Ian Lewis

The past ten years have seen major changes that impact marketing, consumers and market research.

Ten years ago there was no social media. Smartphones and iPads didn’t exist and Google was a private company. So much happened in the last decade. What can we expect in the next?

Market research has evolved substantially in the past ten years. MROCs, listening posts, web analytics, behavioural economics, neuroscience and biometrics, crowdsourcing, and netnography – these are just a few of the emerging research modalities. We are moving beyond the era when market research was about asking, measuring and analysing. The rapidly expanding “river” of information available to marketers will offer huge analytical opportunities and challenges. In “The Shape of Marketing Research in 2021” (JAR March 2011, Micu, Dedeker, Lewis, Moran, Netzer, Plummer and Rubinson), a paper in which the “river” metaphor is introduced, the authors pose the following question:

“With so much information available to drive competitive advantage, who in the client company will “own” this capability and resource?”

An early example of the impact of the “river” is Hewlett-Packard’s August 2011 acquisition of Autonomy for US $10.3 billion. Autonomy focuses on the contextual understanding of unstructured information for enterprises. This acquisition was announced a few weeks after Ray Poynter reported on a discussion among mostly C-level UK market research leaders in a post on The Future Place Blog dated July 12, 2011:“To paraphrase the thinking, there are opportunities to make millions of dollars through approaches such as behavioural economics, netnography, research through gaming, and smartphone anthropology, and neuroscience. But the Big Data opportunity is going to be measured in billions of dollars.”

So what does the market research community think about what lies ahead? The 2011 Cambiar Future of Research Study looked out to 2020 and elicited feedback from a wide range of corporate researchers (N=160) and research company senior executives (N=114).

The 2011 Cambiar Future of Research Study: Researchers are expecting major change.

Four in ten researchers overall and almost 60% of corporate research VPs expect a major transformation of market research by 2020; 70% of those expect this transformation to be evident by 2015. One quarter of corporate researchers expects that the leading research company in 2020 does not exist today! Another fifth expects that Google or Facebook will then be the leading research company.

Corporate researchers will be consultants more than researchers. Virtually all corporate researchers think it likely that successful market researchers will have greatconsulting skills. This trend is already apparent in the US: Best Buy, Novartis, Pepsi and Starbucks have all recruited former BCG or McKinsey consultants to leadership market research and strategy positions.

than researchers. Virtually all corporate researchers think it likely that successful market researchers will have greatconsulting skills. This trend is already apparent in the US: Best Buy, Novartis, Pepsi and Starbucks have all recruited former BCG or McKinsey consultants to leadership market research and strategy positions.

We have global responsibilities.

Researchers believe that growth in market research spending will be driven from outside the US and Europe, and that jobs will have global or international responsibilities.

The future is about listening, measuring emotion, and mining knowledge. While today many researchers struggle with how to leverage listening information, nine out of ten researchers believe listening will lead to major changes. Emotion measurement is expected to be part of the standard toolkit, although the jury is still out as to whether neuroscience and biometrics will be commonplace. Three of four researchers expect that marketing issues will be addressed by mining existing knowledge rather than initiating a project.

leverage listening information, nine out of ten researchers believe listening will lead to major changes. Emotion measurement is expected to be part of the standard toolkit, although the jury is still out as to whether neuroscience and biometrics will be commonplace. Three of four researchers expect that marketing issues will be addressed by mining existing knowledge rather than initiating a project.

The increasing importance of mining knowledge vs. initiating more projects was addressed in “The Shape of Marketing Research in 2021” (JAR March 2011). Addressing the river analogy – “a continuous and organic flow of knowledge” – the authors commented “client researchers and suppliers have developed as project managers, becoming more proficient at managing projects as their careers developed. The river concept offers a paradigm shift in which researchers will need to become synthesizers. This will require substantial training, rewriting of job descriptions, and re-evaluating hiring criteria.” What about today? How are we doing?

managing projects as their careers developed. The river concept offers a paradigm shift in which researchers will need to become synthesizers. This will require substantial training, rewriting of job descriptions, and re-evaluating hiring criteria.” What about today? How are we doing?

Not well. Satisfaction levels are weak, with only 25% of corporate researchers and 40% of research company executives “very satisfied” with the role of their department or company.

External measures confirm that we need to do better. A Market Research Executive Board survey found that “research’s work only has substantial impact with two out of five business partners,” (MREB Business Alignment Surveys, 2005-2011) while BCG’s 2009 study of 40 major global consumer-facing companies concluded “nearly 90% of blue-chip companies aren’t fully leveraging their market research functions.” (The Consumer’s Voice – Can Your Company Hear It? BCG, 2009)

BCG’s 2009 study of 40 major global consumer-facing companies concluded “nearly 90% of blue-chip companies aren’t fully leveraging their market research functions.” (The Consumer’s Voice – Can Your Company Hear It? BCG, 2009)

We asked about barriers to success, and heard back on some fundamental issues.

What are the top Barriers?

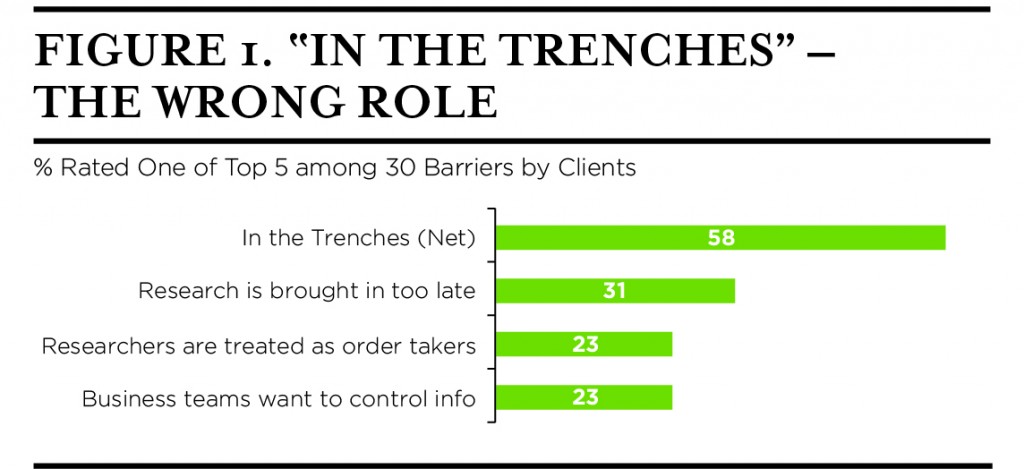

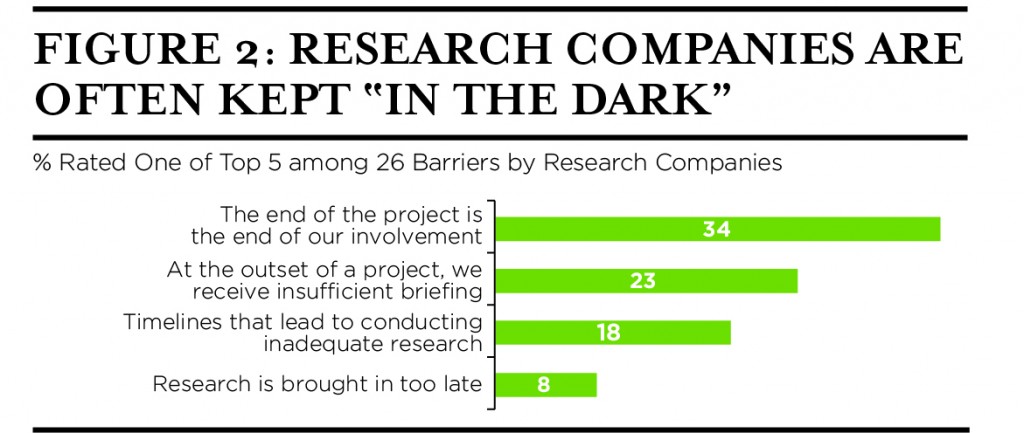

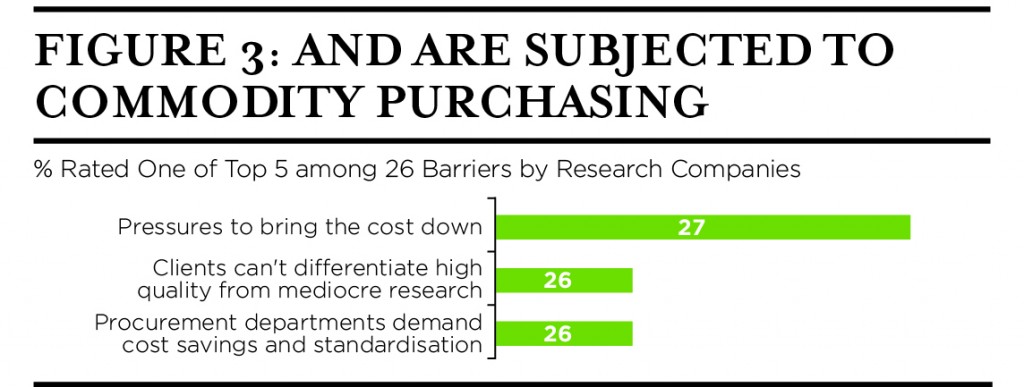

We are not operating as thought partners. There is a huge gap today between our desired role as a thought partner, and our actual role. Six in ten corporate researchers have an “in the trenches” role: they are brought in too late, treated as order takers, or have business teams that want to control information. Research companies often feel that they are “in the dark,” receive insufficient briefing and/or don’t know anything once the project is completed. At the same time they report being treated as if they are selling a commodity.

Corporate researchers and research companies identified additional top barriers.

- Corporate researchers need to lead, educate and inspire their internal customers

- Research companies need to focus on business outcomes rather than research outputs; to upskill in order to facilitate being strategic partners; and to strengthen their understanding of the client’s business

How can we overcome the barriers and become thought partners?

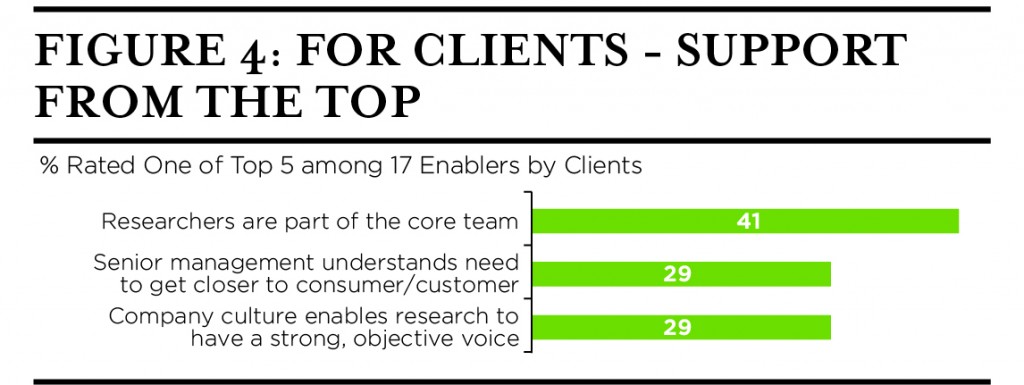

For corporate researchers, support from the top is a key enabler. This echoes a finding from a study among 25 CMOs, “What the C-Suite Wants Insights to Deliver,” presented at the ARF Industry Leaders Forum in October 2010. Given that many research departments are operating in an “in the trenches” mode today, there is a need to negotiate a “management contract” with senior management about how research should engage and operate with the business. (See “High-Impact Research: The New Strategic Partner,” Research World, March 2010.)

research departments are operating in an “in the trenches” mode today, there is a need to negotiate a “management contract” with senior management about how research should engage and operate with the business. (See “High-Impact Research: The New Strategic Partner,” Research World, March 2010.)

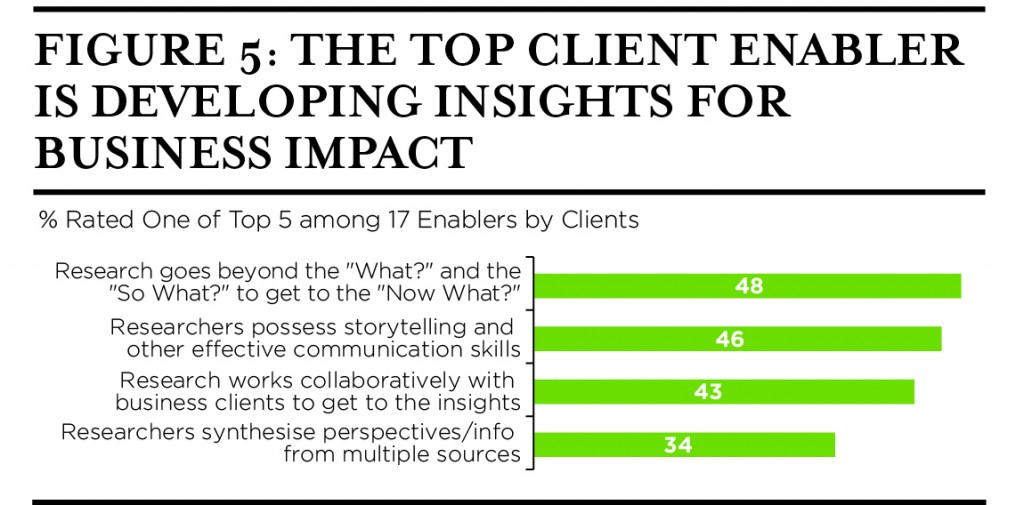

The top enabler is for research to identify and communicate insights that deliver business impact, going beyond the “What?” and “So What?” to the “Now What?” [Figure 8] This requires a different way of working, with a focus on collaboration, synthesis and storytelling.

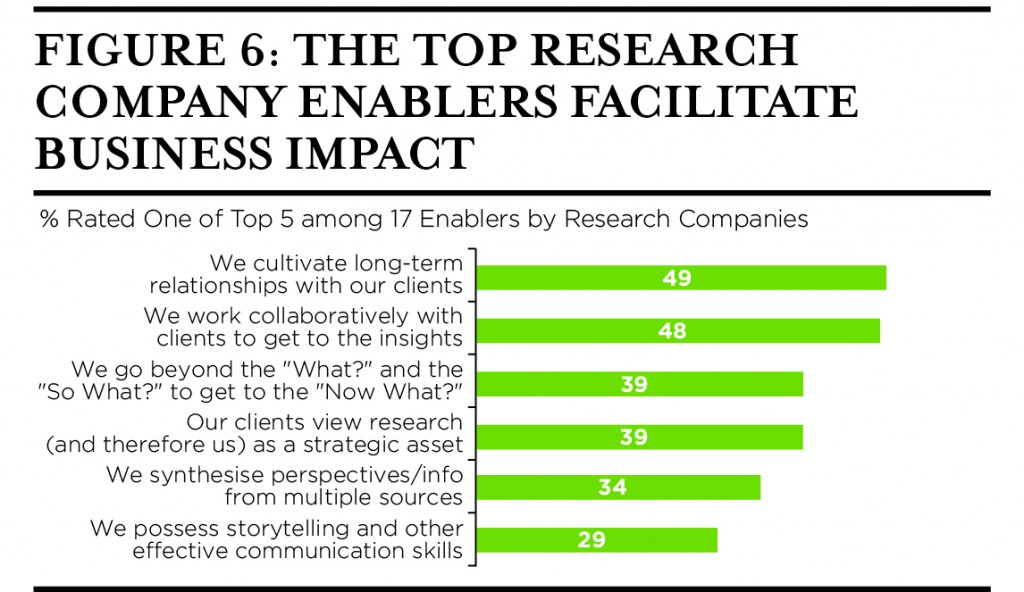

The top enablers for research companies are those which facilitate delivering business impact for their clients. Long term relationships in which the company is treated as a strategic asset, together with a way of working that focuses on collaboration, synthesis, storytelling and getting to the “Now What?” is the formula for success. [Figure 9]

The bottom line is that:

- Full service research companies must become “Integrated Research Agencies.” These agencies will have a culture of working collaboratively, both internally and with clients; the skills to synthesise information from numerous sources; the ability to create presentations that tell stories from the research; and they “get” the client’s business so that they become a true partner with clients in getting to the “Now What?”

- Corporate research departments must partner with research companies that have these capabilities. A new way of working is needed, along with a re-evaluation of research company partners, and a new business model that is consistent with hiring an agency versus hiring a supplier or vendor.

Ian Lewis is a partner at Cambiar in the USA