Laurence N. Gold

It’s over, at least for now. North American commercial market research spending turned around in 2010 and posted a 4.8% year-over-year growth rate as the official recession came to an end. Green lights were given by corporate boards and other buyers following pent-up demand created with increasing economic output and resurgent media spend. The turnaround followed a reining-in of spending in 2009 that saw the first decline in research spend (down 3.8%) since recording began over 20 years ago. All this was preceded by healthy growth averaging 7% annually over the past 20 years.

The world’s largest research market, with its global share at 32%, put its gloomy days behind it as turnover in the US reached US $9.9 billion in 2010, also an increase of 4.8%. This followed a decline of 3.5% in 2009 and an increase of just 1.6% the year before as the recession began to take hold.

Canada, representing 7% of North American regional turnover, escaped the US recession due to strong commodities demand (especially oil) and the absence of a home mortgage crisis, but still fell 8% in 2009, recovering partially in 2010 with an increase of 5.1%.

This good news coincided with 3% growth in the US Gross Domestic Product in 2010. US GDP had seen a decline of 3.5% in the preceding year. In addition, advertising spend came back from a 9% decline in 2009 to 5.6% growth in 2010. In short, all macro indicators were positive for research to recover.

Digger deeper

All major segments of US research turned up. Syndicated services, with the largest share of total spend of any country at 44%, showed slight growth in 2009 , which then increased at a higher-than-expected rate of 4.4% in 2010. Syndicated was shielded from wide swings in research spend by virtue of the multi-year contracts that tend to carry it over short-term economic changes, but the size of the increase was a surprise.

Survey suffered greatly in the recession, declining 7.6%, but then came back most of the way in 2010, growing 5.3%. Throughout, the relentless conversion to lower-cost online data collection and persistent price pressure took a toll on revenues. This segment accounted for 34% of total spend and was affected most heavily in its ad hoc activity, less so in the case of tracking.

Qualitative research took a major hit during 2008-2009, declining 6% and nearly 11% respectively in those two years. These figures are in line with the adspend drop, given the fact that advertising agencies account for a major share of qualitative spending. This came part of the way back in 2010 with a relatively modest increase of 4.1%. Online qualitative seems to have had little revenue impact on this segment so far.

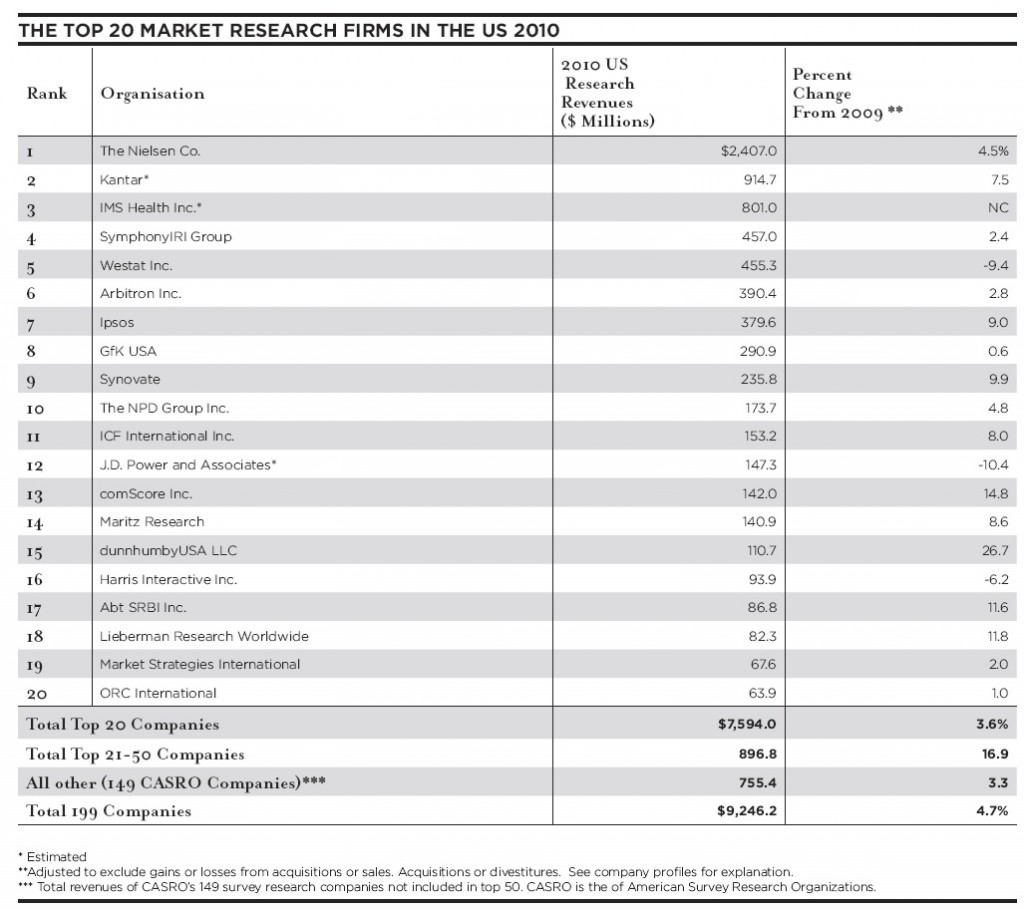

Looking at the recovery another way, the Top 20 research companies’ revenue in the US, which accounted for 77% of total US spend, posted an increase of 3.6% (Table 1). Among the 16 of the 20 that grew were high-growth leaders including dunnhumbyUSA, comScore, Lieberman Research Worldwide and Abt SRBI. Nielsen, which accounted for nearly one third of Top 20 revenue, achieved an overall spend growth of 4.5%. Holding growth to below 4% were Westat, J.D. Power and Company, and Harris Interactive, all with significant revenue declines.

So where did the balance of net growth come from? The next 30 largest companies achieved a growth rate of nearly 17%, and had a large impact despite their smaller sizes. 12 of the 30 grew over 20% each, led by Public Opinion Strategies at 136%, Morpace at 47% and Rentrak at 46%. Six new companies were added to the list, all but one with increases of over 25%. The remaining 149 CASRO companies not in the top 50 posted an average gain of 3.3%

Meanwhile, changes

As the recession took its toll and recovery subsequently ensued, the research landscape began to change. Activities such as online research continued to evolve and mature, while mobile and social media garnered serious attention as research tools.

US online research spend increased 7% in 2010, following a decline of 4% in 2009 and a year of slow growth (3%) in 2008. Nonetheless, this figure remains far below growth rates of over 18% prior to 2007, and more than double that in the preceding years. One component, the so-called new measurement – consisting of market research online panels, word of mouth and ratings & traffic measurement – surged right through the recession, achieving 16% growth. Each of these three elements represents a new way of conducting online research which, until recently, has been mired in data collection activity as a replacement for the telephone. Meanwhile, mixed platform and multi-mode work (mail/online, phone/online, and now mobile/online) have been trying to overcome the weakness associated with online-only.

Still, continuing concern about sample quality lingers regarding online, though progress has been made regarding professional respondents. The popularity of client do-it-yourself/internal online research has been growing, helped by turnkey software provided by application service providers. Despite these advances, virtually no serious discussion of online probability sampling has taken place. These issues, among others, have caused online to stall at about 50% of total survey spend in the US. While cheaper/faster rules, the telephone continues to be an important tool for survey research.

Much talk has ensued regarding mobile as the next research phenomenon, and the reason is clear: there has been a rapid decline of landline use in the US. The latest estimates indicate that the proportion of wireless homes through 2010 reached 30%, with another 16% of homes using wireless phones most of the time or always, for a total of 46% predominantly or exclusively wireless households. Just three years ago that figure was 29%. This growth trend shows no sign of stopping.

It’s clear that mobile is taking up the slack, but it is already running into problems, as was the case with online. There has been virtually no discussion regarding mobile quality in data collection, and the same is true with probability sampling in the mobile panels that are rapidly being implemented as supplements to phone/online panels. Most of the effort has been devoted to taking advantage of mobile’s unique attributes via in-the-moment surveys and media response from smart-phones.

There has also been much talk about taking advantage of the social media experience, but research has been limited mostly to WOM and internet scraping of conversations, blogs, bulletin boards, etc. This has been of service mostly to public relations clients. Researchers seem to be having a hard time making social media work for research, with the exception of creating panels and sample sources from social media sites.

Laurence N. Gold is editor and publisher of Inside Research.