Simon Chadwick

Results of the 2012 Cambiar Capital Funding Index

Generally speaking, 2012 was not a stellar year for private equity and venture capital investment. In our neck of the woods, however, in the market research, information and analytics industry, it was not just a stellar year, it was a galactic one.

Over US $1.7 billion was invested in our industry in 2012, according to the second annual Cambiar Capital Funding Index. That represents a massive 141% increase over 2011. And it was not just the amount of money invested that more than doubled, but also the number of investments (130 in 2012 vs. 63 in 2011) and the number of investors involved (227 in 2012 vs. 100 in 2011). Clearly, this is one hot area where investment capital is concerned.

The CCFI reflects announced infusions of new capital into an industry that we define as market research, information and analytics. New capital means funds that are newly infused into the industry, and so excludes refinancing, acquisitions that are funded internally or other deals that do not require infusion of new capital.

What’s hot

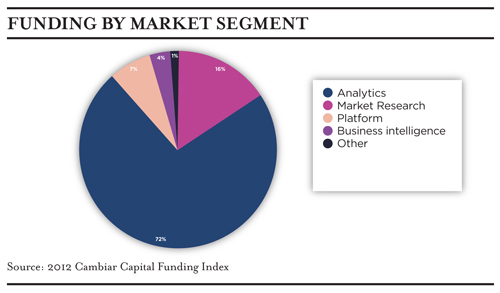

But what exactly is it that is hot? In 2011, we found that traditional market research certainly was not hot, accounting for only US $15 million of the US $830 million invested in the sector by private equity and venture capital firms. In 2012, that figure fell to a paltry US $1.5 million. No, what is really hot is analytics. In 2011, analytics accounted for 50% of all new PE and VC capital flowing into the industry. In 2012, that figure rose to 72%.

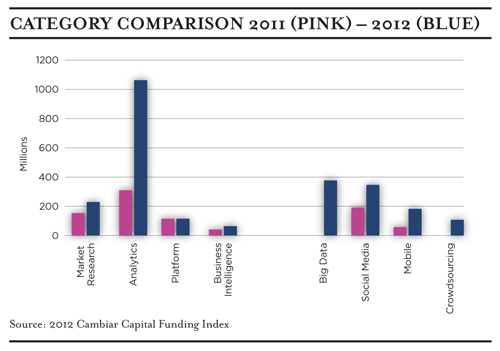

Before moving to what “analytics” actually means in this context, it is worth noting that the bulk of the remaining investment went into platforms (technology designed to collect, analyse or visualise data) and market research. The latter is defined not so much by traditional survey companies as it is by things such as mobile applications, eye-tracking technologies, MROCs, proprietary panel building and DIY applications. This, then, is what attracts investors in the “market research” world, so much so that the actual quantum of investment in this area rose from US $138 million in 2011 to US $226 million in 2012.

But what really attracts them is anything that is (self-) labeled as “analytics.” Here, the quantum of investment rose from US $298 million in 2011 to an incredible US $1,047 million (or US $1.05 billion) in 2012.

But just what is analytics? In 2011, it was heavily defined by social media measurement. That fascination with social media continues today, with the amount invested in companies involved in social media measurement and analytics rising from US $198 million in 2011 to US $338 million in 2012. But it is the arrival out of virtually nowhere of “big data” that really catches the eye – from nothing in 2011 to US $358 million in 2012.

Another eye-catcher in this set of data is the three-fold increase in investment in anything to do with mobile – whether data collection or analytics. Investors pumped US $178 million into things mobile in 2012 compared with only US $53 million in 2011. This matches data from elsewhere (primarily Inside Research and Cambiar’s own Future of Research 2012 study) that suggests that spending on mobile market research and analytics really did take off in 2012 after many years of false dawns.

By region

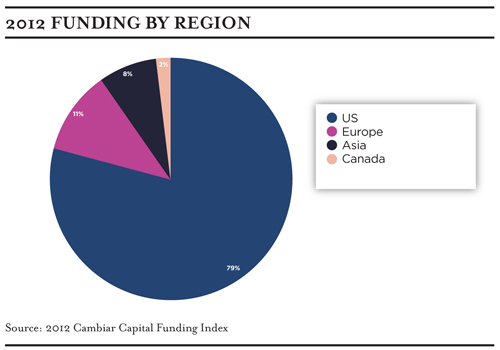

In 2011, the vast majority (over 90%) of investment flowed into US-based companies, leading us to suggest that innovation in this space in America was perhaps more technology driven (and hence capital intensive), while that in Europe and elsewhere relied more heavily on intellectual property. While that still remains true in 2012, the US-centricity of capital investment has waned somewhat, suggesting that Europeans and Asians are also investing in more capital-intensive projects.

Nonetheless, the US still trumps all other regions as the destination of choice for investors, with 79% of all announced investment funds ending up within its shores. In part, this also reflects a fact of life, which is that while some new start-up companies do begin life in other countries (for example, in Africa or Asia), many migrate to the United States to continue their early-stage development for the explicit reason that they can more easily raise funding as a US-based enterprise.

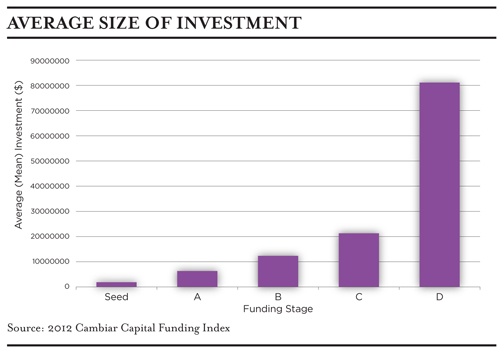

When we looked at the stage of funding, we found that the vast majority of investments were taking place relatively early on in a company’s existence (Series A or B), but that there was nonetheless a significant amount of money also going into later stage (Series C or D) rounds. However, this is very much a function of the size of investments at each stage.

While Series D investments tended to be large (these are, after all, usually investments in companies that have been very successful), there were some extremely large individual investments in companies at earlier stages. These included US $70 million in Qualtrics, a US $50 million Series B investment in the location-based analytics company Quora and a US $50 million Series C investment in social analytics provider RadiumOne (not to mention the US $68 million Series C investment in the crowdsourcing co-creation platform, Quirky).

But the biggest kahuna of all was the big data analytics company, Mu Sigma, which received a whopping US $108 million in Series D financing – the biggest this sector has seen to date.

Who is doing all of this investing? Well, as noted earlier, no fewer than 227 investors put money into the sector in 2012, including 177 private equity and venture capital firms, 28 individuals (mainly previously successful technology entrepreneurs – and this is probably an undercount), 15 corporations (mainly technology companies and media firms) and seven angel funds (also probably an undercount). Just nine investors accounted for 20% of investment occasions, with New England Associates, Andreessen Horowitz, IA Ventures, Norwest Venture Partners and Sequoia Capital leading the way.

Where is this heading?

So, what are to make of this, and where does it suggest that we are going? We would not ever suggest that capital investment trends are indicative of real trends in the industry. After all, investors (to misquote Mark Earls) are herd animals as much as the rest of us. However, it does suggest that investors see great potential in analytics as a discipline, that big data has taken a hold of their imaginations, that social media as a source of data and measurement is still of enormous interest, and that mobile is finally gaining traction. Much of this reflects the sentiments and actions of clients detailed in our Future of Research 2012 study, suggesting that investors are in sync with what major corporations are seeing as vital to their futures. It also amplifies what we have being saying in these pages for some time – that the industry has to redefine itself if it is to be healthy in the future, bringing analytics, social media measurement and big data inside the tent, rather than allowing these to be seen as separate disciplines with which we have only a tenuous relationship.

Simon Chadwick is Managing Director of Cambiar.

3 comments

[…] article first appeared in the January February 2013 issue of Research World published by […]

Dear Mr. Chadwick,

I´m interested in your study concernig actual findings of the CCF-Index. If there is no embargo for the press, would you be so kind to send me a file or a link to download the 2012 insights?

I´m asking on behalf of german “Context” magazine, which would like to publish a summary in the upcoming issue on February 19th. If there is no chance to get a copy today or tomorrow, would you please let me know?

Kind regards

Bertehold Stellbrink

Context

IT WAS DUE TO THE UNSTABLE MARKET RECOVERING FROM THE WORST RECESSION ERA