The views presented here, along with those of a host of other industry leaders supported by detailed data on the industry’s segments, were included in ESOMAR´s Continued Evolution of the Data, Analytics and Insights industry report for 2020. A look at the past, present and future of the industry, and an essential tool in the management’s toolbox, this report is available at esomar.org/evolution-of-insights.

ESOMAR’s collaborator Jackie Rousseau-Anderson interviewed Nathalie Burdet, CMO of Kantar´s Insights Division, about the state of matters on the Insights industry, with particular attention to the established sector. Other interviews in this series includes a take on Enterprise Feedback Systems by Fuel Cycle’s Eran Gilad and Rick Kelly, one on DIY Research Platforms by SurveyMonkey’s Tom Hale, one on Consulting Firms by McKinsey & Co.’s Tamara Charm, and Candace Lun Plotkin and one on Digital Data Analytics by Salesforce’s Anouska Post.

Q. While the overall industry is evolving, Kantar has been going through its own transformation. Can you share with readers a little about that journey?

A. Well, there’s really two components to the transformation. The first is with the brand overall and our go to market strategy. When I joined the company two years ago, we were very siloed. Initially, every single division was going to market separately under their own brand. Since then, we’ve unified under the single Kantar brand and we have been better at integrating our different parts of our business in a seamless way and therefore provide customers with more value. We are working in a far more agile way increasing the speed of response to reinvent our offer, if you just look at what we have done with our Brand tracking offer, Kantar Marketplace or Worldpanel + for example. This year we launched our new website which really encapsulates our entire portfolio and showcases our full expertise.

The second part of our transformation centers around the increasing role of technology in the organization. We are a data, insights and consulting company but we are becoming increasingly tech-enabled. We are all about human understanding powered by technology innovation. We are lucky in that we have a strong data foundation to build upon. For example, our Kantar Profiles Network is the largest single-source of permission-based, GDPR-compliant research-ready respondents with over 100 million respondents worldwide. We can build a variety of solutions on top of and around that data access that allow us to help marketers truly understand the why behind consumer buying decisions. We continue to focus on human understanding, now increasingly powered by technology innovation.

| Top-5 largest companies within the Established Research segment | |||

|---|---|---|---|

| Ranking | Name | Headquarters | 2019 Turnover (US$m) |

| 1 | Nielsen | New York, New York, USA | 6,498 |

| 2 | IQVIA | Danbury, Connecticut, USA | 4,139 |

| 3 | Kantar | London, England, UK | 2,870 |

| 4 | Ipsos | Paris, France | 2,243 |

| 5 | GfK | Nuremberg, Germany | 1,673 |

Source: ESOMAR’s Evolution of Insights 2020

Q. What role have clients played in your transformation?

A. We think client-first, not product-first and we work closely with our clients. It means spending more time thinking about clients’ needs and how our people, analytics, technology and resources can be combined to address them.

Looking at trends, we saw that speed was, and remains, an important trend for our clients and across the industry. There’s also a push to leverage technology across the research value chain to help clients get to insights faster so they can make business decisions faster. We’ve been seeing that trend for quite a few years now. That’s why we’ve been investing in automated, quicker solutions and self-service solutions like our Kantar Marketplace or our Brand tracking offer. But, we also know that our clients want to balance that speed with deep human understanding so we’re working to balance the two.

Another key trend is the importance of applying analytics to differentiate the data sets and find answers. Clients increasingly expect us to go beyond analyzing and identifying what is happening and propose solutions and next steps.

Finally, the digital transformation which we were seeing has been accelerated by COVID and this includes both clients questions around help me understand e-commerce, help me understand the way our consumers use digital, to the way we deliver through agile solutions, online and face to face.

Q. Do you see a difference in the types of clients that are engaging with you to use your tech-enabled solutions versus your consulting services?

A. Yes and no. We have some clients that are using our self-service tools primarily. But we also have a number of clients who will use our tools but then come back to work with our consulting teams to help them really understand the data they’ve collected, the impact it has on their business and the action they can take with it.

We’ve been working with a number of clients in the trade promotion management space. We’re working with FMCG clients who are leveraging a combination of our AI-enabled tools and our consulting expertise to maximize their market opportunity. Using our Perfect Category product, we can actually build out models that will help them determine the economic impact of any changes they might make to product placement or inclusion in an aisle. We also help them with pricing promotions and marketing materials. With a variety of data integrations, and our recent acquisition of Mavens, we can help those same companies identify key target segments for those products and optimize and execute digital campaigns.

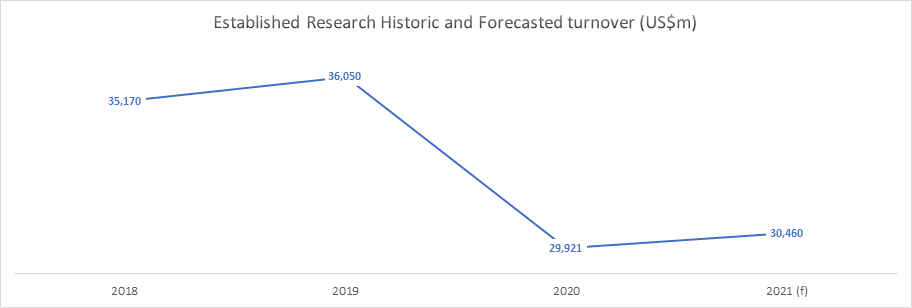

Source: ESOMAR’s Evolution of Insights 2020

Q. Is that execution across the full spectrum of capabilities-from traditional research to consulting to execution-what you envision as the future of Kantar?

A. Absolutely and actually link between insights and activation is a key growth area. Clients increasingly expect us to go beyond analyzing and identifying what is happening and propose solutions and next steps. We have deep expertise and very strong IP combined with incredibly strong data assets and currencies which underpin a lot of what we do and increasingly we are working in a data agnostic advisory way so we are able to work across multiple data asset and using analytics capabilities and technology to drive our scale forward. We have been focusing on innovating our offersacross the business to develop new ways to help our clients understand people and turn insights into action.

So yes, we do see the importance of executing across the full spectrum of research through to consulting capabilities using agile solutions, data sets through to research, consulting and answering client’s questions across that.

We also see the activation of our insights a big opportunity particularly in the area of developing audiences for media buying and helping our clients execute for example we have a Trade Promotion Optimization program which helps our clients plan how to effectively run promotions in store and drive better ROI.

Q. How do you hope to shape the industry in the next 5 years?

A. The importance of privacy data will grow – we are world leader in 1st party data and beyond that data integration and process automation will prevail.

We expect to be at the forefront of leading some of the trends we spoke about so the digital transformation, privacy, analytics, of driving agile and automation through the industry.

We, as an industry, have an obligation to continue to ensure our clients understand the value that the research industry bring to marketing so we continue to show the value of the importance of understanding consumers, importance of measurements, etc. so we continue to bring valuable assets to our clients.

About Nathalie Burdet

Nathalie joined Kantar as CMO of the Insights Division in 2018. Prior to this Nathalie was Head of Marketing and Brand Strategy at NEX Group Plc (formerly ICAP), where she developed, launched and built the NEX brand globally (recently acquired by CME group). Nathalie worked previously for Fundtech, a Global Transaction Banking Solutions Business, as Global Marketing Director. Nathalie holds an LLM in European and international business law and a Postgraduate Diploma in Marketing from the Chartered Institute of Marketing in London.

CMO, Kantar