Jessica Santos and Laura Ruvalcaba

The pros and the cons of using online techniques

We are in the midst of a digital era but Latin American is lagging behind. What are the challenges and techniques for moving market research online? What are the pros and cons of using online methods? And does social media have a place in the region’s research mix?

We take a look at usage and some of the challenges and implications of the digital age, using primary research that is essentially focused on Mexico and Brazil, combining a rich secondary data resource with primary data collected from healthcare professionals (HCPs) in LatAm.

The journey to a fully digital environment is filled with obstacles for emerging markets. For example, security is a complication for China; a survey in English is a barrier to participation in Russia but completely acceptable in India; and time needed to complete surveys is the key issue hindering online participation in India, according to an EphMRA 2011 paper. Although lagging behind on internet penetration, LatAm can benefit by learning from others’ mistakes. China, for instance, has skipped landline and gone straight to wireless technology to avoid infrastructure waste.

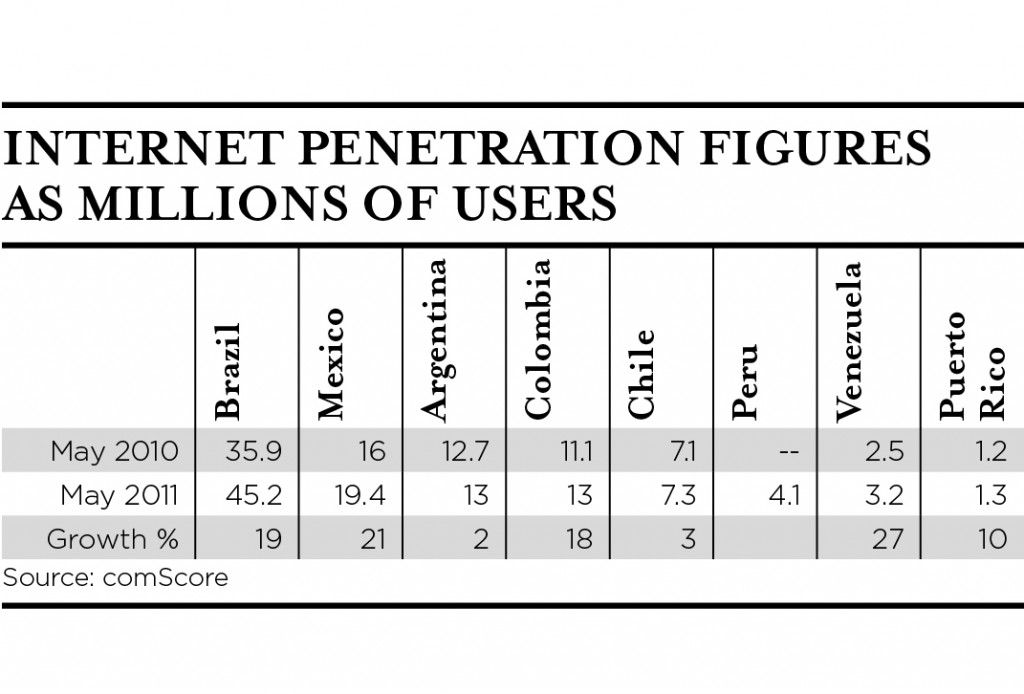

Internet penetration is low and uneven among the LatAm population. It stands at 30.7% in Mexico and 37.4% in Brazil, for example (Internet World Statistics 2011). With 45.2 million users, Brazil has the largest online community with access from home or at work, whilst Mexico barely touches 20 million users and Venezuela has just 3.2 million users (yet boasts 27% growth).

Age is another factor, with 60% of internet users in Mexico aged 24 or younger (INEGI, 2010). The younger generation is regarded as ‘technology adaptors’ and it remains to be seen if the older and more affluent professional populations such as HCPs will catch up as quickly as they did in the EU and US.

Research adoption

Researchers have to use non-digital methods such as face-to-face to reach the wider universe, while being tempted by the success of new digital methods such as social media in the US and Europe. Many are eager to move studies online for efficiency, driven by pressure from US and EU clients who are used to online research, but are hampered by the low internet penetration. For global studies that cover LatAm, how can we position ourselves to present a valid approach?

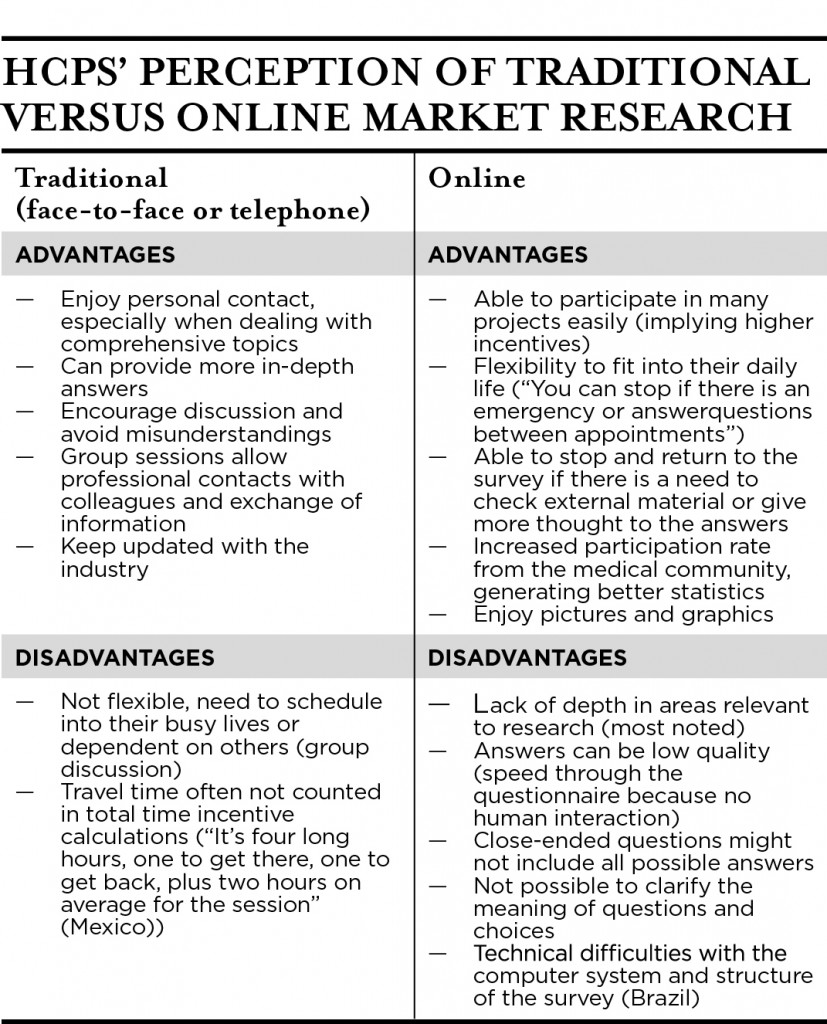

Most HCPs are familiar with market research and are sympathetic to its purpose. Brazilians are more open to online research than Mexicans, who express concerns that personal information might be improperly used or shared without consent, as well as worries about data security.

Based on nearly 100,000 HCPs who were recruited to an online access panel in LatAm, there is high general acceptance for online studies, yet over 50% did not have a chance to complete one within the last 12 months.

Traditional vs. online

LatAm HCPs are torn between the analogue and digital worlds. They are likely to have been educated in a non-digital background but are eager to adapt to the online environment for personal and professional reasons. They appreciate the profound nature of traditional research methods yet are tempted by the efficiency of online methods.

Technical barriers exist for online surveys everywhere but are a particular problem in LatAm, where HCPs face difficulties in accessing links, systems that do not allow some answers to be uploaded, or that label some answers as ‘invalid,’ interruptions in surveys, and non-recognition of usernames or passwords. As not all HCPs have access to the latest IT infrastructure, online scripters are strongly advised to use plain and simple technology or to use earlier versions of applications when possible.

The acceptable length of online surveys ranges from 20 minutes to an hour or even longer in Brazil, and HCPs are willing to participate in longer surveys if results are shared with them. Many respondents mentioned that market research helps them learn about what their peers are doing and is a valuable information source.

Surveys longer than 20 minutes are already common in the US and Europe, and it is likely that LatAm online surveys will be longer once HCPs are more familiar with online methods.

Social media

HCPs are familiar with the internet, as their profession requires them to be up to date and frequently use digital communications. They see the web as an important information source rather than a social tool. Social media sites, including professional social networking sites, are not perceived as ‘serious’ or ‘professional’ and can be ‘a waste of time.’

The ‘entertainment’ focus, mass availability (anybody can sign up), and lack of credibility (one can say anything about any topic) features of social media prevent HCPs from associating social media with professional usage. This affects the possibility of using social media research.

HCPs also feel they may not be incentivised ‘fairly’ or ‘at all,’ and that social media researchers may expect them to contribute their time and knowledge without fair compensation.

Incentives

Incentives are widely used as tokens of gratitude to encourage participation. LatAm HCPs regard them as ‘an extra income’ source that cannot be undermined. They also perceive them as fair compensation for their time and knowledge, and a ‘vital’ ingredient in ensuring commitment. More serious research topics require more effort, and hence respondents expect higher incentives. This may surprise researchers in Europe or the US, who usually use survey length, respondent type and/or incidence rate to determine incentives.

Seven tips for successful online research

Seven key recommendations to consider when using online methods in LatAm are:

- HCPs are willing to adopt online methods, but most have not grown up with technology. Whilst the younger generation are easy adapters, older HCPs require more coaching and support.

- Use mixed methodologies to maximise the benefit of profound insight offered by traditional methods with the advantages of efficiency and flexibility of online methods. Face-to-face or telephone can be a pre- or post-phase combined with online.

- Script online surveys with compatible technology, not the latest technology.

- Incentives are very important and the level is related to the significance of the subject.

- Share results if you need a long survey.

- It may be premature to use social media for market research, but if you do use it, offer fair incentives.

- Participation can be boosted with cutting-edge, interesting topics.

Dr. Jessica Santos is VP methodology & compliance at WorldOne Research and Laura Ruvalcaba is CEO at BRAIN.

2 comments

[…] May 10, 20121 Commentby esomar […]

The points in the article are all very fair. We conduct online research globally including LATAM and our experience is that internet penetration is not so much of a problem as much slower broadband/download speeds in LATAM compared to countries where penetration is higher. This increases questionnaire length and can impact costs and respondent satisfaction/completion rates.