The 46th edition of the U.S. Top 50 Report was featured in the “2019 GreenBook Market Leaders Report,” published by GreenBook, in partnership with the Insights Association and Michigan State University. This in-depth report includes chapters on industry segmentation focusing on how the U.S. research industry is transforming, company positioning and profiles, as well as CEO perspectives and CEO interviews. My thanks to the Insights Association and to Michigan State University’s Research Transformed Collaborative, under the leadership of Michael Brereton, and to Leonard Murphy and my GreenBook colleagues for their support on this new and important report on the U.S. research, insights, and data analytics industry.

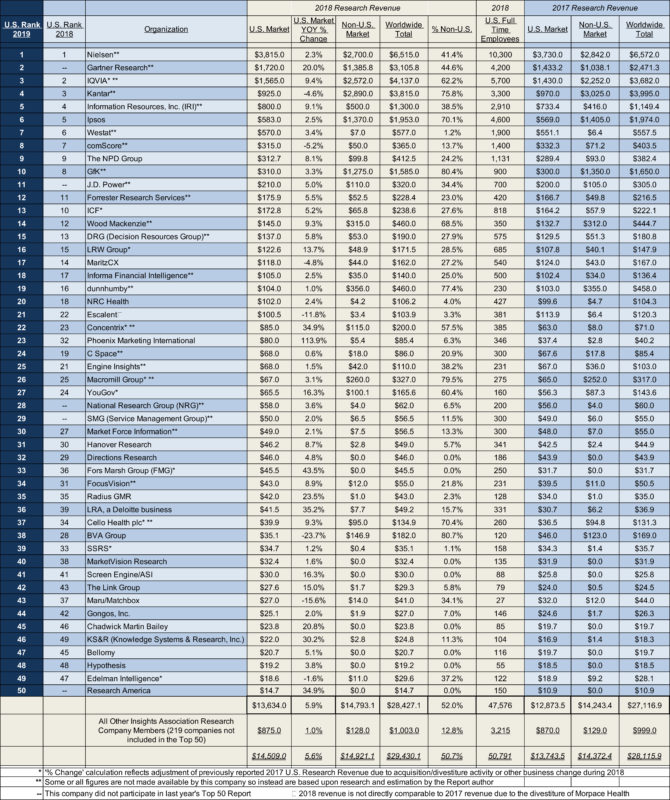

Here are some highlights on the U.S. Top 50 companies, their revenue, growth rate, and services based on 2018 data, as well as how they reflect and advance the transformation of the research, insights, and analytics industry.

U.S. Top 50 Report—Highlights

U.S. revenue for the Top 50 companies was $13.63 billion—a 5.9% growth rate. Non-U.S. revenue for the Top 50 companies totaled $14.79 billion—a growth rate of 3.9%. Total 2018 revenue for the U.S. Top 50 companies was $28.42 billion—a growth rate of 4.8%.

There were five new companies on the U.S. Top 50 list:

- At #2, Gartner Research, the largest of four business segments in Gartner Inc., delivers independent, objective advice to leaders across the enterprise, primarily through a subscription-based digital media service.

- At #11, J.D. Power is a global leader in consumer insights, advisory services and data & analytics and is most recognized for its syndicated quality and customer satisfaction studies of the automotive and many other industries.

- At #28, National Research Group (NRG) is a leading global insights and strategy firm at the intersection of entertainment and technology, coordinating qualitative and quantitative research to solve complex problems.

- At #29, SMG (Service Management Group) is a customer experience management firm that partners with more than 350 brands around the globe to create better customer and employee experiences.

- At #50, Research America is a value-based, full-service and field market research firm that provides organizations with consumer insight needed to enhance products and services for their customer base.

Four companies on the U.S. Top 50 list have new identities:

- At #21, Escalent is the new brand name for Market Strategies International and Morpace, which combined as one company in 2018 as part of an acquisition by private equity firm STG Partners.

- At #22, Concentrix expanded its customer experience research footprint by acquiring Convergys and its extensive research portfolio, including Voice of the Customer (VOC) survey technology and CX analytics.

- At #25, Engine Insights—formerly ORC International—is one of the four major marketing solutions divisions of Engine Group, a data-driven marketing solutions company.

Top growth

In 2018, one-quarter (13) of the U.S. Top 50 companies reported double-digit increases in year-on-year (YOY) revenue, with the average percent of increase at 22.7%. Nine out of the 13 companies achieved 20% or more YOY growth in 2018.

- #23, Phoenix Marketing International realized a 113.9% increase largely through the acquisition of Nielsen’s Brand Effect products and services.

- #33, Fors Marsh Group, which utilizes behavioral and data science to improve organizational processes, business solutions, and customer experiences, increased their 2018 revenue by 43.5%.

- #36, LRA, a Deloitte Business, a customer experience company helping clients to improve brand health, recorded a 35.2% increase.

- #22, Concentrix, a wholly-owned subsidiary of SYNNEX Corporation (NYSE: SNX) specializing in technology-enabled customer engagement, realized a 34.9% increase.

- #50, Research America had a 34.9% increase in 2018 U.S. revenue.

- #46, KS&R, creating and executing global custom market research initiatives in more than 100 countries and 50 languages, realized a 30.2% YOY increase in U.S. revenue.

- #35, Radius GMR, providing strategic insights based on attitudinal and behavioral approaches to brand performance, realized a 23.5% YOY increase.

- #45, Chadwick Martin Bailey, a consultative primary research company providing insights and strategy on brand development and management, increased their 2018 U.S. revenue by 20.8%.

- #2, Gartner Research realized a 20.0% YOY increase in U.S. research revenue.

Only one-quarter (12) of the U.S. Top 50 companies reported that revenue was flat (any increase did not exceed the inflation rate) or decreased in 2018, with the average percent of decrease at -4.9%. This is the lowest number of companies reporting flat or declining annual revenue for many years.

On an even more positive note, one-half of the U.S. Top 50 companies, reported single-digit increases (increases exceeded the inflation rate) in YOY revenue, with the average percent of increase at 4.7%.

Putting it all together, three quarters of the U.S. Top 50 companies reported that 2018 was a very good year. For these 38 companies total U.S. revenue was $11.79 billion, compared to $10.93 billion in 2017 – a growth rate of 7.9%.

Click on the image to enlarge

Stay tuned for part 2 of this article, which will be published Wednesday 26 February.