Having spent much of my post-MBA career in the world of technology – whether it was implementing large-scale ERP systems or, fast-forward to today, conducting focus groups with software developers – I’m continually astounded at the pace of technological change affecting our personal and professional lives.

About a year ago, while researching a talk I gave for the Qualitative Research Consultants Association (QRCA)’s annual conference, I came across an interesting prediction by Laura McLellan, a former Gartner analyst. She posited that by the year 2017, CMO’s would be spending more on technology than CIO’s – and her hypothesis came true a year ahead of schedule in 2016. Crazy to think that marketing departments are now spending more on technology than the department that is in charge of technological infrastructure!

Much of this increase can be attributed to a fundamental shift in how organisations perceive the role of their marketing departments. Marketing now shares P&L responsibility with other parts of the organisation and entirely owns cross-functional Customer Experience. In addition, with the soaring costs in attracting, maintaining and growing a customer base, marketing is now turning more and more to data-driven solutions to deeply understand the customer journey as well as quantify the ROI of their marketing activities.

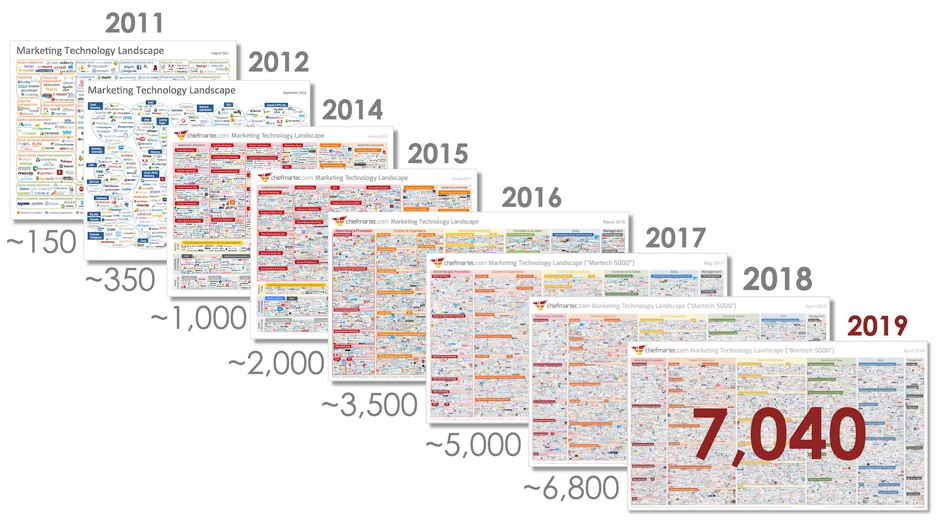

This exponential increase in technological investment has led to a proliferation of companies competing in the Marketing Technology (MarTech) landscape. Since 2011 until now, there has been double and triple-digit growth in the number of vendors vying for a piece of this lucrative pie.

MarTech landscape 2011 to 2019

Interestingly, this year only saw a 3% growth in the number of vendors – so one could conclude we have plateaued in quantity. This past year has seen some high-profile acquisitions (Adobe’s purchase of Marketo; Salesforce’s recent acquisition of Tableau; and the SAP/Qualtrics merger) which I think will set the tone for the future. In the next five years, I predict we will see many more acquisitions and consolidations as the market cannot sustain this many offerings.

What does this mean for us researchers?

With our clients increasing reliance on real-time analytics solutions and artificial intelligence (AI) algorithms to make decisions, our job as market researchers is to help them ‘humanise’ the data. The data itself has inherent limitations in both quality and quantity that can lead to opportunities for market researchers. We can offer communities to help pinpoint predictive behavior not readily seen in the data; identify key characteristics valued by customers to assist in narrowing target messaging; and create detailed feature lists to describe unique attributes inherent to a specific industry. These are just a few opportunities we can offer our clients to augment their technological investments.

We can offer communities to help pinpoint predictive behavior not readily seen in the data

We can also employ some of these tools ourselves in our own research practices. We have all seen AI tools being incorporated into survey platforms, online bulletin boards and text analytic tools – but what if we took it a step further? What if we took something like a Customer Data Platform (CDP) tool to perform a segmentation rather than fielding a custom survey to 300+ customers?

A CDP essentially marries internal customer data (sales, CRM, customer service) with externally available profiling data (LinkedIn, Facebook) to segment and create a very basic set of personas. What if we used this as our jumping off point to go deeper – either by in-depth qualitative interviews or to target ‘look alike’ respondents from a wider population. This is just one example of how we, too, can take advantage of these new technologies.

In the future these tools will only get more refined, allow us to ‘up-level’ and offer more value-added services to our clients. I, for one, am excited about the ‘rise of the machines’…