ESOMAR Global Market Research 2010

A gradual return to growth following two years of economic pain characterises market research’s state of health.

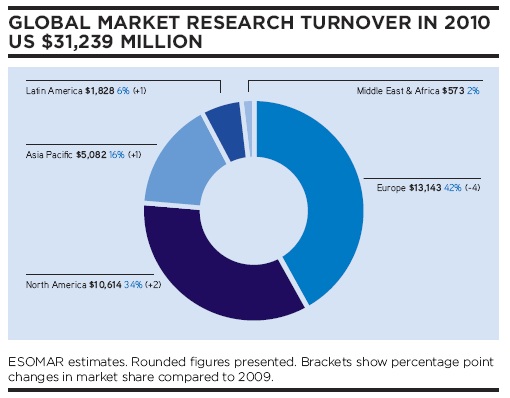

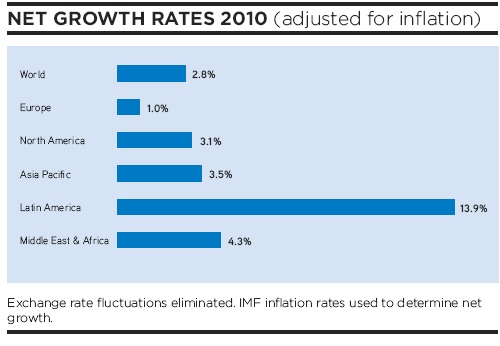

Buoyant emerging markets are compensating for declines in countries still struggling to shake off economic instability and harsh domestic conditions. ESOMAR’s annual industry study, Global Market Research, will be launched at the ESOMAR Congress in Amsterdam. It shows global turnover rising to US $31.2 billion in 2010, a year-to-year increase of 5.2% (2.8% after adjusting for inflation).

The Global Market Research report digs behind the headline figures to explore the diverse opportunities and challenges across borders and business sectors. Respected industry figures from some of the most influential agencies and client companies discuss how the evolving consumer market affects the demands placed on researchers, and what the industry is doing – and failing to do – as it seeks to address the needs of international businesses.

Top-line findings

- Market research turnover increases in 54 countries or sub-regions, including 12 of the top 15 markets.

- The North American research sector records its first period of growth after two consecutive years of net declines, a year-to-year increase of 4.8% overall (3.1% after adjusting for inflation).

- Latin America is the fastest-growing region in 2010, with growth of 20.4% (13.9% after adjusting for inflation) as demand for insight into the burgeoning markets of this region surges. Brazil alone, which accounts for just under half of Latin American research turnover, sees net growth of 26.5%.

- Europe, the single biggest region for research, sees turnover of US $13.1 billion, a rise of 3.3% year-to-year (1.0% after adjusting for inflation), fuelled mainly by investment in central and eastern European markets.

- The Asia Pacific research industry reports substantial increases: year-to-year growth of 5.6% (3.5% after adjustment for inflation), with turnover growing to US $5.1 billion. Growth is led by China, Singapore, India and star performer Vietnam (24.6% growth after inflation), but is tempered by declines in Japan and Australia.

- The smallest region for research, the Middle East and Africa, recovers from the economic crisis with 10.1% growth (4.3% after adjusting for inflation), led by South Africa and Nigeria.

These figures reflect returning confidence in global markets, and shows the extent to which multinationals are investing in young, emerging markets as they claw their way out of global recession.

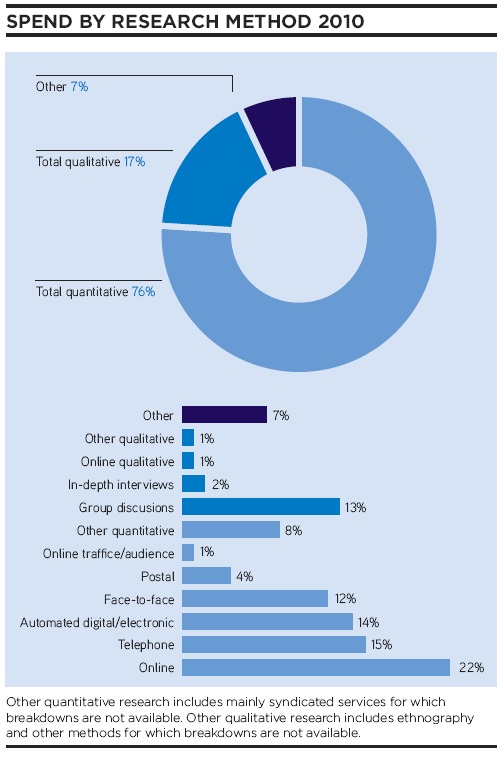

The use of online techniques continues to gain popularity. Bulgaria stands out as the market with the greatest proportion of research conducted online (59%), due to its position as a centre for outsourced research. Other big online markets include Canada, Japan, the Netherlands and Germany.

Changing needs

Online research now accounts for just under US $7.5 billion of spending globally, as clients seek not just cheaper but quicker ways to gauge consumer sentiment. The Global Market Research report includes interviews with some of the most senior client-side researchers in the world, revealing how the need for efficiency, deep insight and coordination of information is determining their research choices, and how they’re applying the knowledge they generate. The report features Joan Lewis, Procter & Gamble’s global consumer and market knowledge officer, Lorna Walters, senior vice president, global market research at Reckitt Benckiser, and Gilbert Heise, head of market research at Volkswagen.

After a quiet year for mergers and acquisitions in 2009, market consolidation picks up again in 2010. Notable deals include IMS Health’s takeover by a private investment consortium for US $5.2 billion; InfoGroup’s acquisition by private equity house CCMP Capital for US $635 million; and Gartner’s purchase of the Burton Group for US $56 million. The GMR report shows the top six research companies controlling 48% of the industry in 2010, up from 45% in 2006. Already, 2011 has seen more of the same kind of momentum, with Ipsos buying Synovate, and WPP having set aside £200 million (about €230 million) for investment. Market consolidation seems likely to continue.

This year’s GMR also explores the debate over the ‘right’ shape and size of the market research industry’s footprint. As a slew of new companies and new, mainly web-enabled, methodologies create new options for clients and intensify competition for research budgets, the report looks at how the established research sector views the risks and opportunities of opening up the definition of research. David Barr, director general of MRS, the Market Research Society in the UK, says, “We have these new guys coming from outside – it might as well be from outer space – but they’re trying to get the same expenditure that many research companies are seeking, and the traditional industry can’t quite work out whether they should throw their arms around them or see them as a threat to tradition.”

The fast-paced world of social media, user-generated content and e-commerce is raising concern among lawmakers and the public about where the lines of personal privacy should be drawn. There are big implications for the way researchers operate. In the GMR report, the privacy heads of three of the biggest global research networks give us their perspective on how the legal landscape is being reshaped – and what that’s likely to mean for those who work within it. George Pappachen, chief privacy officer at Kantar/WPP, sees the challenge as maintaining the transparency in the relationship between researcher and respondent in a new-media context: “A well-lit room is what market research has historically promised stakeholders. The main challenge going forward is to maintain that paradigm, even as the means to activate it evolve.”

The report also includes discussions with some of the industry’s rising stars, just a few years into their research careers, on their experiences so far and their hopes and expectations for the future.

Outlook for 2011

At press time, there was great uncertainty over the stability of the eurozone, and world financial markets were reflecting that concern. Until very recently, however, reports from ESOMAR contributors around the world have been consistently positive. The vast majority expected the market research industry to record growth again in 2011.

Emerging markets were especially bullish, with Brazil, Russia and India forecasting another year of strong growth. In Asia, most markets were expecting to see research turnover for the year increase. The strongest performances were tipped to come from Vietnam, Singapore and Indonesia. Africa, too, was looking likely to grow.

However, cautionary notes were still being sounded, even by some of the bigger, more resilient markets. There is still a lingering nervousness in the industry, much of it based on some current macro-economic indicators:

- In the US, there are still concerns about the government’s ability to manage the national debt limit. If current economic conditions deteriorate in the US there is a real risk of a negative impact on research spending for the remainder of the year.

- In the UK the economy is recovering more slowly than anticipated Most are anticipating a 2011 outcome similar to that of 2010.

- In the eurozone, expectations are positive in robust markets like Germany. For the troubled economies of Spain, Greece, Portugal and Ireland, the outlook is considerably bleaker. Research budgets in those countries are not just being trimmed, but in many cases completely eliminated. Only essential projects are being retained, and price competition for those projects that do remain are undermining the longer-term viability of some companies.

Despite these not inconsiderable challenges, however, the latest published financial reports support the industry’s overall optimism. ESOMAR predicts that the global industry will grow by 4% in 2011, provided the economic situation in Europe does not destabilise further. ESOMAR hopes to report next year on a pattern of continued growth and a steady return to prosperity.

To see a preview and order the report, please go to www.esomar.org/publications.

GLOBAL MARKET RESEARCH 2011 is free to ESOMAR members in PDF format. It can be downloaded in the MyESOMAR section of the website.