Trish Doran Rainone

First published in Research World March 2010

How do clients differentiate between research suppliers, and which ones are awarded the largest projects?

After 20 years of conducting market research in a packaged goods environment, I decided to pursue a new opportunity in the financial space. Whilst the transition to financial was generally a welcome challenge, I was surprised that the expectation for consumer input and insight was much lower than I was used to, and the quality of work and level of service from the research suppliers was often disappointing.

I needed to know why, and asked the following questions: are we working with the right suppliers? Was our account assigned a more junior team because our company didn’t demand more? Is it that my staff are not senior enough to guide a higher level process? Or is market research in financial services below par compared to other industries? After three years in the financial sector, I can honestly say that a bit of all these elements play their parts.

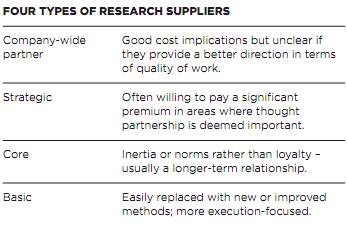

Four types of research suppliers

This led to a stimulating discussion about our expectations of suppliers and then an evaluation of our supplier relationships, especially those with whom we were spending a million dollars or more. The model used to evaluate our supplier relationships was quite simple, and featured basic, core and strategic suppliers, plus a category called strategic company-wide partners, which was introduced due to recent pressure by procurement.

This where it became very interesting in terms of our expectations.

Basic suppliers were often used for a particular methodology and worked with us at a more tactical level. They offered off-the-shelf approaches, assigned a junior person as the main contact, were resistant to changes and additions to the current method and were not very responsive in giving updates throughout the project. We expected volume discounts and often accepted analysis on a one-off basis. We did not seek additional information about other services and they rarely offered this information.

Core suppliers worked on a few types of projects – both strategic and tactical – and we expected a supplementary point of view about the business challenges. We had greater access to senior people but we were the ones who had to request updates on projects and timely responses were sporadic. Because they are familiar with our business and how we like projects managed, they were often awarded projects due to inertia on our side rather than loyalty.

I am always disappointed when I call a supplier for an update and they cannot give me basic information on how the project is progressing, and this is often the case with core suppliers who are too busy to provide individual attention.

Strategic partners had different qualities that helped earn our loyalty. We tend to buy more from them over time and they are winning a larger share of the budget, frequently for projects worth over a million dollars. They may be awarded a project even if they are not the lowest-cost bid and we are often willing to pay a premium in areas where thought-partnership is deemed important. Furthermore, with the consolidation of many research companies, these suppliers stayed abreast of the latest developments, offered us new services, and the senior person acting as the main contact, updated us on how additional services and new methods could help our business.

What made these ‘million dollar’ relationships different?

My first response is the senior person managing our account, because it is not just about the relationship with the company but also the person representing your company. I had an excellent relationship with one of our preferred suppliers and worked to get the senior person promoted because of the great job he did for us. We doubled our spending with this company because of his leadership. It was not a good day when he was moved from our account. A bumpy transition was exacerbated because the new lead had to take his four weeks of carried-over vacation during this transition. What was the company management thinking? Luckily for us both, the loyalty and generally good relationship developed over the last few years helped us through this difficult phase.

Other criteria that defined loyal partnerships consisted of:

- Having a senior person who wants to discuss the business challenge and offer alternative methods to address the research question. This should be a two way conversation – not just the supplier asking questions. Experience in the industry and knowledge of the company culture come in play here. It feels as if some suppliers are bringing in junior people who lack general business knowledge, receive minimal training and can only take direction instead of offering meaningful alternatives.

- Receiving the proposal on a timely basis, outlining the objectives, timeline and process accurately. This may sound very basic, but we have received proposals that have been copied from previous projects (and for other companies) that have not been scrubbed completely.

- Having a senior person who is available on a daily basis throughout a project and who shows interest in the process and the results. Frequent communication of study progress should be standard.

- Being flexible in making changes and additions to method. We may ‘buy into’ the model you recommended, but this does not mean a turnkey project to us. We don’t need the same results you just gave to our major competitors.

- Starting the presentation with the objectives and answering these questions first. Again, this may sound basic but seldom happens and this is a common complaint from many of my peers. We want presentations with charts, graphs and pictures that tell a story and involve the audience, and this requires the senior person creating the presentation – not just editing it. Many techniques remain fairly constant, but data gathering and communication of results are light-years away from when I started over 20 years ago. If this statement doesn’t feel right to you, it means that you are probably becoming extinct.

- Initiating a bi-annual check-up from senior management. I strongly suggest that a senior executive takes the time to reach out to the company research director that is spending a million dollars or more of their budget on you. It is vital that you invest as much time in retaining a good relationship as you do trying to acquire new business. Many of my colleagues agree that currently it is the clients who reach out to suppliers to promote this type of communication.

- Providing a proactive meta-analysis to clients is the ‘Holy Grail’. Once you hit a million dollar account from a company, additional analysis is expected. ‘What did we learn over the studies completed that year’, triangulated with syndicated data available, and offering new insights. The unprecedented M&A activity provided larger suppliers with the opportunity to acquire and harness new information that can provide differentiated information. I would be thrilled to have a supplier call to say an interesting pattern emerged while comparing current results to previous studies.

Kick off and touch base

I am not overlooking the hurdles that challenge suppliers today or saying that underperformance is one-sided as this is obviously not the case. There is pressure for lower costs, faster turn around and less people to get more done. We are all trying to catch our breath in these times.

Research teams need to be willing to share information so the supplier is more knowledgeable and better-able to generate insights. A kick-off meeting to discuss objectives and share information on the project could make a significant difference in expectations and outcomes. Senior leaders should make a point to touch base during and after a project to keep the relationship on the right track.

Pro-active communication on a bi-annual basis for million dollar clients is a must for a healthy relationship. Start the year off right by building a stronger dialogue with current partners, reach out to acknowledge the relationship, and open up lines of communication.

Trish Doran Rainone is VP Market Research at Chase Card Services.