The spread of middle-class lifestyles in Latin America has created a new wave of opportunities for marketers and market researchers.

Latin America is no longer a new frontier for market research, as the region continues to prosper and generate the conditions necessary for upwardly mobile consumers. The consolidation of a new middle class has withstood economic headwinds from the US and European financial crises, and has become a new status quo.

Market research executives say turnover has benefited from these positive shifts, especially the emergence of new middle-class majorities in the region’s two key markets, Mexico and Brazil. Brazil alone has incorporated 29 million people into its middle class between 2003 and mid-2011, according to official figures.

“In the case of Brazil, the improved distribution of income and the growth of the lower middle class – these will certainly trigger research in the area of fast-moving consumer goods, despite the global crisis,” says Luiz Sá Lucas, technical director of IBOPE Inteligência.

In fact, he adds, Brazil’s growing prosperity, stability and social cohesion mean new preoccupations such as sustainability and the “green economy” are gaining ground among local consumers. The firm forecasts an 8% real growth (net of inflation) in Brazilian consumption for the year.

A new consumer

“We’ve widened the targets of our research,” says Julia Helena Carrillo, technical and commercial director for Consultor Apoyo in Ecuador. “Segments which previously did not have purchasing power now definitely have [it].”

Ecuador’s example shows how even in the smaller countries there has been growth in the lower middle class, or “belly of the market” (to distinguish this segment from the “base of the pyramid,” since emergent LatAm consumers are not really poor). The share of income going to Ecuador’s middle class, as opposed to the very rich, increased about 10% between 2005 and 2010, according to the World Bank

Despite the obvious benefits, this expanded consumer base has created a dilemma for the research industry, says Carrillo, because few research professionals come from the emergent middle classes that clients now want to understand.

“This world was unknown to researchers,” she says. ”That’s why ethnographic techniques, including work with video and photos, have become important for researching these segments.”

These immersive techniques may allow researchers a more thorough understanding of the day-to-day reality of the middle class, but since a great deal of this new lifestyle is tied to the internet, online must be part of researchers’ evolving strategies too.

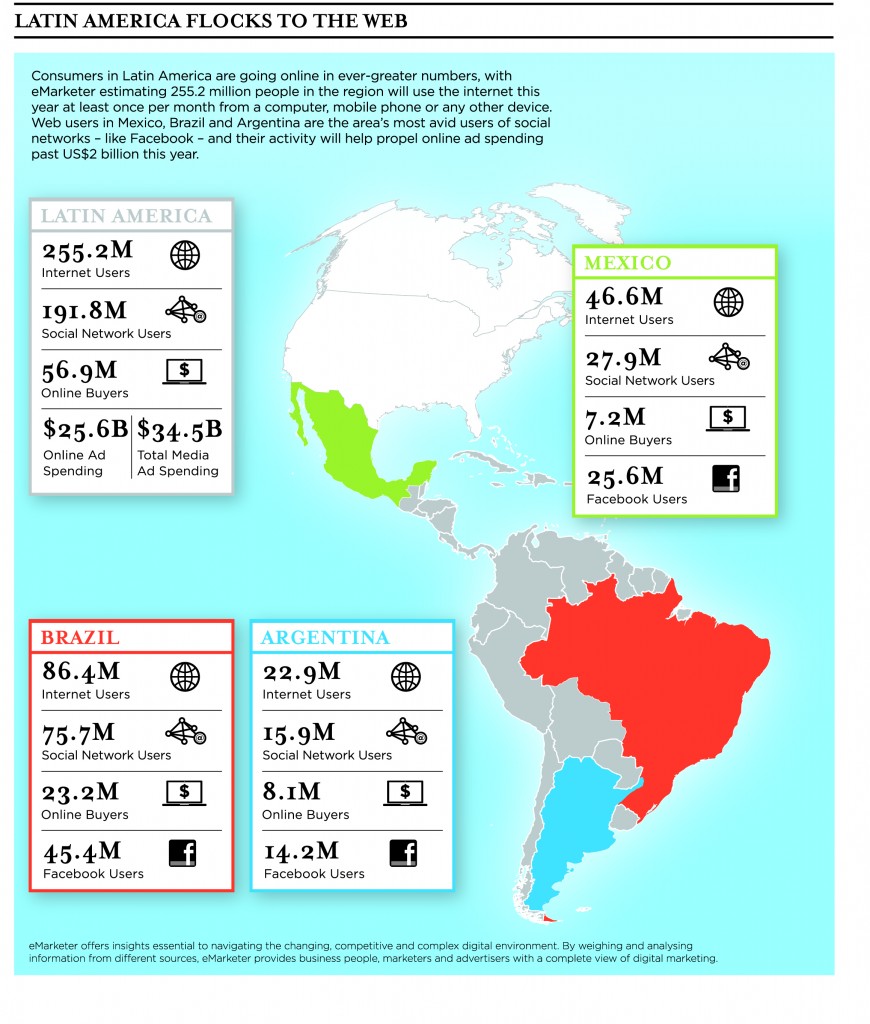

“We’re seeing massive levels of penetration by cellular phones with data plans for surfing social networks and the internet,” says Carolina Mejía Posada, founder and director of Inspired Active Knowledge in Colombia. “As they participate in social networks, LatAms become global consumers, and this completely transforms their decision-making process and relationship with brands and products.”

In other words, the region’s youthful online audiences are increasingly taking their social cues from the online world. “As consumers, they travel beyond the borders of country and region,” she adds.

Social networking plays a surprisingly dominant role for LatAm’s online audiences, where, according to comScore, five of the top ten global markets for Facebook in terms of penetration are found in Chile, Argentina, Colombia, Peru and Venezuela.

Even less wealthy Latin Americans are accessing smart-phones that allow them to go beyond text and voice services. In Brazil, which already has approximately 19 million smart-phones, 19% of owners are from the lower middle class, according to an Ipsos online panel study conducted last year for the local digital ad agencies Grupo.mobi and WMcCann.

A Nielsen study the same year for the Mobile Marketing Association (MMA) found that 87% of Brazilian ad agencies planned to launch mobile marketing campaigns that year, compared to 62% the year before.

Researchers tested

These fast-paced social and economic changes mean researchers have had their hands full in recent years.

“One thing is for sure, it has been impossible to become bored,” says Alejandro Garnica, executive director of the Americas Research Industry Alliance (ARIA). “We’ve been driving 200 kilometers an hour, and changing the tires at the same time.”

Mejía Posada worries that changes have happened so quickly that research has fallen behind in adapting to technological change and socio-cultural shifts like the rise of a millions-strong LatAm middle class. “We’ve been spotting all these changes, and yet we’re not moving at the speed we should to adapt,” she says.

That has raised the question of whether the region’s providers should push clients toward new opportunities, as a consultancy might, or simply deliver the information the client requires to follow a preset strategy. The usual answer is that research should do both, and many regional research executives believe a healthy relationship exists in LatAm, where buyers and suppliers of research help each other identify new trends and opportunities.

Yet Jorge M. Frech, managing director of Mercaplan – a firm with offices throughout Central America and the Caribbean – sees it somewhat differently. It is mainly the marketers, he says, who have been aggressive in developing products or pre-testing advertising to capitalise on the region’s growth. That, in turn, has spurred researchers to parse the new social and economic realities. “Clients are driving the need to measure the changes, more than we as research organisations,” he says.

Others disagree, but what’s certain is that regional growth means a higher profile globally for LatAm researchers, as multinationals look to emerging markets to make up for low growth in mature economies, according to Luiz Sá Lucas. “Brazil and the other emerging market nations are seen as a key business opportunity now that the American and European economies are stagnating.”

Mapping growth

But where exactly will this growth come from? Which countries and client categories will see the greatest opportunities? “The expectation is that the next five years will bring growth, with Brazil and Mexico as drivers, though of course we shouldn’t forget that certain countries will grow faster,” says Garnica of ARIA.

In ESOMAR’s 2010 Global Market Study, five Latin American countries were seeing double-digit turnover growth: Brazil, Argentina, Peru, Honduras, and Paraguay (see Table 1). Brazil posted 27% growth, and was by far the region’s largest market, with US $815 million in turnover, nearly half the region’s total. (LatAm as a whole had some US $1.8 billion in turnover in 2010, according to the study.)

Brazil’s dominance, considering its population of 190 million, will no doubt continue unrivaled, but the top five list also shows how small markets sometimes deliver unexpected opportunities. Paraguay, for example, has had some of the highest GDP growth rates in recent years, thanks to an agricultural and trade boom. Its GDP grew 14.5% in 2010, and 5.9% last year, according to the Spanish bank BBVA.

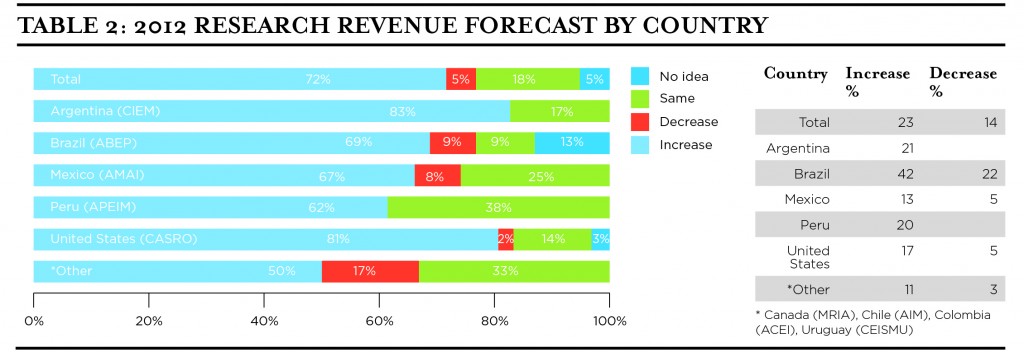

Overall, research executives interviewed said 2012 would see an improvement over 2011, a flat year in many countries, as regional economies gain traction, boosted by a recovering US and ongoing trade with China.

Indeed, figures from ARIA’s most recent survey of 130 research executives in the Americas show there is optimism about 2012 (see Table 2). 70% of the researchers in the four countries ARIA’s survey covered (Peru, Brazil, Argentina, and Mexico) said they expected revenue to increase this year compared to last.

In Mexico, researchers expected a 12% revenue rise, while Peruvian and Argentine researchers forecast about a 20% jump. In Brazil, meanwhile, researchers were the most optimistic, projecting a 42% rise in revenue this year as compared to 2011.

As for clients, many researchers said they expected to see growth in the research demands of locally based marketers that have become successful serving the home market (some of which, like the Brazilian high-end clothing brand Osklen, have expanded internationally). Travel, as well as health care, education and financial services, were also mentioned as potential growth sectors.

Guillermo Oliveto, president of Consultora W in Argentina, sees many discretionary products in the mobility and leisure categories, such as laptops and video games, benefiting from the fact that in coming years many consumers will gain access to them for the first time.

“But there will also be growth for top-shelf brands that are more everyday-type purchases,” he says. “For many consumers, these will be their very first splurges. The importance of this sort of purchase is key, not only for the individual, but socially too. A prestige brand in the closet or on the dining room table is evidence of an accessible luxury, and tangible proof for oneself and others of social mobility.”

Lingering risks

Of course, LatAm is not immune to political and economic risks. Though the region weathered the recent global economic slump well, there is no guarantee the new middle classes won’t face a major challenge in the future.

“As the saying goes, everything that glitters is not gold,” says Susana Marquis, Argentina-based director of Susana Marquis – La Investigación que inspira (Research that Inspires). The expression applies to seemingly positive changes that may have negative side effects.

For example, Paraguay’s soybean boom has changed the country’s eating habits, booming Brazilian real estate means household budgets are squeezed by rent and loan payments, and governmental generosity in Argentina and Venezuela has helped push inflation up to worrying double-digit levels.

LatAm, once known for its unpredictability, has certainly become more stable, but the region still produces unwelcome surprises that can affect businesses’ bottom lines.

However, the region’s research professionals believe that, beyond political disputes and economic hiccups in certain countries, the foundations for the social gains have been set in motion by deep changes that won’t easily be undone.

“It is hard for them to disappear, because this wasn’t a trend set in motion simply by external trends, although the high commodity prices have helped,” says Rolando Arellano Cueva, president of Arellano Marketing in Peru.

The fact is that LatAm consumers have become used to a new measure of clout in their societies, and it is unlikely that they will give that up, no matter what the future brings. “The traditional balance of power has shifted, and now it is not businesses but consumers who are empowered,” says Arellano.

Alejando Garnica is Executive Director of AMAI, Jorge M. French is Managing Director of Mercaplan, Julia Helena Carillo is Technical and Commercial Director for Consultor Apoyo, Luiz Sa Lucas is Technical Director of IBOPE Inteligencia, Rolando Arellano Cueva is President of Arellano Marketing.

1 comment

[…] Latin America’s Middle-Classes – “Base of the Pyramid” or “Belly of th… […]