Navigating through uncertainty

From permanent shifts to temporary change, six core themes are transforming consumer markets as behaviour, values and priorities shift in the light of the COVID-19 pandemic. The current situation calls for agility, brave decisions and focus. Business must zero in on those changes to consumer behaviour and values which will last beyond the pandemic. In a fast-evolving world, research and insights remain more important than ever.

Many of these themes represent a deepening of trends that were already present: for example “Wellness Redefined”, which sees a holistic approach encompassing spiritual and physical wellness is reinforced; or “Where and How Consumers Shop”, which sees an acceleration of trends such as the rise of online, click & collect, frictionless retail and brands bypassing retail to go direct-to-consumer.

From sustainability to purpose: the triple bottom line

Sustainability has not fallen by the wayside as some initially supposed it would. Rather there has been a sharp shift towards “purpose”, a more holistic view of sustainability. In fact, 45% of respondents to our June Sustainability Voice of the Industry Survey believe that the attention paid to how companies treat employees and consumers during the COVID-19 pandemic will become permanent. Finding a sustainable balance between people, planet and profits, the so-called triple bottom line, along with empathetic and open communication, authenticity and transparency is essential for business recovery and post-lockdown survival.

Hometainment and the new experiential consumer: the home is where it’s at

Hometainment is all about consuming things that were previously consumed out of the home at home. Whether it’s watching a virtual concert inside a video game or purchasing a device that replicates the experience of going to a department store make-up counter, consumers will be introduced to new experiences in the home. This trend pre-dates COVID-19 but clearly is seeing an acceleration today. The challenge for companies is that out-of-home experiences tend to command a premium – one concert costs more than an annual subscription to Spotify; a coffee can cost £3-4 in a café. Generating the same returns in at-home experiences is challenging.

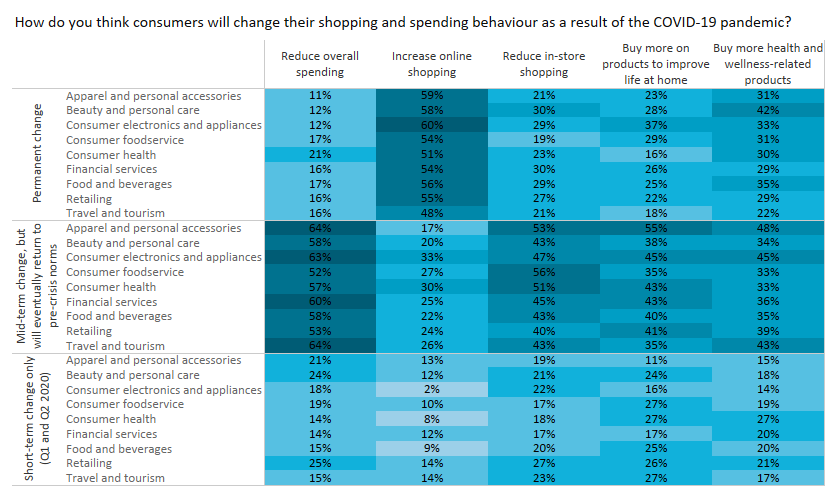

Where and how consumers shop: the new shopping mission

Where and how consumers shop has clearly seen a huge shift, visibly benefitting online retail. Subscription services have also seen growth, with consumers valuing the convenience, home delivery, uninterrupted supply and the discovery and experience aspect of the services. The new shopping mission sees those consumers who are returning to stores and malls looking to get in and out quickly, reducing trip frequency and planning ahead. This has a particularly strong impact on sectors which rely on impulse purchases such as beauty and fashion. Local retailers have seen a benefit as shopping local, in less-crowded and easier to reach locations has become newly attractive to the risk-averse, crowd-aware shopper. Contactless and frictionless has also unsurprisingly seen a boost – the concept of a contact-free retail store has become less futuristic and more of a priority.

(Click on the image to enlarge in a separate window- ed.)

Source: Euromonitor International Voice of the Industry COVID-19 Survey, July 2020

Wellness redefined: wellness as an antidote to uncertainty

In times of uncertainty, many consumers look to wellness as an antidote to the stresses and strains of life. Add to that the fact that the current crisis is a health crisis, then the importance placed on wellness is even greater. With economic growth collapsing in many countries, this priority will be balanced by increased emphasis on value and quality. Immunity-boosting products, as well as those promoting inner calm and mental wellbeing, are particularly in demand. Digital health services have surged in popularity. As well as an entertainment hub, the home will increasingly become a wellness hub.

Innovation and the new ‘core’: changing priorities create opportunities

New product innovation has been at the centre of growth strategies for FMCG brands over the past decade. However, the constraints of a severe and potentially prolonged global economic recession, coupled with a severe and uncertain public health crisis, do not invite obvious opportunities for risk-taking. However, a window of changing priorities, evolving channel preferences and newly established occasions (increasingly, in the home) must be addressed in order for brands and retailers to stay competitive long-term. Innovation should remain at the heart of growth for consumer goods companies, despite a reduced pipeline and a more focused approach.

The “new normal”: from the public to the private sphere

The new normal sees consumers spending more time and money both at home and on the home, and less outside the home, with a shift from the public to the private. Many trends already being witnessed will accelerate, not least amongst them digitalisation and the growth of e-commerce. New routes to market, such as direct-to-consumer will also grow in importance, and consumers will seek local products and services. However, some consumers will suffer “virtual world fatigue” so it’s important in the medium to longer-term to remain innovative in the real world, focusing on health, functionality and quality to overcome price pressures.

Agility, innovation and bold choices are needed to emerge from the crisis

There is clearly no doubt that COVID-19 has transformed the economic and consumer landscape. It has changed the way we as consumers live, work and shop. A contraction in spending, amid the worst global recession since the Great Depression, will clearly impact the performance of consumer markets, with consumers re-evaluating their priorities much like they did in the aftermath of the Global Financial Crisis. Businesses need to focus on agility, innovation and be willing to make bold choices to identify pockets of growth and to meet the needs of those trends that are here to stay. The basis of these bold choices must remain actionable research and insights.

For further insight, download a complimentary copy of Euromonitor International white paper How Will Consumer Markets Evolve After Coronavirus.