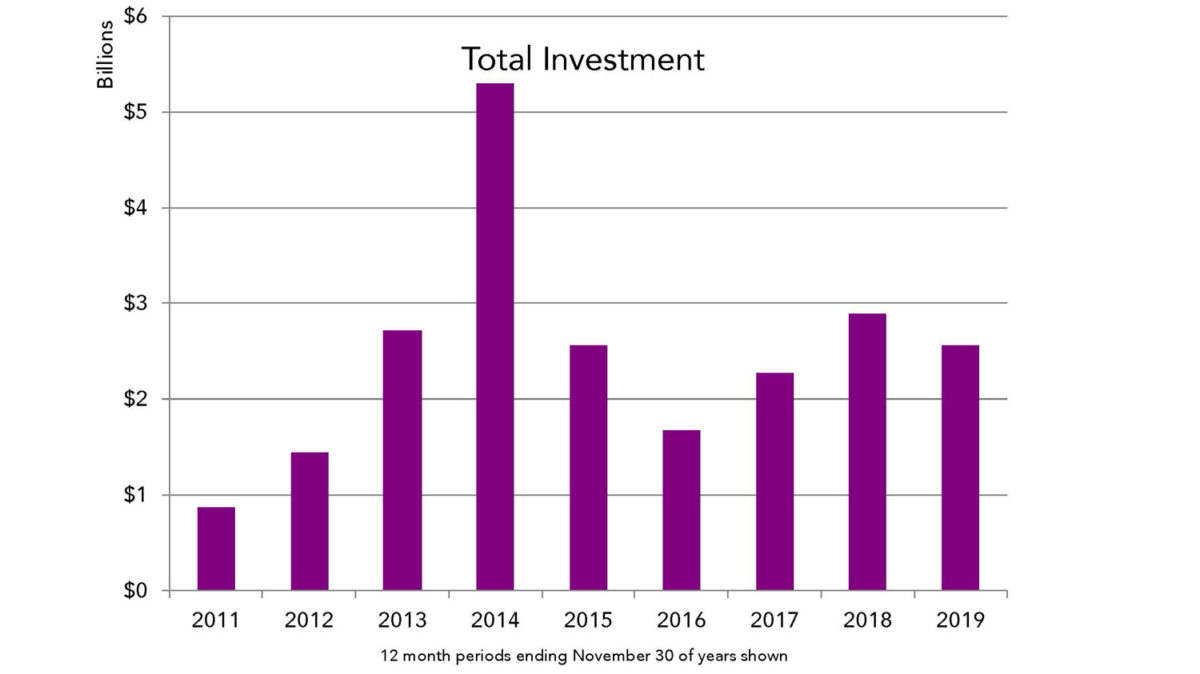

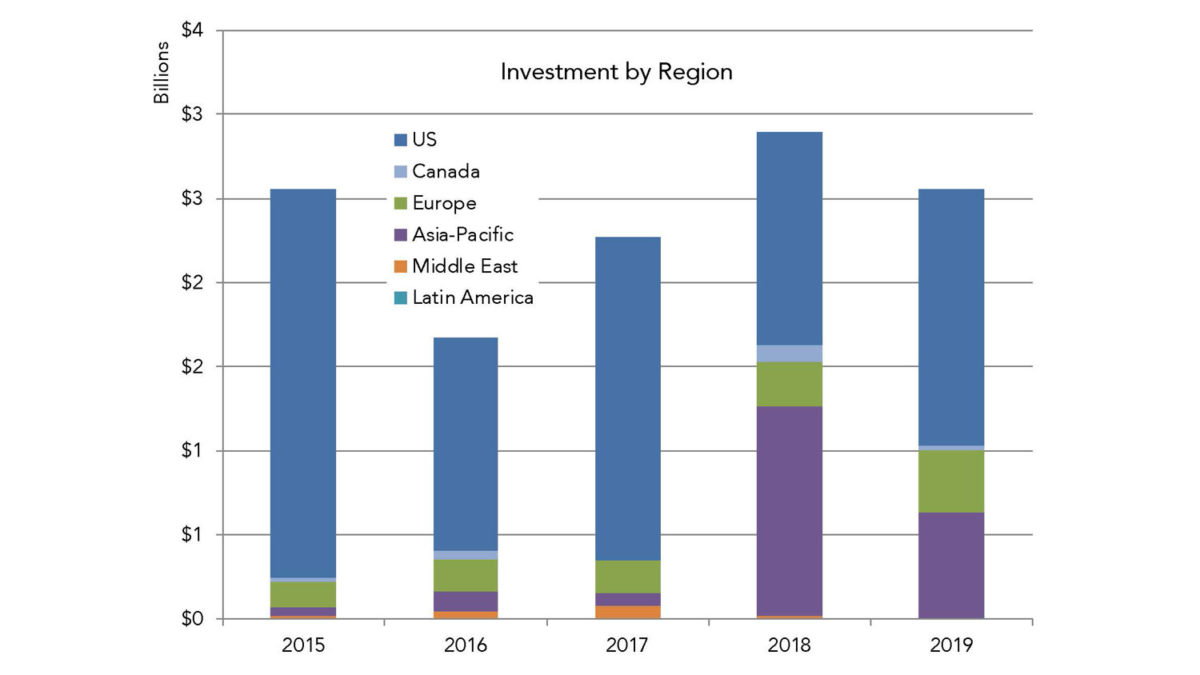

On the surface, inward investment into the Insights Industry appeared remarkably stable in 2019. The number of transactions monitored by the Cambiar Capital Funding Index (67) was identical to that of 2018, while our estimate of the sum total of investment (US $3.2 billion) was down just 11% from the prior year.[1]

On the face of it, this would suggest that there is still considerable investor confidence in our sector and its ability to innovate. Under the surface, however, a very different story is playing out – a story of profit taking, investment in proven winners and significant geographic shifts.

Reaping what was sown, but less new sowing

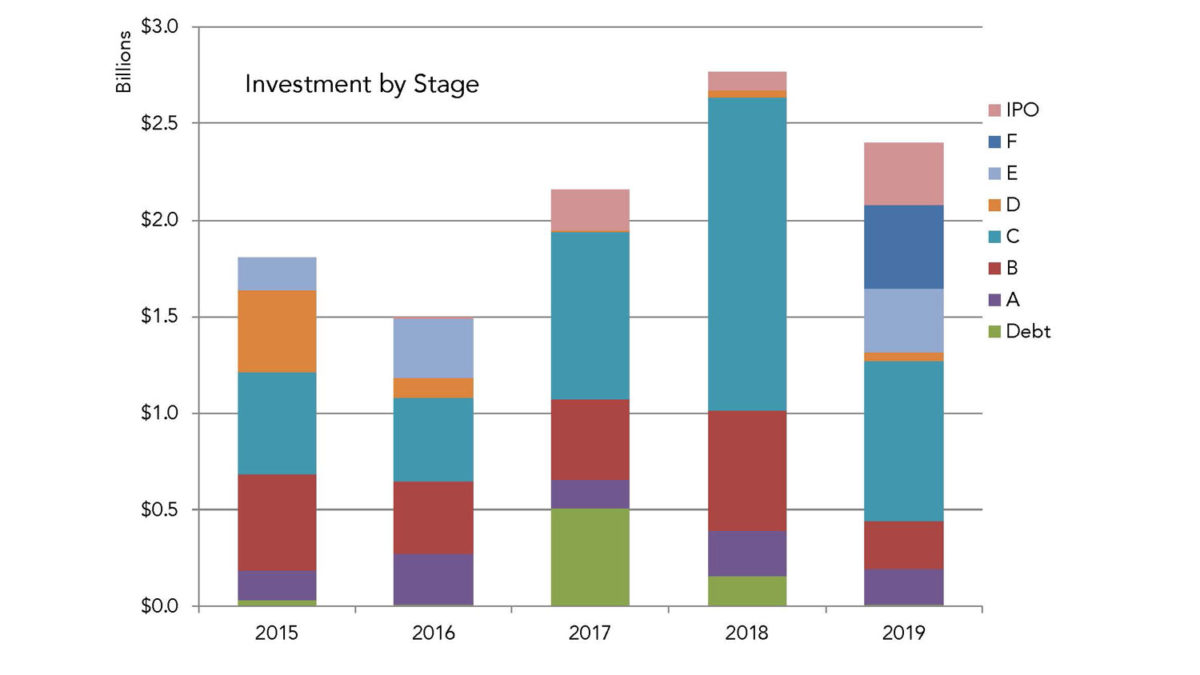

First, let’s take a look at profit taking. For any Venture Capital Fund, the ultimate goal in any successful investment is to take the business to market via an IPO (Initial Public Offering) on the Stock Exchange. Since, on average, only 10% of VC investments succeed, a large IPO can make all the difference to a fund’s ultimate ability to deliver a healthy return on investment to its backers. In 2019, fully 13% of total inward investment in the industry came in the form of IPOs, the highest level seen since the Big Data boom year of 2014. If that were not enough, another 30% came through what can be deemed “pre-IPO” funding rounds. These are what are known as Stage E and F rounds – essentially the fifth and sixth major injections of venture capital funding in a successful and, by now, relatively mature company. Typically, such rounds enable the business to mount a final growth spurt before being taken to market.

Thus 43% of all investment in 2019 was poured into companies that were proven successes and would provide significant returns for their VC backers. These were not funds into new innovation but “doubling down” on the winners.

As may be expected, these investments are typically very large. As in previous years, just a few companies accounted for the vast majority of these funds.

| Company | Investment ($m) | Investment Stage | Sector |

| Zhihu | 434 | F | Q&A Platform |

| Medallia | 326 | IPO | CX Platform |

| Thoughtspot | 248 | E | Big Data Analytics |

| CultureAmp | 82 | E | Employee Analytics |

| Innovid | 30 | Pre-IPO | Video ad measuring |

At the other end of the scale, Stage A and B rounds of funding – typically investments into new, early stage businesses representing new innovations – shrank to their lowest level in the history of the Index, representing only 17% of all money invested.

Funding definitions:

Seed: very early stage funding, usually at the beginning of a company’s life

Series A through F: sequential rounds of equity funding as the company grows, with “A” being the first in the series; usually these rounds are funded by venture capital or private equity funds which then become shareholders of the company

Debt: funding, often carried out by banks, that injects capital into a company; that capital then becomes a debt obligation for the firm – funders become creditors rather than shareholders

IPO/Stock Issuance: a public stock offering to raise capital.

This is not to say that there was a complete lack of investment in small, innovative start-ups. Indeed, 43 of the 67 total transactions were Seed, A or B funds. However, typically these involve much smaller amounts of money. More to the point, in 2019 there were 10% fewer such transactions and the average amount invested was 25% lower, suggesting that VC appetite for new investment in our sector is waning somewhat.

New directions

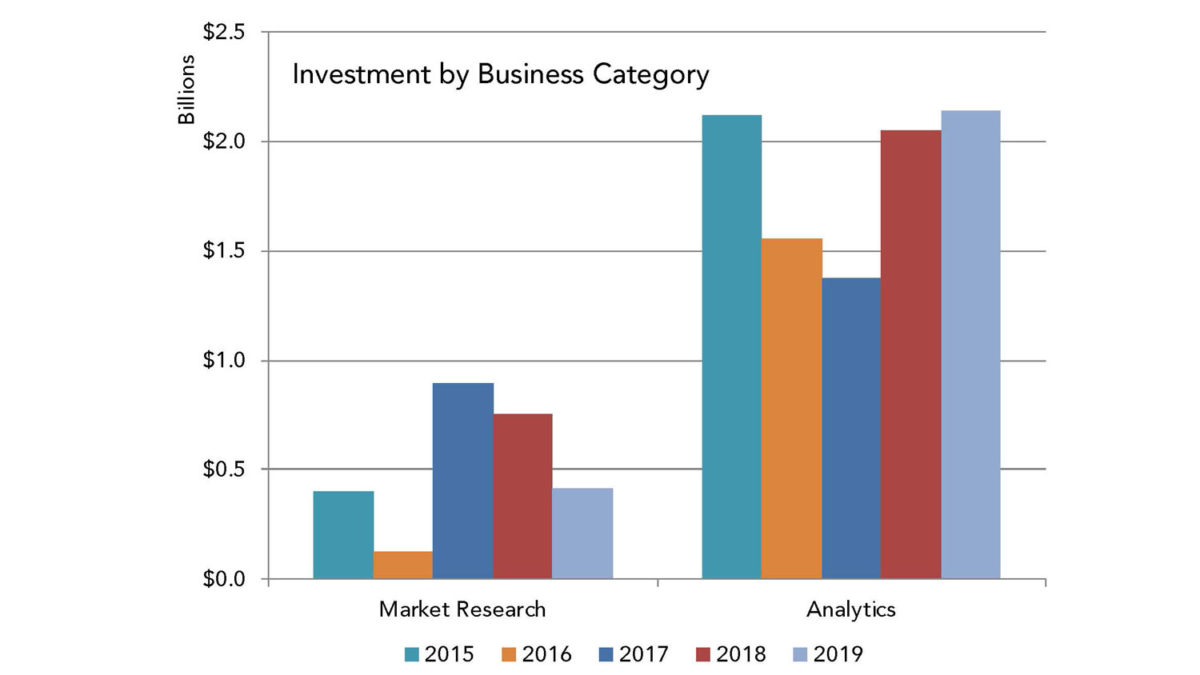

Each year we look into the entrails of inward investment into the industry, we usually discover a “flavor of the year”, more of which in a moment. One thing that has remained steady, however, is the persisting preference among investors for data analytics over what may be termed classic market research. 2019 was no different.

As in previous years, the main interest in the market research sector continues to lie with platforms, with Medallia being the main standout this time around.

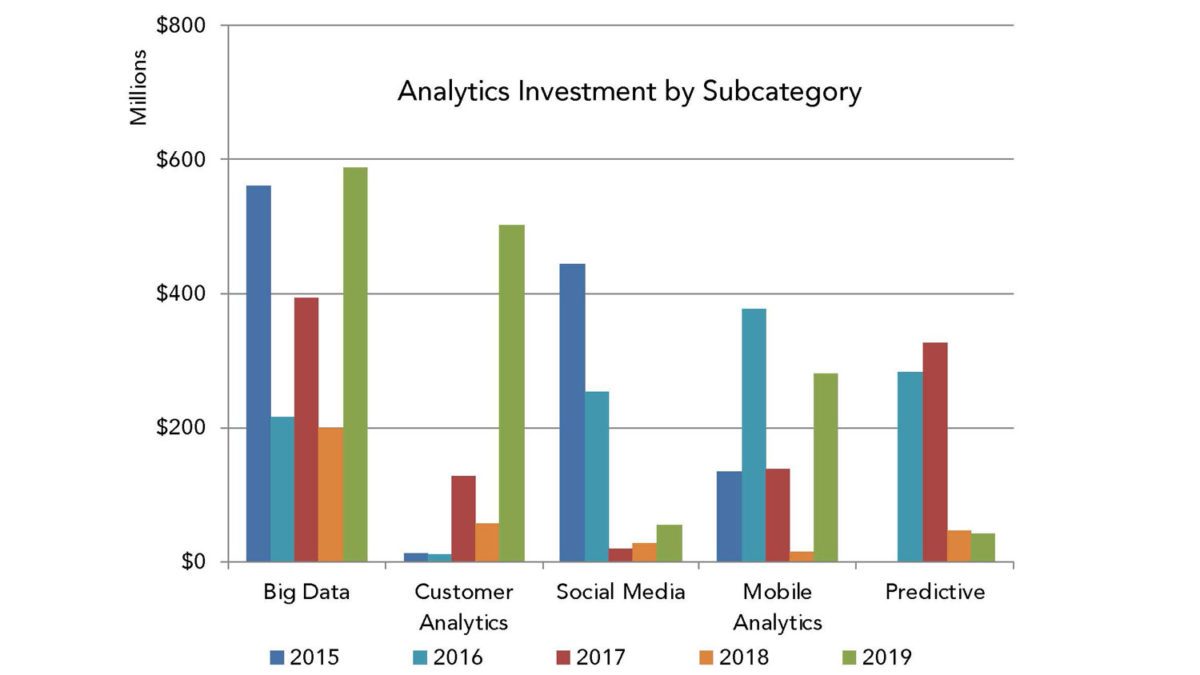

In the analytics sector, the “flavor of the year” trend continues unabated. In 2014 it was Big Data analytics; in 2015 social media analytics; in 2016 mobile; 2017 predictive; and in 2018 video analytics (thanks to a massive series of investments in a Chinese firm specialising in this area). 2019 is no different. This year, we see not only a resurgence of interest in Big Data and mobile, but also the emergence of a brand new flavour – customer analytics.

Note that video analytics is not charted, primarily because investment in the category (literally) fell off the charts. However, on December 3rd 2019 – three days after our cut-off date for this analysis – the Chinese video app analytics firm Kuaishou received a $2 billion investment from TenCent. Clearly, video analytics is now very big business in China.

Given the predominance of such large investments – and the profit taking prevalent in the sector at present – it perhaps behooves us to take a look at where early investments are being made, even if they are fewer and lower than before.

Leading the pack is Big Data analytics ($74m), followed by customer analytics ($38m), MR and CX platforms ($37m) and predictive analytics ($35m). The presence here of MR and CX platforms is probably a halo effect of the successes of Qualtrics and Medallia – after all, venture capitalists are herd animals just like the rest of us (cf. Mark Earls).

The continued fascination with Big Data analytics suggests that the investment community still believes there is room for a few more players in this space, while the emergence of customer analytics and the resurgence of predictive analytics may be viewed as intertwined. Whether these emerge as trends over the next couple of years remains be seen, but this seems as good an indicator as any that they will.

Geographic shifts

For the first seven years of this index, the vast majority of investment activity in the Insights Industry took place in the United States. In 2018, that changed dramatically, with Asia Pacific – and, in particular, China – taking center stage. This was due in major part to the $1 billion investment in SenseTime, a video analytics firm based in Hong Kong. While not as pronounced this year, it is still true that both Asia and Europe now account for a significant portion of the investment pie.

What is perhaps even more interesting here is that in both the US and China, the majority of funding occurred at later stages (C and above), while in Europe it was in earlier manifestations of development (C and below). This may suggest two things:

- China is now challenging the US in terms of building large and successful new analytics businesses and capabilities;

- Europe, which hitherto has excelled more in new businesses based in IP rather than technology, is catching up in the tech-based insights world.

This shift in the geographic makeup of investment in this industry is also reflected in those doing the actual investing. In the past we have consistently and regularly seen a group of stalwart investors in this space including Sequoia Capital, Andreessen Horowitz and Norwest Venture Partners. Today, the standout investors appear to be more likely to be Chinese, including Baidu and TenCent Holdings, neither of which are typical venture capital funds.

A shifting focus

The Insights Industry has attracted over $28 billion since 2011, the first year that the investment community really became interested in the sector. In that time, we have seen investors focus on a number of different disciplines with some spectacular wins in many of them. Most of these, until two years ago, were located in the United States.

Today, the focus is shifting. In the US, the emphasis is now more on reaping the benefits of past investments rather than investing in new ventures. At the same time, the geographic focus is also shifting, with both China and Europe taking a much more active role. How this will play out in the future is anybody’s guess. A second wind of investment interest in the US is a distinct possibility, especially in the area of customer analytics as well as CX/UX platforms. Chinese dominance in video analytics is another, while awakened European interest in the more technological side of insights could bring interesting new competition to the sector.

There is, however, one other aspect to this analysis that should be noted as we look forward to what 2020 will bring in terms of new funding for the industry. Since the inception of the Index, the Cambiar team has been scrupulously careful only to include investments that relate solely to the generation of insights. We have consistently excluded investments in martech and adtech firms that rely on analytics to frame their services and products. With each successive year, this has become increasingly difficult as the worlds of insights, martech and adtech elide and blend into one another. Arguably, companies such as Google, Amazon and Facebook now possess more analytical firepower than the entire industry combined. Much of this could rightfully be classified as “insight”.

Which poses the question: where does

our industry go from here? How do we (if we do) continue to distinguish between

pure insight generation and insights that get thrown off the process of digital

marketing and advertising? Time will tell but, in the meantime, the Index will

continue to try and distinguish between the two.

[1] The actual total of investments monitored was $2.6 billion. Since we suspect that we capture only 80% of all transactions (since some are unannounced or do not reveal the amount invested), our estimate is adjusted to reflect this.