David Murphy

First published in Research World November 2009.

Young & Rubicam chief consumer insights officer John Gerzema talks about declining trust in brands and how research can help an energy-driven enterprise.

In his recent book, The Brand Bubble: The Looming Crisis in Brand Value and How to Avoid It, co-authored with Edward Lebar, John Gerzema argues that businesses are riding on a brand bubble that is about to burst. In the book, Gerzema and Lebar revealed that while brand value had increased by over 80% over the last 30 years, consumer trust in brands had declined by 50% over the same period. The problem, Gerzema argues, is that a small number of megabrands are responsible for the rise in brand values, and this is masking the underlying problem that consumer trust in brands is actually eroding at a rapid pace. In fact, they found that the top 250 most-valuable global brands were worth almost US $2.2 trillion, more than the GDP of France. This finding is backed up by research from Booz & Co. that found that the value of the top 10 US brands is larger than the market capitalisation of 70% of US public companies. The massive value of this smaller number of brands, Gerzema argues, has created a false sense of security in the value of the average brand that is unwarranted.

Brand Asset Valuator

The basis of Gerzema and Lebar’s analysis was Y&R’s Brand Asset Valuator (BAV). This is the largest continuous database of brands in the world. Since 1993, Y&R has invested over US $115 million in the BAV and has measured over 35,000 brands.

“It’s a very robust database,” says Gerzema. “We measure every brand we can find, and we measure them as consumers measure them in the real world. Many brand studies are category-focused, but ours are as consumers see them – how they actually shop.” The analysis led Gerzema and Lebar to conclude that the tried-and-tested formulas that companies use to create sales and market share for brands are becoming irrelevant, and are losing traction with consumers. Today’s consumer, says Gerzema, has moved from “mindless consumption to mindful consumption”. What this means is that people have become more strategic and more thoughtful about how they consume products and services.

“Today’s more sophisticated consumers still have their passions, so they will decide where they feel it is worth spending extra money for a premium product, and where they can afford to buy something more functional,” he explains. One obvious consequence of this is that mid-tier brands risk being caught in the gap between these two extremes. But the problem extends far beyond mid-tier brands. In the book, the authors uncovered what Gerzema describes as a ‘trust virus’ – a substantial erosion in consumers’ trust of brands. This, he says, is most noticeable in the financial services and automotive sectors, but extends also into apparel, pharmaceuticals, FMCG/packaged goods and consumer electronics. “Consumers are in a mode where they are reappraising every product and service they buy, and questioning what brands they really need,” he says.

Trust virus

One of the driving factors behind this phenomenon is the web, or more specifically, Web 2.0 – the web of blogs and forums and user reviews, where the consumer has taken control – and brands just have to get used to the idea. “Brands are being commoditised in compressed periods of time,” says Gerzema. “This is a function of the rise of search and social media, and the ability for any brand or idea to be analysed and evaluated instantly.”

As an example, he cites the movie industry. “In the past, even bad movies could be successful,” he says. “But this summer, lousy movies did not make money. So you had a movie like Land of the Lost and thanks to Twitter, word soon got round that it was no good, and so it did not make money. Sites like Twitter, TripAdvisor, epinions, they are all part of this trust virus that we refer to in the book. In fact, we found that 72% of people now rely on what other people say about a brand, versus 16% who rely on advertising, so the push model has become a pushcart.”

Energised differentiation

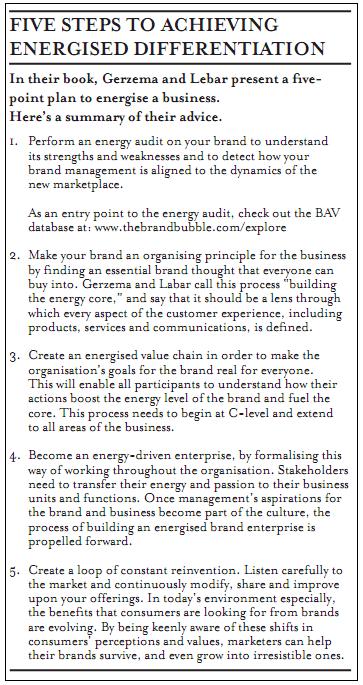

So much for the bad news, but there is a glimmer of light at the end of the tunnel. In addition to the trust virus, the authors also uncovered a phenomenon they describe as ‘energised differentiation’. This is an attribute displayed by brands such as Adidas, Pixar and iPhone, which resonate with consumers in a special way. Brands that display energised differentiation, says Gerzema, communicate excitement, dynamism and creativity, in ways that the vast majority of brands do not.

The building blocks of energised differentiation are vision, invention and dynamism. Vision is all about the company and culture behind the brand. Gerzema cites Apple, fashion company Zappos, the Stumptown Coffee Roasters, which is committed to sustainability, and the microloans company, Qiva, as examples of brands that have this vision.

Invention is all about, in Gerzema’s words, ‘walking your talk’. Energised differentiation cannot be faked, he says. Consumers’ perception of a brand will be influenced by tangible product and service experiences, from product innovation to the retail environment, to the experience a consumer has when they contact customer services.

Finally, dynamism is about how a brand creates a persona, emotion, advocacy and evangelism among consumers, through its marketing activities and other forms of interaction with consumers.

To build an energised business, Gerzema says companies need to stop thinking about marketing as a department, and start thinking of it as a way of thinking. “You have to get the organisation to accept the critical importance of branding and marketing, so we talk about marketing not as a cost, but as a fiduciary responsibility to shareholders,” he says.

He concedes that some companies will see this as a provocative idea, but adds: “If brand value is now one third of operating value, then marketing is on the hook for the stock price, which delivers future value to shareholders, so you need to make the brand an organising principle for the business. The brands I really admire all have brand managers as the CEO, such as Richard Branson, Steve Jobs and Howard Schulz. There needs to be this alignment between the CEO and the CFO, so that marketing can permeate the company and allow you to organise and amplify different ways of sharing insight.”

Fast, friendly and flexible

The market research function needs to change too, he says. “This is an incredibly exciting time, because insight and developmental research is incredibly useful, but it has to be fast, friendly and flexible, and often, it is none of these,” says Gerzema.

To back up this point, he quotes Jay Kumar, CEO of Frito Lay, who has said that he has to make 80-90% of decisions without strong quantitative research, because the process is too slow.

“Research is too often siloed, and I would say that consumer insight needs to be the catalyst for action,” says Gerzema. “It also needs to be more friendly in terms of the ability to share insights and inspire people throughout the organisation. And it needs to be more collaborative, and act as a catalyst for teamwork. If you have phenomenal insights, then what you need is not a PowerPoint presentation about them, but a way to draw implications from those ideas to inspire the other functions.”

Gerzema argues for a more active and holistic vision for research, in which metrics are used to measure momentum and creativity, but also to measure consumers’ holistic perception of a brand.

“We see that consumers evaluate brands from multiple vantage points, because they have all these modes of communications and receptors, so brand messages compete with a multitude of other messages, and research needs to take account of this,” he says.

Open-source research

Gerzema is an enthusiastic advocate of Procter & Gamble’s Connect + Develop open source research initiative, in which the company reaches out to anyone with an idea that meets its needs, inviting them to submit it to the company for consideration. He points to P&G’s hugely successful Swiffer mopping, sweeping and dusting brand, which came out of a collaborative project with an obscure Japanese company that led to the idea of the disposable electromagnetic cloths that are key to the brand’s success.

“When you open up the research function in this way, you get all these different potential collaborators researching and creating products for you,” says Gerzema.

He declares himself a fan, too, of ethnography, and indeed of any research technique that can help a company gain a better insight into what consumers need. “I think of research as a craft, and every craftsman has his tools. The art of research is to understand that you have all these potential tools at your disposal, and it’s about knowing when to choose which one, and when you should rely on other people and their tools.

“Just as a company will track the factors that drove a sale, and the sequencing of those factors – whether it was all down to search, or whether advertising had an influence – so research is the same. It’s about how you can understand that there may be other valuable inputs that may make your research projects a path to understanding consumer behaviour. Different factors influence consumer behaviours, so there is a great opportunity for research to become more organised and more sequential.”

In the meantime, there is the modern-day consumer and their more mindful approach to consumption to deal with. This is no doubt partly due to the economic crisis and the general need for belt-tightening that has been felt in households around the world. So does Gerzema believe that consumers will revert to their old ways when the economy picks up?

“All bets are off with the post-crisis consumer,” he says. “We are seeing a massive reappraisal of brands, so on top of the decline in brand value, we now have the post-crisis consumer, who will be much more mindful with consumption and who will be looking for brands to deliver, so if your brand is not energised and delivering real momentum, it will face commoditisation, and we find, once you go down that road, it’s difficult to escape.”

John Gerzema is chief consumer insights officer at Young & Rubicam and co-author of The Brand Bubble: The Looming Crisis in Brand Value and How to Avoid It.

John Gerzema is chief consumer insights officer at Young & Rubicam and co-author of The Brand Bubble: The Looming Crisis in Brand Value and How to Avoid It.