With the imminent arrival of Disney+ and Apple TV+, MarketCast conducted a survey earlier this summer of 3,000 current video-on-demand (VOD) users aged 16-54 in the UK, Germany, Mexico, and India. The survey covered perceptions of current and future streaming services, and looked to understand the extent to which an already disrupted market is about to be disrupted again.

The Rise of Netflix and Prime

When it comes to the UK, Germany, and Mexico, there is one company leading the pack: Netflix. Claimed usage of Netflix averages to 77% across the three markets while the closest competitor, Prime Video, has an average claimed usage of 46%. In India, the Disney-owned local provider Hotstar dominates reported usage (76%), followed by Prime Video (65%) and Netflix (61%).

To understand Netflix’s dominance, we investigated perceptions of the different services. Across all markets, Netflix was synonymous with ‘high quality content’ and ‘unmissable programmes’. However, there was some variation across the three markets Netflix led in:

- In Mexico, the streaming service leads all competitors on all measures

- In the UK, BBC iPlayer challenges Netflix in terms of ‘ease of use’ and ‘family-applicability’

- In Germany, perceptions of Prime Video are fairly close to Netflix especially for delivering ‘something for everyone’

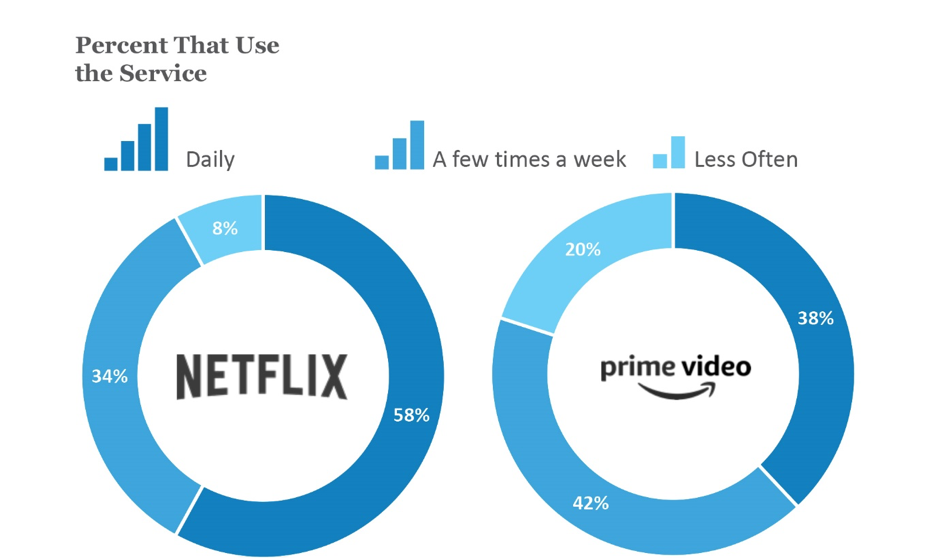

Across markets, Prime Video is seen as the second choice VOD service, both in terms of claimed penetration and brand perceptions. However, only 38% of Prime Video users claim to use it daily. This is compared to 58% for Netflix users. One possible reason for the difference is that whilst Prime Video is also seen to have ‘high quality content’, it’s less likely than Netflix to be seen as ‘unmissable’.

However, whilst Netflix excels amongst 16-34s, Prime Video is able to boast a more balanced profile. Indeed, reported usage in Germany and India amongst 35+s exceeds that of Netflix. This provides Prime Video with a broader audience platform from which to build.

Disney and Apple’s Demographically Desirable Audiences

Despite limited information on these forthcoming services (at the time of going to field), intended uptake for new streaming services from both Apple and Disney is high. And, crucially, the potential audience for both services are financially comfortable, heavy TV consumers. However, some key differences exist:

- Disney has a younger-skewing potential subscriber base (16-34s interest is 9% higher than 35+s) than Apple TV+

- Apple TV+ intenders are more likely to be parents of children over 12 years old (5% higher than Disney+ intenders) whilst Disney+ intenders are more likely to have younger children

- And when it comes to other entertainment, those interested in Disney+ are more likely to be film lovers (13% higher than VOD users). However, those considering Apple TV+ are more engaged with audio streaming services (10% higher than VOD users)

The Battleground: Amazon Vs Apple and Netflix Vs Disney?

Should consumers hit a saturation point and begin to choose, it appears that there are two groupings of competition:

- Those leaning towards Disney+ rather than Apple TV+ are more likely to already subscribe to Netflix (80% compared to 73% of VOD users) and, like Netflix, subscribers skew younger

- Those leaning towards Apple TV+ rather than Disney+ are more likely to be existing Prime Video users (56% compared to 51% of VOD users) with both stronger amongst 35+s

What Does This All Mean?

With forthcoming streaming services from Comcast, Time Warner, and others set to fragment the landscape, it becomes difficult to make predictions, but our data highlights:

- Netflix’s delivery of high-quality, unmissable content has seen it rise to the position of market leader, particularly in the UK and Mexico

- India and Germany are where Prime Video and Netflix are closest, with Prime strongest amongst the 35-54 audience

- Disney+ looks to have good potential amongst younger, affluent audiences, with its film franchises and traditional child-friendly content proving to be appealing

- Apple TV+’s potential audience is also desirable and most similar to Prime Video

There is currently an appetite for new entrants; however, there will likely be a saturation point due to time and cost limitations. But in the meantime, it appears the disruptors will face disruption.

Read the study findings in full on the MarketCast website here.