The views presented here, along with those of a host of other industry leaders supported by detailed data on the industry’s segments, were included in ESOMAR´s Continued Evolution of the Data, Analytics and Insights Industry report for 2020. A look at the past, present and future of the industry, and an essential tool in the management’s toolbox, this report is available at esomar.org/evolution-of-insights.

ESOMAR’s collaborator Jackie Rousseau-Anderson interviewed McKinsey & Co.’s Senior Expert and Leader of Agile Insights Tamara Charm, and Partner Candace Lun Plotkin, about the state of matters on the Insights Industry, with particular attention to the Consulting Firms segment. Other interviews in this series include a take on Established Research, by Kantar’s Nathalie Burdet, one on Enterprise Feedback Systems by Fuel Cycle’s Eran Gilad and Rick Kelly, one on DIY Research Platforms by SurveyMonkey’s Tom Hale and one on Digital Data Analytics by Salesforce’s Anouska Post.

Q. Where do you see growth in the industry coming from?

A. We are living in a time of unprecedented change. COVID-19 is first and foremost a humanitarian crisis. Additionally, it has changed so many aspects of our daily lives: the way we shop, the way companies do business, where we spend time, what we spend time doing, and how we relate to each other in our personal and professional lives. These changes are not uniform, but they are granular across generations, ethnicities, income tiers, geographies, professions, and industries. To not only survive but thrive in both our current reality and a post-COVID-19 world, companies need to understand their current and potential consumers and customers at a detailed level. This includes their buying behaviors and attitudes, such as whether they shop in-person or online, how they engage digitally across multiple channels more broadly, and the ways their preferences are changing.

Data, analytics, and insights have a vital role to play in helping reorient companies as realities on the ground continue to shift. Successful companies will most likely double down on their own internal capabilities to gather intelligence, in addition to working with a series of vendors.

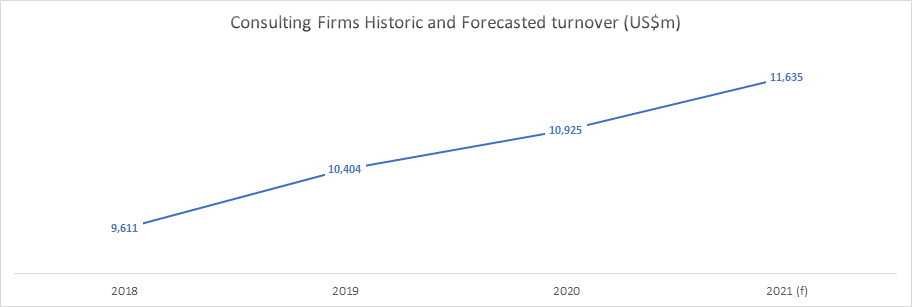

As data sources multiply, growth will come not only from companies collecting and analyzing their own new data, but also from companies that can help their clients navigate their growing collections of data through to its ultimate implications, and put in the place teams to execute test-and-learn approaches and apply insights in a practical way.

Thinking about companies more broadly, we believe the fundamentals of growth will remain the same: the companies that succeed will be the ones that spot growth opportunities before their competitors, based on a deep understanding of consumers and customers, and which have the speed and agility to capture that growth. Such companies will invest in growth through the downturn (data shows that is what winners have done in the past), track and “relearn” what customers and consumers need as habits and needs shift, and make good use of data for precision and speed to deliver to customers.

We believe since data and insights are must-haves, there are likely to be good prospects and opportunities for those in the business.

| Top-5 largest companies within the Consulting Firms segment | |||

|---|---|---|---|

| Ranking | Name | Headquarters | 2019 Turnover (US$m) * |

| 1 | McKinsey & Company | New York, New York, USA | 1,155 |

| 2 | Accenture | Dublin, Ireland | 822 |

| 3 | Booz Allen Hamilton | Mclean, Virginia, USA | 805 |

| 4 | PwC | Arlington, Virginia, USA | 616 |

| 5 | KPMG | Toronto, Canada | 598 |

* Only insights-related turnover

Source: ESOMAR’s Evolution of Insights 2020

Q. How do you see your company fitting into the broader data, analytics, and insights industry?

A. McKinsey & Co.’s purpose is to create positive, enduring change in the world. Our mission is to help our clients achieve distinctive, lasting, and substantial improvements in their performance, and to build a great firm that attracts, develops, excites, and retains exceptional people.

Increasingly, deep expertise in data, analytics, and insights is core to accomplishing this mission and serving our purpose. The global pandemic has put a new spotlight on the power and potential of data, analytics, and insights to effectively navigate the challenges presented by these unprecedented times.

As B2B and B2C companies seek new opportunities for growth amid the pandemic, we find that now more than ever they rely on us to help translate consumer and customer insights, and big data into concrete initiatives to drive above-market growth.

We help clients navigate a range of challenging economic climates around the world, including some of the worst economic crises. We do this by combining deep experience in helping businesses grow with our expertise in utilizing data, analytics, and insights to drive meaningful change. Our insights span industries that include high tech, retail, industrial, healthcare, automotive, travel, infrastructure, and logistics as well as a full range of business functions, whether it is marketing and sales strategy, operations, digital, organization, etc. We bring together a powerful combination of insights, and both industry and function experiences combined with numerous playbooks, capabilities, and technologies to drive lasting impact in times of great change.

Q. What would you say are some of the key trends you’re seeing in the industry right now?

A. We see three key trends:

1) The power of data integration across sources: Increasingly, companies that can merge primary insights and analysis of big data sets to get to deep behavioral insights are uncovering ever more granular insights. Having the tools and data environment to work with multiple types of data sets is critical.

2) The need for agile insights delivery: The pace of change for businesses is only continuing to accelerate. With that comes placing a premium on being able to produce deep, quality insights quickly.

3) The importance of translation: Increasingly, the people who are in the data, analytics, and insights space are being asked to not only uncover insights, but also to transform them into recommendations for the business. What does this information mean for the frontline sales force, for e-commerce, or for the tools we provide to operations and customer-facing employees? The insights are the what, and actions plans are the critical how. Companies that can do this well are increasingly in demand.

Interestingly, across all these trends, we see a growth in pure data and tool providers, many of which are using end-to-end technology to drive a self-serve model. At the same time, we see growth in companies that can provide a holistic end-to-end technology to drive the self-serve models. At the same time, we see growth in companies that can provide a holistic end-to-end solution that includes translation of insights into actions. In other words, providers that can offer a curated combination of the three trends—ability to derive deep insights from multiple large data sets, with speed and agility, and also translate them into action plans—are increasingly in demand.

Source: ESOMAR’s Evolution of Insights 2020

Q. What are some of the biggest changes in the industry you’ve seen in the last 3-5 years?

A. The industry is experiencing yet another digital revolution, this time at an even more accelerated rate. Just as many consumers and customers in large-scale B2B businesses have gone online or tried new digital methods (or combinations of human and digital interaction) for the first time, we are also seeing the growth in digital methods for data collection. While this was a trend before COVID-19, it has intensified over recent months, when often digital is the only option. We believe we have reached a tipping point, as trends toward remote interaction of all sorts have accelerated. Moreover, our own research has shown these changes are likely here to stay, for both consumers and B2B customers. Thankfully our industry is innovative and continues to push the state of the art on ways to collect and then synthesize primary insights digitally.

Another change has been the drive toward personalization. The increasing ability to reach individual consumers and customers with customized messages allows those companies that are able to build these abilities at scale to achieve differential results. A third change is the primacy of customer experience. Increasingly, companies can differentiate themselves by offering exceptional customer experience. The data and science behind identifying the journeys that matter most has leaped forward, and with it has come a strong focus on this area of analytics across most companies. On a related note, we are also seeing companies increase the metabolism with which they are refreshing customer and consumer journeys and insights—fresher insights and actions are required to keep up with the rapid changes in customer and consumer behavior.

Senior Expert and Leader of Agile Insights

McKinsey & Company

Partner

McKinsey & Company