Scott Christofferson and Beverly Chu

The skill profile is evolving with less core research and more synthesis and consultation for greater business impact.

The role of the market research department has evolved from data provider to consultative partner over the last 15 years or so. The first major step in this transformation was insight. But insight alone is insufficient for real business impact: today’s market research team must be a consultative thought partner to the business, in addition to its traditional duties. This requires staff to spend more of their time on consultation and synthesis and develop stronger capabilities in those areas. This is not just a matter of training and experience: leaders need to help staff discover their own development opportunities, establishing processes to support synthesis, and aligning roles to each team member’s strengths.

Companies used to hire market research staff primarily for their core research execution skills. Once this early research gave marketing teams a baseline understanding of their customers and consumers, they began to place a premium on consultation and insight. Indeed, a Market Research Executive Board (MREB) survey of 1,681 internal business partners in 36 large companies shows that 61% want market research to play a strategic partnership role but only 29% believe it does so today.

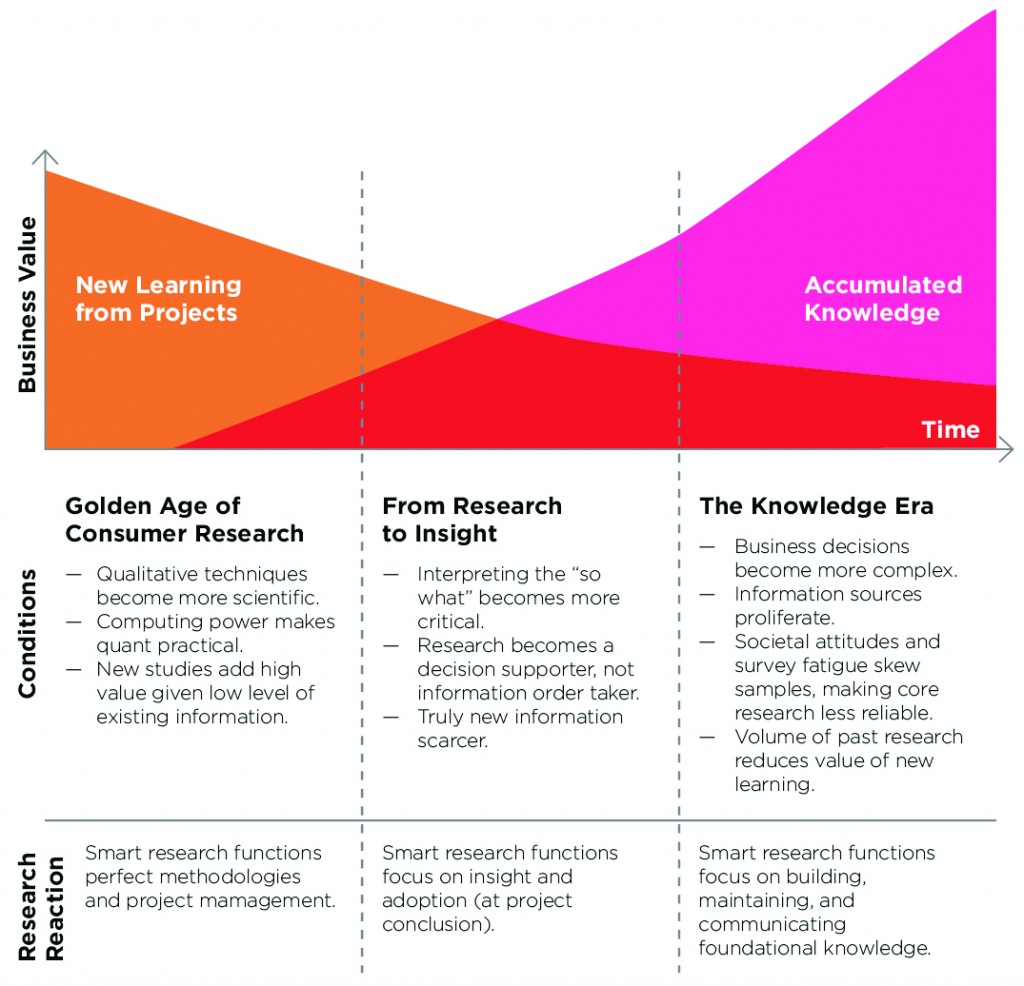

More recently, we see leading companies finding greater business value in what they already know than in the next marginal point study (see Figure 1). But harnessing accumulated knowledge uses different skills from executing research studies. Specifically, it requires synthesis skills like cross-project analysis and nonlinear thinking alongside higher-order consultative skills like influence and storytelling.

Figure 1: The evolving role of market research

Client-side heads of market research already recognize this: of the 100 who responded to MREB’s Research Skills Diagnostic in 2010, 97 prioritized consultation or synthesis over core research skills for further development on their teams.

How are we doing?

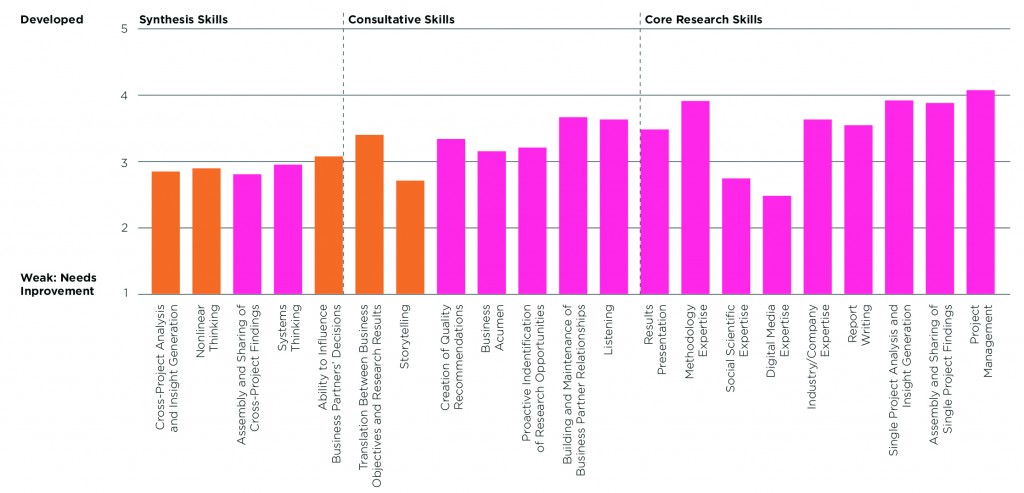

Managers perceive their staff as relatively weak in these areas today (see Figure 2).

Figure 2: Skill strength: Research heads’ average team ratings

Staff (n=377) do not share this view, which most likely reduces their motivation to improve. While market research heads generally see synthesis as the weakest skill on their team (2.9 on a five-point scale), with core research as the strongest (3.8 on a five-point scale), staff view their skills sets to be relatively equal in strength (3.55 on a five-point scale). The largest perceptual gap lies in the synthesis category.

Market research heads and staff do not share a common vision of the future for applying these skills. Heads would have their department spend roughly equal time on (1) core research activities, (2) consulting with business partners, and (3) management and synthesis of knowledge. But staff would ideally spend more than half their time on core research activities and just 21% of their time consulting.

The road ahead

Heads of market research believe – and MREB research confirms – that both synthesis and consultative skills can be developed among existing staff. But development is not easy; we see the most successful companies pursuing three complementary approaches:

- Help researchers self-discover their development needs. In other words, build “will” before training or coaching the “skill.”

- Build platforms to support cross-project synthesis. Structure from leadership significantly lowers the burden on staff.

- Play to researchers’ strengths. Individuals who are strong in all areas are scarce; winners redesign work flow to employ the distinct strengths of different team members.

Many researchers pursued their current career because of their intellectual curiosity and love of analysis and insight generation, not to be business consultants or influential communicators. This can also color their interpretation of situations where their research doesn’t have the impact they desire. For example, when a business partner isn’t convinced to act on an insight, researchers overestimate the impact of holes in the evidence and business partner irrationality and underestimate the impact of their own business acumen and influencing skills. It’s no wonder we see the perceptual gap reported above!

But you cannot train or coach new skills that staff are not motivated to learn. Rather than telling their teams about the importance of consultation and synthesis skills, leading companies are showing them – letting their bright and capable researchers draw the conclusion themselves.

| Case Study: Business acumen development center (Coca-Cola) | |

| The Coca-Cola Company is one of the world’s largest soft-drink retailers and manufacturers. Also known for Sprite, Powerade, and other beverages, Coke offers more than 500 brands in more than 200 countries. |

Situation: Coca-Cola’s research team had the opportunity to work on important strategic projects, but few yielded the strategic impact desired. The Head of Research diagnosed the problem as insufficient business acumen on the team, but even high-potential researchers did not realize that their level of business understanding fell short of executive expectations. |

|

Action: Recognising that self-awareness best comes from experience, Coca-Cola created a development center to simulate strategic problem solving and dialogue with real senior executives. They architected the experience to maximize the return on senior executive time and ensure that researchers would get actionable feedback on their business acumen. |

|

|

Result: Center participants, now committed to deepening their business understanding, have accelerated into important positions within the company. One researcher, for example, was promoted to head of Insights for Eurasia and Africa within one year. Equally important, senior executives welcomed the training and volunteered their time. |

|

Building and sustaining synthesis efforts is difficult for researchers on their own. We have seen companies in a range of industries – such as pharmaceuticals, FMCG, hospitality, and technology – develop powerful platforms to promote synthesis. One company identified core business drivers that cut across categories and geographies (e.g., brand, channel, consumer), turning a vague “synthesis” goal into a specific set of topics meriting a documented point of view. These documents established a knowledge baseline for all future research efforts. Another company placed its synthesized knowledge into a wiki-style intranet site, making it easier to syndicate and keep up to date.

Even with these efforts, it is unlikely that an entire team of technically skilled researchers will also become excellent at consultation and synthesis. Our aforementioned survey of heads of market research shows that fewer than half believe that their whole team has the aptitude to develop strong consultative skills. Yet 99% of them are looking for “bionic” researchers: strong consultative skills and strong core research skills. This approach seems sure to disappoint.

A number of MREB members have built bionic teams instead of bionic researchers. The approach is somewhat controversial, because it requires breaking up the well established client-service model wherein a single research manager assumes end-to-end responsibility for meeting a business partner’s need.

| Case Study: Dedicated Roles (Motorola Mobility) | |

| MOBILITY

Motorola Mobility is a leading manufacturer of wireless telephone handsets and accessories, set-top boxes, and video distribution systems. |

Situation: Motorola Mobility sought increased impact by creating dedicated roles. A careful analysis of the research team demonstrated not only clearly distinct consultants and research managers but also individuals with valuable strength in scarce synthesis and consultation. |

|

Action: Motorola Mobility restructured its consumer insights department, specialising staff into dedicated roles:

Note: Motorola Mobility’s Consumer and Market Insights team held an all-day team workshop where individuals in different roles collaborated to clarify responsibilities, create buy-in, and understand the value of all three groups’ contributions.

|

|

|

Result: Besides enjoying better role fit and task efficiency, the Consumer and Market Insights team maintained its high level of impact even while reducing its resources significantly. |

|

These two strategies cannot solve all skill-related challenges. Our ongoing work, for example, points to a need for further innovation in areas like synthesis techniques and communication tactics. But they represent material progress in transforming the Market Research function’s role and increasing its contribution to business success.

Scott Christofferson is Managing Director and Beverly Chu is a Research Analyst with the Market Research Executive Board.