Carlos Ochoa

Nowadays we are in the middle of the migration of market research data collection from offline to the Internet. This consists on a process which is advancing relentlessly, but at different paces depending on the regions and countries: whereas in the North of Europe and in the USA online research has become a fully established discipline, in Latin America the use of the internet in research has just started to take its first steps.

This migration has been a huge challenge for the different actors who participate in online surveying and besides, it has involved some methodological long-range changes which should make us think about something more than just a simple migration. The main change in the surveying methodology has been the development of online panels; communities of users who are willing to participate recurrently in online studies in exchange for incentives. Panels have become the best solution to replace the easiness in accessing a fresh, non-remunerated sample, previously this happened with the traditional personal or telephonic surveys.

But let’s now focus on the Latin American region where everything seems to be in place for online research to take off, however it hasn’t happened just yet.

Market Research status In Latin America

According to the data published in the ESOMAR Global Market Study 2012 the Latin American region represents 5.5% of the global spending on research, i.e. $1,858 million. We are talking about a region heavily populated, but small in terms of business volume.

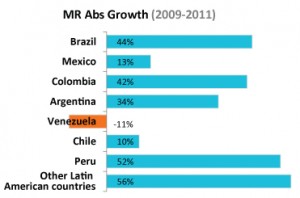

Nevertheless, if we analyse the period 2009-2011, Latin America was the region that grew the most with a net growth of +3.9% which contrasts with the contraction suffered by Europe in the same period (-2%) or the moderate increase of North America (+0.5%).

Nevertheless, if we analyse the period 2009-2011, Latin America was the region that grew the most with a net growth of +3.9% which contrasts with the contraction suffered by Europe in the same period (-2%) or the moderate increase of North America (+0.5%).

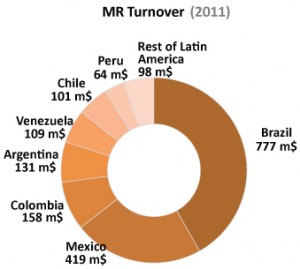

During this period, Brazil has established itself as an economic power in the region; this has been reflected in the research industry: $777 million in 2011. The second most powerful country was Mexico with $419 million. After those we find a group which comprises Colombia, Argentina, Venezuela and Chile, all of them between $100-150 million. All the countries experienced a growth between 2009 and 2011, except Venezuela, a country with a very complex political situation.

To better understand what these countries represent in the industry, we could make some comparisons. For example, Brazil, the greatest power of the region and one of the countries that grab the attention of investors from all over the world is, in terms of market research spending volume, equivalent to Italy in Europe. At the same time, Mexico could be compared to Sweden, whereas Colombia has a spending size similar to Turkey.

To better understand what these countries represent in the industry, we could make some comparisons. For example, Brazil, the greatest power of the region and one of the countries that grab the attention of investors from all over the world is, in terms of market research spending volume, equivalent to Italy in Europe. At the same time, Mexico could be compared to Sweden, whereas Colombia has a spending size similar to Turkey.

But, what happens with online research?

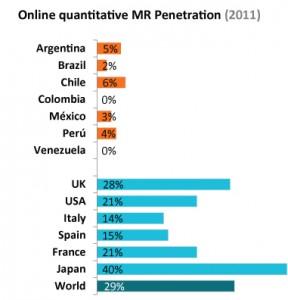

The market research in the Latin American region seems to be healthy, but things change when we focus on online research. While in most developed countries online research penetration is situated between 15% and 40%, in Latin American countries this penetration oscillates between 6% at its best (Chile) and the nearly nothing in countries such as Colombia and Venezuela.

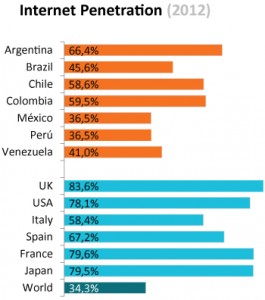

When we try to find the causes of the poor development of online research in Latin America, the sights are focused on internet penetration. Obviously, tinternet use of the population is a key factor in the development of the online research of a country. But, to what extent is it decisive?

When we try to find the causes of the poor development of online research in Latin America, the sights are focused on internet penetration. Obviously, tinternet use of the population is a key factor in the development of the online research of a country. But, to what extent is it decisive?

According to statistics updated on June 2012 by Internet World Stats, internet users in Latin America have increased rapidly during the last years representing the 42.6% last year. It is expected that the connected population in the region will keep growing and reach 53.4% by 2016.

If we compare the internet penetration between the most advanced countries in online research and the countries from the Latin American region, there are some differences. These differences are not dramatic and they can hardly explain the slow adoption of the online research in the region. If we have a look at Colombia, this country has 60% of its population connected to internet while in Spain it reaches the 67%. However online research in Spain represents the 15%, while in the South American country it doesn’t even manage 1%.

If we compare the internet penetration between the most advanced countries in online research and the countries from the Latin American region, there are some differences. These differences are not dramatic and they can hardly explain the slow adoption of the online research in the region. If we have a look at Colombia, this country has 60% of its population connected to internet while in Spain it reaches the 67%. However online research in Spain represents the 15%, while in the South American country it doesn’t even manage 1%.

Internet is slowly getting into the region but online market research is not advancing simultaneously. Hence, internet penetration does not explain everything. What other factors are holding back the development of online research?

Social class problem

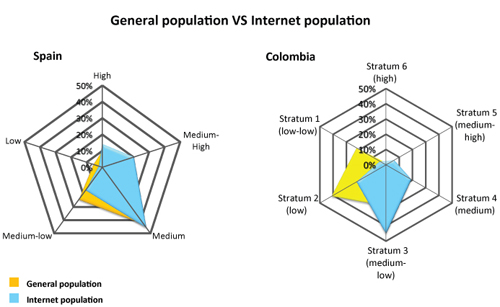

One of the most relevant key factors is social class, more specifically the big social class differences that exist in Latin America. Let’s take the example of Colombia and Spain again. In Spain, as it occurs in the most European countries, there is a predominance of middle class which, thanks to its education level and economic means, have a relatively easy access to the internet. So, if we compare the distribution between population social class connected to the net and not connected, the differences are really little. When the same comparison is done in Colombia, the differences are substantial: the population with Internet access is mostly from middle class (stratums 3-4) and the non-connected population fall into the lower classes (stratums 1-2).

The lack of lower classes with internet access hugely hinders the collection of representative sample in Latin America.

The lack of lower classes with internet access hugely hinders the collection of representative sample in Latin America.

Migrate, what for?

Another problem that the online methodology has to face in the region is the absence of clear incentives to migrate. In Europe, USA or Japan, regions where the labour costs are relatively high and the supply of workforce is limited, the main stimulus that has boosted the online research was the reduction of costs and timings. The methodological advantages arrived later.

Instead, in Latin America, the abundance of cheap workforce prevents online research from having a clear advantage in costs and timings. If we add the social class problem to this and the necessity of facing the learning curve, the researcher ends up asking himself, migrate? What for?

The real advantages of online research (innovation, economies of scales, multimedia stimulus…) cannot be discovered by local researchers due to the lack of short term incentives.

The chicken or the egg causality dilemma

The chicken or the egg causality dilemma

Researchers could be interested in using the internet to investigate the Latin American consumer. The European and the North American researcher, who is used to these methodology’s virtues, and who demands an online sample when they need to do research in the region.

In addition, the lack of local demand impedes the creation of big Latin American online panels. And the absence of them, limits the interest of the local researcher, who has to face the lower classes representativity, as well as, the small economic incentive of migrating. All of this leads to a kind of “the chicken or the egg causality dilemma”: no panel means no local demand, no local demand means no panel.

4 changes that could encourage migration

Four factors that could lead to the change that online research in Latin America needs:

Tackling the “social class” problem: it is a specific problem of the region, so the solution cannot come from more advanced regions. Local panels have to ideate ways of recruiting low social classes. Some options in which they are working are: offline recruitment and Internet connections as an incentive.

Mixing methodologies: the problems of combining methodologies, offline and online, for example, stem from the interphases used not from the sample’s origin. That is why, mixing F2F and CAWI in the same online survey, offers more guarantees than mixing with telephonic survey.

Investment: the only way to break the vicious circle between lack of panels and lack of demand is to invest in creating panels which will promote local demand and will answer the external demand.

The mobile effect: the Latin American online research could be born “mobile”. This device can resolve the problem of the lower social classes in the region.

The implementation of these and other solutions that lead the online research to the take-off in the region should be done within the region itself. The local knowledge is a differentiating factor and the region is not as “uniform” as might be thought from outside. In other words, the online research in Latin America should be created in Latin America.

Carlos Ochoa is the Marketing Manager at Netquest. Netquest is committed to promote the integration of online in all areas of market research in Latin America and thereby facilitate the local researcher work; increasing the reliability of the studies conducted in the region. www.netquest.com