent on ensuring data accuracy or determining the ideal research methodology. Even if suppliers are committed to providing the most appropriate research solutions and quality data, in-house researchers still cannot fully rely on suppliers, possible due to gaps in expectation between the two parties.

Gaps in the level of services and the standard of deliverables often exist. For instance, most suppliers bid on a project by following the client’s suggested research methodology and assume it to be the most appropriate, while the client is more concerned with if the outcomes can address their research objectives and answer their questions. They expect suppliers to raise alternatives if there are better approaches, and are frustrated when they realise that suppliers do not give them a heads-up on the limitations of the research methodology, or provide out-of-the-box advice in the early stages, leading to unexpected missing puzzles at the end of the research. Gaps in the expected standard and quality of deliverables are also common and could imply that more time is required to negotiate and communicate. In order to close the gaps, in-house researchers may even have to validate data accuracy and provide supervision on detailed steps, such as coding.

The ultimate purpose for in-house researchers to hire suppliers is to help solve their research needs with minimum project management and to transform their role. A ‘carefree’ service from suppliers will become more important than before. Therefore, instead of relying on clients to drive the details of research projects, suppliers should work more independently and rely less on clients’ instructions and save time for in-house professionals who can focus on result interpretation rather than project management. The cornerstone for success is for suppliers to equip themselves with the latest research methodologies and analytic models, to proactively advise in-house researchers, bridge gaps in expectations and gain more ‘hands-off’ reliance from the client.

Piece-meal vs. holistic understanding of client’s business

These developments imply expanded scopes of service and more opportunities for suppliers, because their clients are not just involved in formulating marketing plans, but also impacting other internal partners in their business planning. As these opportunities are internal, suppliers will need to better understand their client’s business in a holistic manner as if it were their own; to grasp information about their client’s market and competitors; building their team’s knowledge about clients’ business and create a long term partnership with clients rather than having project-based knowledge.

With the easy access to information provided by the Web 2.0 generation, providing information alone is no longer exclusive to researchers. The value of in-house researchers hinges on their ability to consolidate, analyse and interpret the information in an insightful way to impact the overall business, and this will multiply if suppliers can match this transformation at the same pace. Both sides should focus more on transforming their roles into strategic insight providers and analytical advisers – yet, their roles should not be duplicated. While suppliers provide digested macro-market and consumer insights and advice on the latest research methodologies; in-house researchers consolidate digested information from research suppliers and multiple sources, produce precise insights and help formulate business solutions in the best interest of the organisation.

Andy Kung is manager of Loyalty Marketing & CRM at Shangri-La Hotels & Resorts and Grace Tse is senior analyst, Business Insight & Research at Disneyland Hong Kong.