Ask any researcher and he or she will tell you that what they do is important and that it has an impact on the business. Surprisingly, not all of their stakeholders would necessarily agree. Using the BCG maturity typology for consumer insights (CI) functions in major companies, we find that in the 80% of departments that do not measure up to the status of “strategic partner”, over half the stakeholders interviewed did not agree that CI gave the firm a competitive advantage; and that over a third did not agree that CI contributed materially to financial performance[1]. In effect, these stakeholders were saying that they were wasting the money being spent on research. As you might imagine, departments in such companies invariably face budget and resource cuts when the organisation comes under pressure.

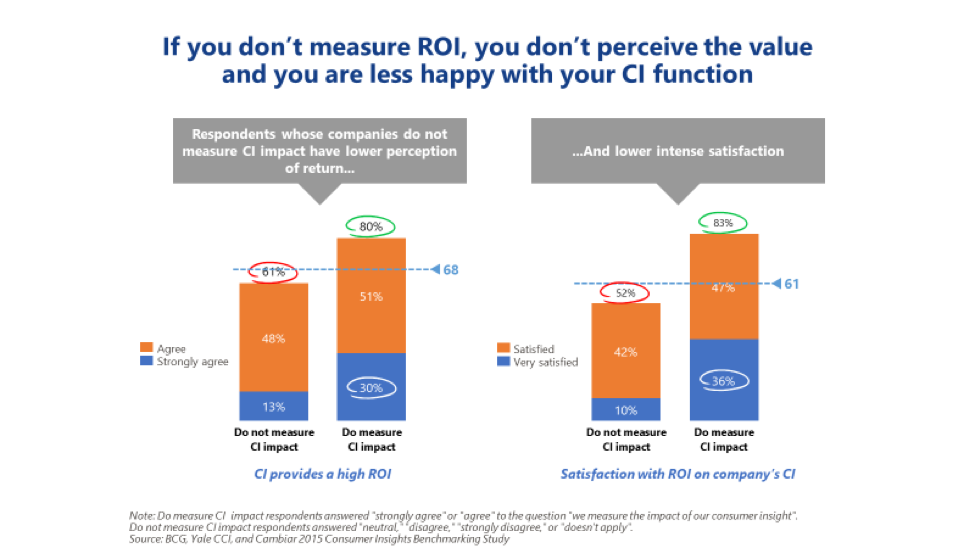

By contrast, there was widespread recognition of the contributions made by departments that met the conditions for being strategic partners – and greater, more intense satisfaction with their output. It was clear that there were a number of factors at play here: these departments had more control of their own budget, allowing for more strategic projects and more experimentation with innovative new methods and approaches; they invariably had a champion in the C-Suite; they were forward looking and less likely to do validation work. But there was one factor that leapt out even more than the others: strategic partner functions almost invariably measured the impact of what they were doing on at least 50% of the projects they carried out. The more they did so, the more intensely satisfied their stakeholders were.

While the fact that measuring your impact (or Return on Investment) had a significant correlation with satisfaction did not surprise us, we nonetheless were intrigued as to how these departments were actually able to do so. After all, the sheer ability to measure ROI on insights has been a matter of some considerable controversy for a very long time. Many researchers argued (and continue to argue) that it is impossible to measure ROI. Too much happens between the time the research is done and the impact of decisions based on that research making itself felt in the market; marketers do not always follow research recommendations; there are other factors at play, such as distribution, media mix, competitive behavior and so on. In short, there is too much noise to allow for a clean calculation of ROI or impact to be made. And yet here were nearly a third of the companies studied doing precisely that (or claiming to). How were they doing it? What metrics were being used?

To find out, the Global Research Business Network (GRBN) teamed up with BCG to conduct a follow-up study among these companies with a view to unlocking their secrets[2]. Over 200 senior executives and practitioners were quantitatively interviewed across ten industry sectors. A further 20 IDI’s with the same population helped dig deeper into the intricacies of measurement.

The results spoke to a need for discipline, common sense and process:

- Discipline in as much as measuring business impact requires real commitment to do so on all projects where it is feasible;

- Common sense revolving around precisely, clearly understanding and stating the business objectives of a project up front so that all (researchers, stakeholders, agencies) are in agreement about the metrics to be measured;

- Process – like many aspects of business management, measurement needs to follow a process to which all adhere.

They also spoke to recognising that business impact measurement is not a one size fits all issue. It can be messy, but to reduce the potential for “mess”, stakeholders and researchers need to be in alignment. This means that the most important part of the project of all is the original briefing where the business objectives (not the research objectives) are agreed and understood by all. Unfortunately, this is a requirement that in too many departments is honored in the breach. It is not unknown for even the stakeholder not to understand the real business objective, let alone the researcher. A briefing process and document is therefore vital to achieving this understanding.

Once that has been achieved, then the metrics used to measure impact or ROI can also be agreed. In many circumstances (for example, a copy test) setting a financial metric (increase in revenue or reduction in cost) can be set and easily measured. The same can apply to some more complex projects – for example, media mix modeling. One client told us about such a project saving $15 million in unproductive media spending – a clear and present example of an excellent return. In other cases, financial impact may need itself to be modeled through the use of sophisticated analytics. This is especially useful for more strategic projects that touch many aspects of the business, such as segmentation. But it’s not always possible to get directly to financial impact. In those cases, departments resort to surrogate measures such as increase in customer retention, brand awareness or likelihood to try. If all else fails, anecdotal evidence may be deemed appropriate. The point is to agree up front what metrics are going to be used and stick to them.

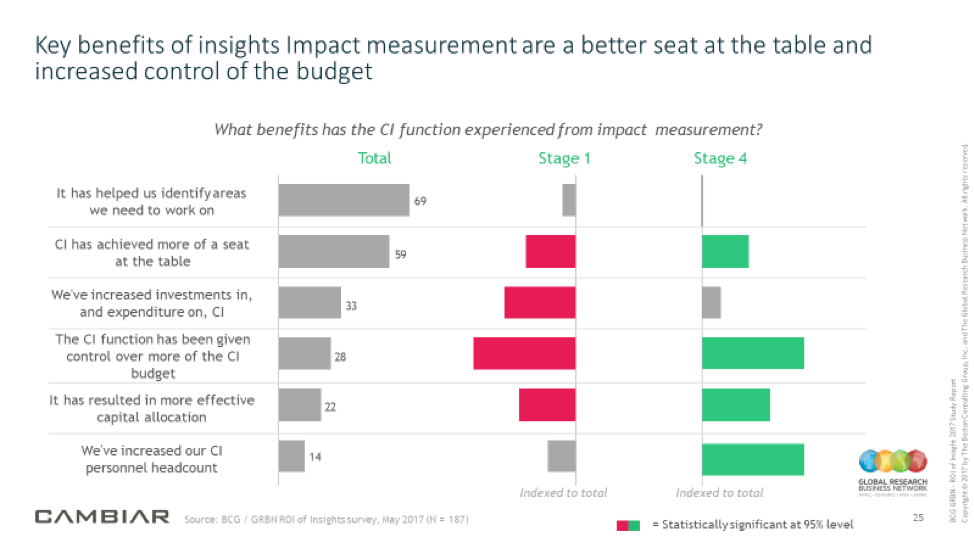

What also emerged from this study was the clear and enduring benefit of measuring impact.

Not only were CI departments who measured the impact of their work more likely to have a seat at the strategic table, they had greater control of their budgets (allowing for further strategic and innovative work) and saw an increase in available resources. Satisfaction with their contribution increased dramatically and they garnered more respect in the organisation. As such, think of business impact measurement as a flywheel – the more you measure, the greater the resources, the greater the impact, the greater the satisfaction and the more you measure…..

But this does not happen all on its own. The whole point about measurement is to prove the value of insights to the C-Suite and to the organisation as a whole. As such, the results need to be strongly marketed across the enterprise in the form of newsletters, infographics, portals, videos, posters, insights fests – any way in which the message can be carried powerfully and with authority.

Finally, if you are a research agency executive reading this and thinking “what does this have to do with me?”, get this: departments that measure business impact are far more satisfied with their agency partners and involve them in the whole process, including the business objectives. This leads agencies to think about how they too can contribute to impact – in the form of design, deliverables and consulting. Let’s face it: wouldn’t you rather be working with a client that has stable to increasing budgets, more resources and does more strategic and innovative work? One that is likely to be a long-term partner rather than a cost-cutting, price-badgering firm that takes your work and hands it over to a DIY platform? Precisely. Get involved and do it now!

For more information about the findings of these studies, as well as access to the invest In Insights Handbook, visit www.roiofinsights.com. There you will find resources to get started on this journey, including seminars, training and templates.

Simon Chadwick is editor in chief of Research World and

managing partner at Cambiar in the USA.

[1] Consumer Insights Benchmarking Study conducted by BCG, Cambiar and Yale – 2015/6

[2] BCG GRBN ROI of Insights Report – November 2017. Available at www.roiofinsights.com