The satisfactory developments of the industry in Latin America were mainly shaped by the positive net growth of its two largest markets, Brazil and Mexico – at 3.2% and 0.6% respectively. This comes in a region with vast differences amongst its markets such as high inflation levels – especially in Argentina, but also Uruguay and Mexico to a certain extent – but overall reasonable economic growth for 2017.

What factors have influenced the Latin American sector?

Regional overview

Only five out of the 17 Latin American countries included in the GMR2018 reported a turnover level exceeding US$ 100 million – Brazil, Mexico, Colombia, Argentina and Chile. As a result, Latin America represents just 3% of the global market research turnover. If it were a country, it would be the seventh largest market. Unfortunately, the extraordinary situation in Venezuela made it impossible to extract information for this country, but we hope to restore this situation in the near future.

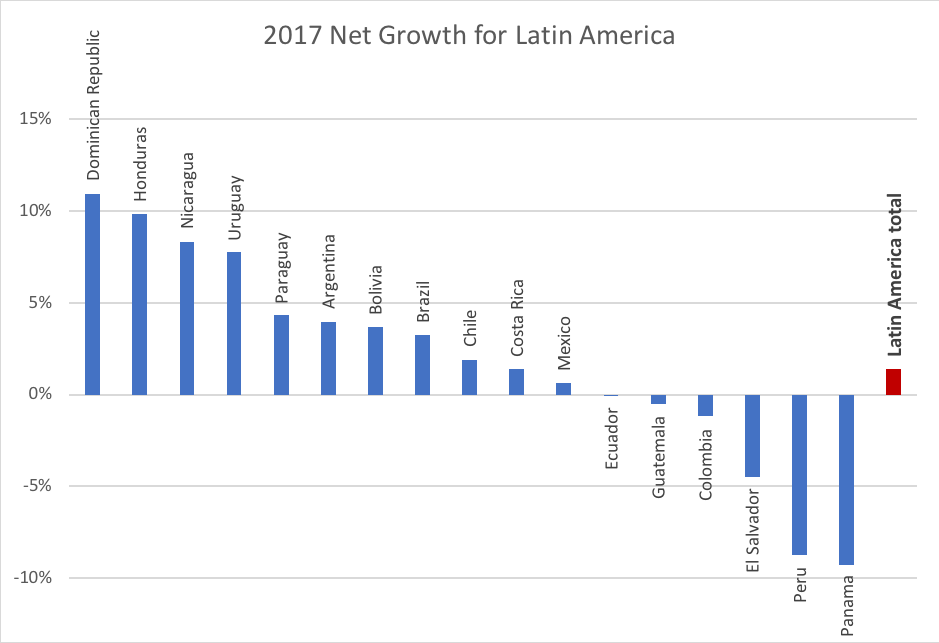

Levels of net growth for all the countries in Latin America, plus weighted average for the region (in red). Even though there are mixed results, some countries come from relatively small bases, making them prone to exaggerated fluctuations.

Most remarkable perhaps is the uneven behaviour of the individual markets, as GDP growth does not necessarily translate into higher market research turnover. Countries report levels of net turnover growth that span from almost plus 11% to minus 10%, showing the diversity of the region. It should be noted, however, that the low base from which some countries report their numbers may exacerbate their growth rates in either direction – as could be the case for Dominican Republic, Honduras, Nicaragua and Panama.

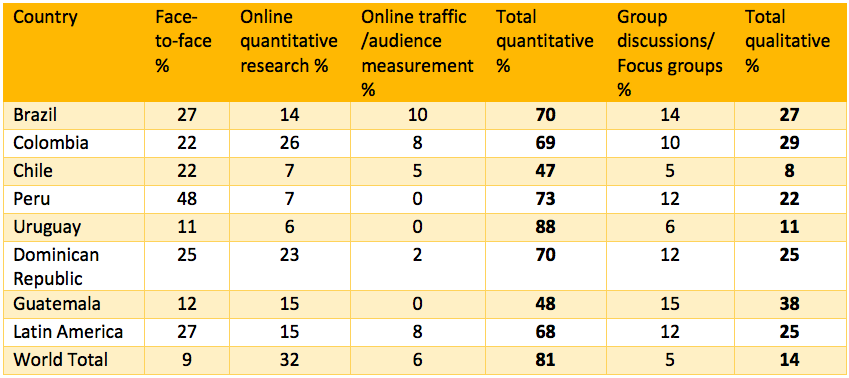

Almost all Latin American countries report substantially higher levels of qualitative research being performed than other countries – up to 25% on average compared to the global 14%. Furthermore, two methods dominate research in the region, namely face-to-face quantitative research, in all instances significantly above the global average, and group discussions and focus groups in qualitative research, also mostly above the global average.

Differences in technology reach

Alejandro Garnica, Executive Vice-President of AMAI in Mexico sheds light on this result: “this is due to the fact that labour costs have been relatively low for decades now, and also to the lack of universal access to technological solutions – as [in Mexico] Internet barely reaches beyond half of all households. Besides this, there is not much familiarity with technological solutions which means that, even the most sophisticated clients which use them extensively in other countries, hesitate before applying them on a massive scale in Mexico.”

These results are noteworthy in the sense that, as of recent years, the world is increasingly moving towards other, less traditional research methods such as online quantitative research, online traffic or audience measurement. Latin America seems to be in the process of transitioning from the most traditional to more technological methods, but at 23%, it remains well below the global average of 38%.

As Duilio Novaes, president of ABEP (Associação Brasileira de Empresas de Pesquisa) explained, whereas “face-to-face research is conducted with questionnaires applied through tablets and smartphones” which may lead us to think that they will soon become digitalised, “product tests still need to be face-to-face since products need to be shown and evaluated in their use,” implying how face-to-face is expected to remain the method of choice for the time being.

Percentage of research spend by research method

This table includes a selection of key quantitative methods. Those not specifically listed come within the heading of “Total quantitative”. Furthermore, quantitative and qualitative do not add up to 100% and the remainder to be considered as ”Other methods” falls outside of the listed categories.

A lot of research in Latin America is focused on the food, beverages and confectionary sector, representing around 20% of all research, quite different from the heavily USA-influenced global average on pharmaceutical and media and entertainment sectors, both standing at 16%. The only notable exception can be found for Brazil, where a quarter of all research is conducted for the wholesale and retail sector, including oil. This highlights the different composition of the Brazilian economy compared to the other countries in the region.

A close look at the main players

Despite the uncertainty experienced during the economic and political crises, Brazil managed to report a healthy net growth of 3.2% in 2017, partly because of the multinationals that operate in the country. As Duilio explains, “multinationals have their own methodologies, they approve global studies and because of that, they differ from the local research companies.” They allowed Brazil to escape the downturn imposed by the crisis which, in his words, “affected the budget of the consumer goods and services sector. As less projects are carried out, there is a strong uncertainty on investments, which pushes them to focus only on those really needed.” Other reasons lie in the contained growth of the Brazil economy during 2017, escaping the declines of previous years, and a more measured inflation rate, able to maintain the reported absolute growth levels.

Mexico, on the other hand, saw its growth rate substantially adjusted by high inflation of 6% to a near-flat net growth of 0.6%. Despite these macroeconomic factors, Mexico had to deal with increasing costs – an all too common threat for other markets as well. Furthermore, the electoral period saw the confusion of the public between reliable research and anecdotal data gathering. In words of Alejandro Garnica, confusion was unfortunately “fostered by the politicians themselves. Overall, none of the contenders was honest enough to accept the validity of adverse survey results.” Furthermore, the media “lacked rigour in their criteria and sense of audience protection by presenting, uncriticised, any figure that would make their way […] as if all surveys were equally precise and legitimate.” This opinion reinforces the idea of educating the media when reporting on election results to avoid damaging the credibility of the profession and biasing the democratic process (see the ESOMAR, AAPOR, WAPOR course for journalists at www.poynter.org/educators-students/2016/how-to-report-on-trends-in-opinion-polling/ ).

In the case of Colombia, a moderate growth in absolute terms of 3.1% was reversed to -1.2% when accounting for inflation. The country experienced a period of political uncertainty that resulted in market distrust, according to ACEI (Asociación Colombiana de Empresas de Investigación). Nonetheless, the market is finding new paths of growth in new sectors of the economy and through the use of digital sources and techniques – it should be noted that Colombia, one of the largest countries of the region, has the highest usage of online quantitative research.

Finally, despite worrisome levels of inflation, Argentina managed to report positive net growth for 2017 of 4%, thanks to improved expectations from clients and an increase in syndicated studies, according to CEIM (Camara de Empresas de Investigación Social y de Mercado). This result is further explained by a positive GDP growth for the year.

A detailed look at this region is available in the latest industry report, the GMR2018, which gathers information on the size, composition and trends of the market research industry for the world (go to www.esomar.org/knowledge-center/reports-publications for more details and to www.esomar.org for information about the LATAM conference taking place in São Paulo from 7 to 9 April).