The Australian Broadcasting Corporation (ABC) is Australia’s largest public broadcaster reaching more than two-thirds of the Australian domestic population each week across five television stations, eleven radio networks and vast digital offerings.

However, we are operating in a market where broadcast stagnation, digital disruption and audience fragmentation have become the norm. The entrance of global digital players in the market has pushed the ABC to consider how to revive and sustain audience engagement with relevant content and products. What is the role of public service media in 2020 and beyond, and how do we evolve to ensure we are meeting the needs of our customers?

Fortunately, the ABC has a strong and established data culture with decades of audience measurement from which to draw on. However, industry audience measurement does not capture the complete picture of behaviour and attitudes, nor does it combine linear broadcast occasions with digital usage across varying market products. In order to find new ways to drive audience engagement we need to understand the media moment in full; the dynamics of media occasions and needs (relatively unknown in our organisation) and marry this with our current data sources to create a 360-degree version of the truth.

To do this, we created a map of the media market in Australia, first capturing video and audio occasions (both linear and digital) and soon to expand to news and information as well as social media consumption. Collected over a series of online quantitative surveys in 2019 and 2020 we have captured, thus far, over 22,000 occasions (using a simple 6w’s model) from more than 5,000 adults and children across Australia. The 6w’s include the who, why, what, where, when and with whom questions that help us better understand the full picture.

Whilst the methodology itself is not new or different, the scale of the project sets it apart in our market. As a public broadcaster, our audience is every Australian, no matter their age or location. Our business has relied heavily on broadcast and digital ratings in the past, as the only source for robust and representative research. Our project was and continues to be, set to the same standard of delivery as the local currency.

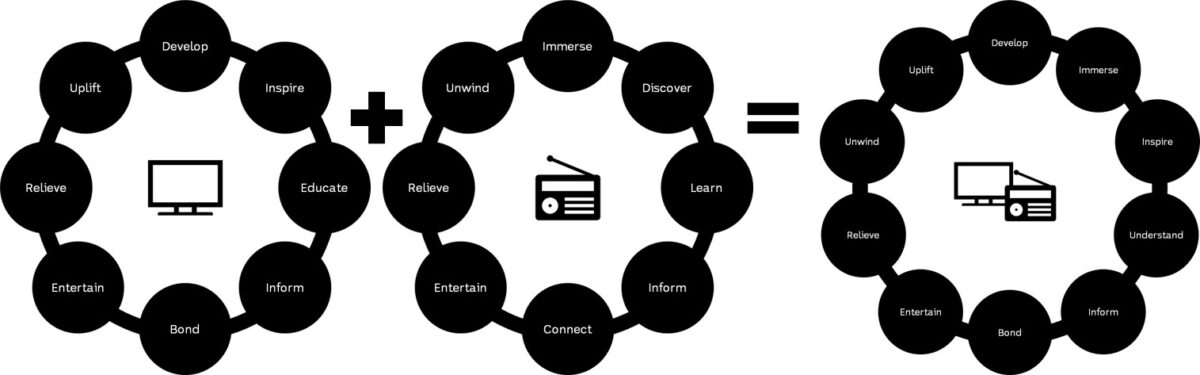

From the results of our studies, we employed a latent class analysis to create multiple need state segmentations based to format, in this instance video, audio and text, and to an audience, adults and children. Although this appears to be duplication of work – we know that audience media needs are typically universal – our business gravitates to format. We are in the process of layering our segmentations into a single unified model, one that reflects how audiences choose content – not formats – that reflect their emotional and rational desires at the time, and the inward and outward pressures or expressions at play.

The overlap in need states between formats is further evidence that we can no longer act in silos at the ABC – that audiences act on a need, needs determine content selection, which in turn determines the platform. We are no longer playing in a world where liner television dictates audience behaviour – audiences have assumed control.

Our project continues to roll-out. With a business of roughly 4,000 staff, we have conducted multiple embedding sessions with all levels of employees including audience and enterprise researchers, marketers and creative designers, strategists, journalists, content decision-makers, product owners and distribution specialists. These sessions not only share our market map but encourage internal stakeholders to shift their thinking by placing greater emphasis on the ‘why’, complimenting, if not superseding the ‘what’. This moves us away from an observational perspective to a more immersive understanding of behaviours.

Additionally, we have hosted workshops for opportunity identification focusing on new or improved content, products, communications and even ways of working. We have combined our results with television, radio and digital ratings for evaluations that help explain successes and failures. Our team of insights analysts can now better formulate responses as to why a particular program or product did or did not meet expectations.

Our work has had implications for our brand image, proposition, and even our strategy-pivot in response to the COVID-19 pandemic. When Australians were forced into lock-down, turning to linear and digital media, we could predict what our audiences needed from the ABC at that time, and what a shift in our priorities would look like within the broader market landscape. With our research, we could determine who ‘owned’ the escape-space and the potential audience engagement with our range of dramas, comedies and specialist programming that offered audiences a way to ‘switch off’. We also took the opportunity to measure audience needs during challenging circumstances; a situation we take seriously as an emergency broadcaster to the Australian public.

Unfortunately, due to the COVID-19 pandemic, it is not easy to prove causation between our improvements in audience understanding and increased audience reach or perception of our value to the Australian public at this time. Though we have certainly seen an increase in time spent on ABC products! Media consumption behaviours changed tremendously throughout varying phases of COVID-19, and it was important to shift our focus to ensure we continued to deliver as a valued partner with our audiences changing needs.

In essence, our map of the media market in Australia acknowledges the limitations of traditional data sources and attempts to rebuild their value. This is the first step in our journey to bring together broadcast ratings, digital analytics, and primary research to create a singular understanding of occasions and audience needs. This is an elaborate program that has provided our organisation with meaningful insights to ensure we continue to deliver to all Australians. It is also an enhanced approach that contributes to thought leadership in the Australian media research space.