Jo Bowman

New horizons, fresh challenges. Fast-growing emerging markets buoyed the global market research industry and countered losses and sluggish performances elsewhere in 2012.

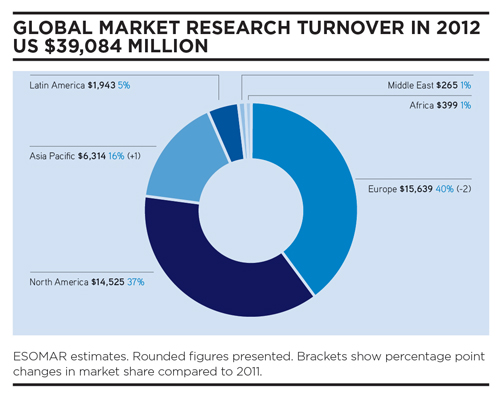

The ESOMAR annual industry study Global Market Research, which is released later this month, shows that total world turnover rose 0.7% in 2012 to US $39.1 billion. As always, the report is packed with industry data and analysis of the hottest growth markets, the fastest-growing companies and the most significant mergers and acquisitions. It also features interviews with respected industry figures, both research suppliers and client-side executives, on how the business is dealing with change – and what remains to be done if research is to keep pace with the increasingly mobile, data-driven world.

Top line findings

Two of the biggest short-term threats to global economic stability – the breakup of the Eurozone and the United States plummeting over what became known as the “fiscal cliff” – have been averted. Western European economies continue to flatline, while the US appears to be on track for growth in the year ahead. In the developing world, which has been responsible for maintaining growth globally for many multinationals while more established markets have struggled, some of the biggest countries are facing a slowdown in growth, and next-tier markets are showing robust growth, albeit from a small base.

For the first time, the industry turnover figures include estimated revenues for the sector referred to as ‘’Advisory Services’’, which includes consultancies such as Gartner, Forrester, International Data Corporation, Mintel and Euromonitor – key contributors to the wealth of market research being created. This year’s report presents comparable trend data for the year’s 2011 and 2012 as the study contributors were asked to provide an estimate that relates to the Advisory Services sector for the previous year too.

- Market research turnover increased in 46 countries or sub-regions in 2012 and declined in 39. For the first time, Africa and the Middle East are reported as distinct regions.

- Inclusion of Advisory Services adds a minimum of US $5 billion to global market value.

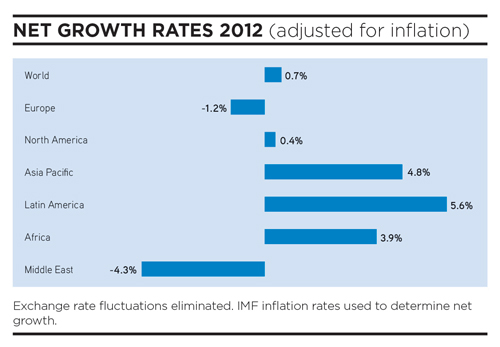

- North America’s slow progress towards recovery continued, with the region posting 0.4% net growth (after adjustments for inflation) to US $14.5 billion

- Asia Pacific, which held the title of fastest growing region with North America, slipped behind Latin America in 2012, posting net growth of 4.8% to US $6.3 billion, thanks largely to a return to growth in Japan. The far smaller but fast-developing markets of Myanmar, Laos, Pakistan and Indonesia all posted stronger growth than China, which grew 11.2%.

- In Latin America, growth surged 5.6% to US $1.9 billion, with Brazil and Argentina both posting double-digit growth, surpassed only by Honduras, where an election year pushed up opinion polling.

- Europe, which accounts for 40% of all market research turnover, suffered another year of decline, down 1.2% to US $15.6 billion. The biggest EU markets – with the exceptions of Germany, Sweden and Ireland – all posted losses. Europe’s strongest performer by far was Ukraine, which grew 24.8%.

- Africa posted 3.9% net growth after it faced a decline in 2011. Research revenues grew to US $399 million, with Kenya and Nigeria seeing a further increase in foreign investments.

- The Middle East suffered a drop in turnover of 4.3% to US $265 million, making it by far the worst performing region for the research industry. Israel flatlined and the Gulf states saw 7.1% growth, but unrest and uncertainty in Egypt, Syria and beyond led to plummeting confidence and research investment.

The order of the world’s top 10 biggest research markets remained largely unchanged in 2012, aside from Brazil overtaking Italy to claim the seventh spot. Brazil saw better than expected growth, lifted by political polling and research surrounding the upcoming Olympics and football World Cup. The UK kept hold of second place, despite declines in 2012.

Tipping point

Online quantitative research – which for the first time includes mobile internet – shot up 5% from last year, to US $10.5 billion…In addition to quantitative work, online is also being used for qualitative research. The biggest users of online research as a proportion of total research investment are Bulgaria (45%), Japan (45%), Sweden (39%), Canada (38%) and the Netherlands (36%). In many other markets, the proportion of business being done online is growing. The scale of change being made possible by the digitisation of business and of consumers’ lives is transforming the research landscape and its inhabitants, with many newcomers to the sector.

“There’s a real tipping point this year, but it will take three to five years for people to really understand what it means; maybe they’ll see it in hindsight,” says Reineke Reitsma, VP, research director at Forrester Research.

Information being generated at every moment of our digital lives promises to reshape our world in ways that go far beyond serving more targeted advertising or sharper recommendations on Amazon. “It’s potentially transformational,” says George Terhanian, chief strategy officer at Toluna. Big data holds big promise for many businesses, not least because much of it is already owned by the businesses and governments that want to exploit it. But there are limits to what big data can currently yield, warns Stephen Needel, managing partner of US-based Advanced Simulations. He notes that, while linking a range of data sets to look for new patterns sounds exciting, it’s far easier said than done. “Once we get over the fact that there’s lots of data, everybody’s assuming you can merge all this information, and that turns out not to be the case. There’s more stuff that can’t be put together than can be put together. Then once we put it all together, does it even matter? Can you do anything with it?”

Greg Mishkin, vice president research and consulting with Market Strategies International, says that, like all data, big data can be read in many ways. “While the data itself is very objective, making sense of it and putting a story around it is very vulnerable to interpretation. You can tell equally convincing stories that say the opposite of each other based on very similar data. Ultimately, a good storyteller can argue both sides.”

No one is suggesting big data alone holds all the answers to client questions, but its power and prevalence mean agencies need to think differently and broaden what it means to be a researcher. Leonard Murphy, editor-in-chief of the industry GreenBook blog, says talented people must take their core skills from the old era of research and apply them in different ways. “Will everybody be able to do that? No,” he says. “They’re certainly going to have to learn new tools – and certainly let go of the idea that this is how you ask a question; that’s just not going to fly. The future is about ‘why,’ not ‘how.’ It’s certainly not going to be a role focused on data analysis or statistics.”

This year’s Global Market Research report looks at how mobile technology is adding another dimension to the industry. With penetration at 96% globally (according to International Telecommunication Union,) mobiles are providing access to consumers in emerging markets who otherwise couldn’t be reached and offering flexibility to respondents in advanced economies. “It’s really about choice and meeting people where they are,” says Andrew Grenville, chief research officer at Vision Critical.

As with big data, one of the greatest challenges of mobile research is interpretation. “What do you do with 5,000 photos? How do we get the real meaning?” asks Sally Joubert, CEO of Luma Research in Australia. “That’s where we’ll be looking for technology to help us, and I’m sure someone will come up with some cool software that can really help with that. I certainly know that a lot of it is still very time consuming, but feedback from clients is that pictures really can tell a thousand words and give people real insight.”

In an always-on world, there are fresh questions to address about privacy, anonymisation and informed consent. The GMR report finds that, while passive research often gives consumers the shivers, people who say they’re concerned about privacy are often lax about reading the fine print in the online agreements in which they give away so much about themselves.

Signs of optimism

In spite of the tame growth in the global market research industry in 2012, there’s confidence that business is improving. A significant majority of respondents to the GMR questionnaire see a stronger business year in 2013: 60% said there’d be growth this year; 19% expect takings to be down; 21% anticipate no change.

Success, the report suggests, will depend on research demonstrating its value and being prepared to take a different approach to client problems. “We have typically, as an industry, sold projects – clients have said ‘I need to do this ethnography’ or ‘We need this brand tracker,’” says Mishkin. “We have been order-takers, relying on the buyer to know what they need and to use it well. We need to get out of that order-taking mode and get more into driving business answers.”

Philip Garland, VP methodology with Survey Monkey, says: “We still need to ask questions. Businesses and academics all need information, so the question probably hasn’t gone away; it’s just that the solution is not fit for purpose.” Can research adapt quickly enough? “If we can’t, it’s lights out,” he warns.

GLOBAL MARKET RESEARCH 2013

ESOMAR INDUSTRY REPORT

IN COOPERATION WITH BDO ACCOUNTANTS & ADVISORS

Now in its 25th year, the report includes:

- Global and regional highlights and growth data on 80 countries, with Myanmar newly added to the list.

- Country-level breakdowns of sources of turnover, spend by client type, project type, research method and design.

- Expert insights into the questions around big data and the rise of mobile research.

Global Market Research 2013 is being launched officially at Congress on September 23rd.

GLOBAL MARKET RESEARCH 2013 is free to ESOMAR members in PDF format and can be downloaded in the MyESOMAR section of the website.

1 comment

Greetings from California! I’m bored to death at work so I decided to check out your site on my iphone during lunch break. I really like the information you provide here and can’t wait to take a look when I get home. I’m shocked at how quick your blog loaded on my mobile .. I’m not even using WIFI, just 3G .. Anyhow, fantastic site!