Having access to more accurate predictions of the demand for products is a competitive factor for CPG (consumer packaged goods) manufacturers and retailers at any time. But as brands and retailers are forced to adapt to new shopper behaviours in response to the COVID crisis and understand how this is affecting their categories, products and channels, forecasting has never been more important to help track constantly changing shifts in consumer demand.

As we continue to overcome the challenges and look ahead to a post-COVID world in terms of consumption, channels, category management, shopper frequency and choice, let’s examine the ‘six rules of demand forecasting’ within the context of the current global pandemic.

1. Forecast regularly

Most companies’ marketing & sales departments tend to take a closer look at forecasting once a year when there is a planning review, but now more than ever it needs to be done on a regular basis. Every week is different and forecasting will help to identify those changes, guide a business and enable it to plan and adapt accordingly. In the current crisis, this allows you to create different scenarios, and also to understand the impact of second wave lockdowns and new restrictions. The rule of thumb is the more often you do it, the better.

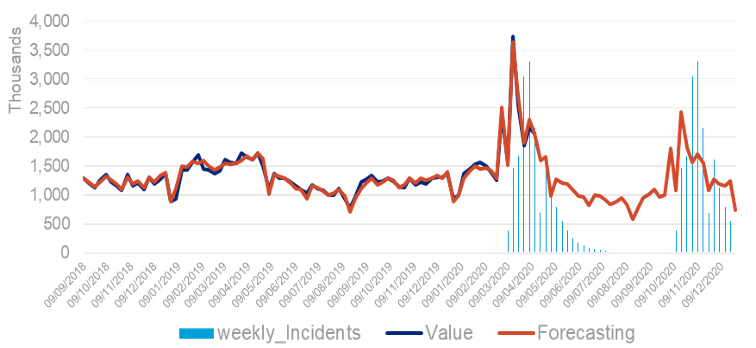

If we take the example below using IRI data from Greece, we can see how COVID incidents can change week by week (blue bars) and, in this case, a second wave is expected towards the end of the year. Hence forecasting the sales of Frozen Vegetables (red line) needs to take these new incidents into account to properly predict what the sales will be. Running a scenario forecasting model will provide a much more accurate view of the impact on sales as new incidents come in.

Source: IRI Analytics Center of Excellence – Greece Frozen Vegetables forecasting model

2. Plan for the unexpected

COVID-19 is the biggest challenge that CPG retailers and manufacturers face right now, but it’s certainly not the only one. Forecasting methodologies know how to handle different cases, and can safely be used to help in any scenario planning, such as a financial crisis, legal requirements or for regulatory changes in the industry.

But just as forecasting can be used for one-off events and crises, like the impact of a fire at a food manufacturing plant that halts production, ultimately it provides a business with the right tools to manage whatever is thrown at it. The current crisis is a unique situation and because things are changing quickly, regular forecasting is critical, supported by a strong methodology.

3. Prioritise the short-term view

For CPG retailers and manufacturers, long-term forecasting is the norm, but what this pandemic has taught us is that we also need to look at short-term tactical forecasting. A view of changing consumer behaviour and demand week-by-week can highlight what is happening today in a particular region, but also within the context of the business.

As a manufacturer, you may be looking to answer questions like ‘should I advertise because demand will increase for my products?’ or ‘should I increase my investment in digital media over other media?’ When it comes to development and innovation, you might want to know if you should accelerate development of new products, such as cleaning or hygiene items, or pivot production to focus on other products – as many companies have done this year.

Retailers need to anticipate changes in shopper behaviour and demand, such as stockpiling and panic buying during new lockdowns or tighter restrictions.

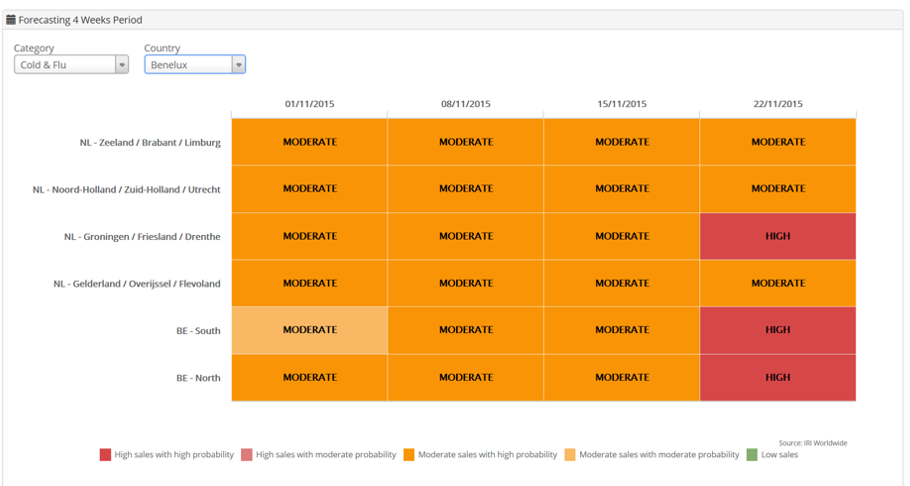

Looking at the flu outbreak example below, in order to better manage its advertising and representative visits, this drug company has tracked flu indicators per region in Benelux to forecast where an outbreak will happen in the coming weeks and how sales could be impacted.

Regions are listed in lines and the weeks are in columns, with each cell indicating if the threshold of the flu epidemic is low, moderate or high (from a low certainty it will happen to being quite sure it will happen) enabling them to take action in these areas.

Source: IRI Analytics Center of Excellence – Tactical Forecasting application – Benelux Cold & Flu forecasting model

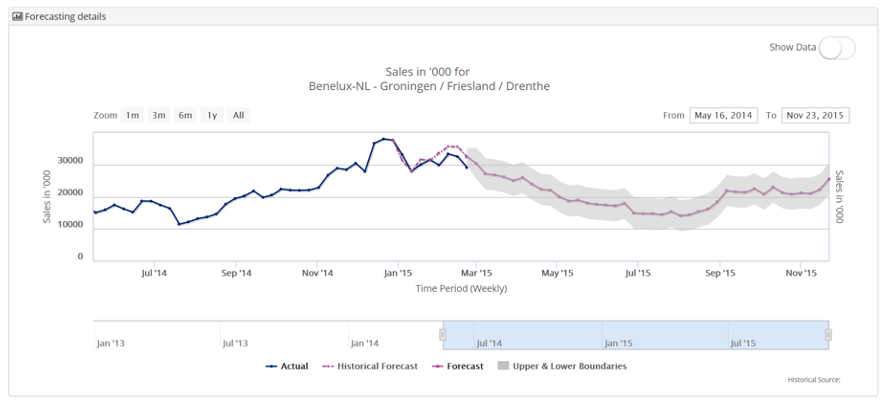

When the company clicks on each cell they are then taken to a page with a regional sales forecast to best assess the flu impact, including lower and upper boundaries that take into account more pessimistic or optimistic scenarios (chart below).

Source: IRI Analytics Center of Excellence – Tactical Forecasting application – Benelux Cold & Flu forecasting model

CPG organisations could develop the same forecasting techniques but using COVID indicators to anticipate events and take the appropriate actions during a second wave in each region. Knowing and understanding the likeliness of specific indicators in any given category can help guide the business.

4. Invest or stagnate

There is an assumption that all organisations run forecasting studies, but all too often forecasting comes last on a long list of priorities. Sadly, it’s not always seen as business critical and often regarded as less important than other forms of measurement. Many companies are not prepared to invest in it or to measure the return on investment of forecasting in the same rigorous way they do for marketing mix activities.

Forecasting should sit at the heart of any business, whether that’s production, sales, logistics or marketing, where even 1% of accuracy can make a huge difference to the bottom line.

5. One size does not fit all

Forecasting is not a one-size-fits-all approach. It needs to be relevant and specific to a retailer or a manufacturer, down to the category, product and geography. There could be thousands of metrics that apply to a business, as well as market variables like online vs. offline, click & collect, channels, and market specific or seasonal trends (e.g. demand for sausages for summer BBQs). Forecasting algorithms can help figure out which are the right ones at the right time.

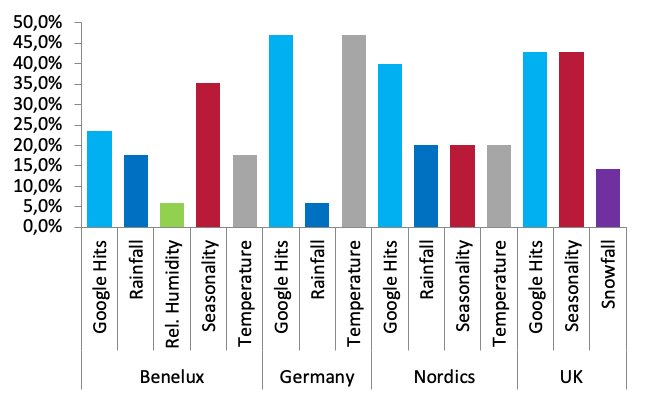

In the example below, we can see that the same causal variables that could impact flu (Google hits, rainfall, humidity, seasonality, temperature, snowfall) are not impacting sales in the same way in different European countries. For example, seasonality is a key indicator of a flu outbreak in the UK, but not in Germany; Google hits are a good indicator of the flu outbreak in Germany, the Nordics and UK, but not in Benelux; and temperature is a good indicator in Germany but not in the other countries. This is exactly why each forecast model has to be designed for each studied geography and category.

Source: IRI Analytics Center of Excellence – EU Cold & Flu forecasting models

6. Technology leads to accuracy and speed

The technology behind forecasting continues to advance at pace with the evolution of machine learning, artificial intelligence and simulation, providing greater accuracy and speed at a time when this is more important than ever. Technologies like IoT sensors and analytics solutions also allow retailers and manufacturers to better track the movement of products through the supply chain, in turn giving them a more accurate source of data for their modelling.

But while machines and technologies get smarter, let’s not forget the importance of the human element in demand forecasting, a vital component that can never be replaced.

We are in uncertain times, consumer demand is constantly shifting and unpredictability is the new normal. Forecasting remains more relevant now for CPG organisations to stay ahead of the game and overcome or limit the impact of this and any future crisis.