Exploring the ways tech savvy consumers have innovated in their lives and how market research practices can follow their lead.

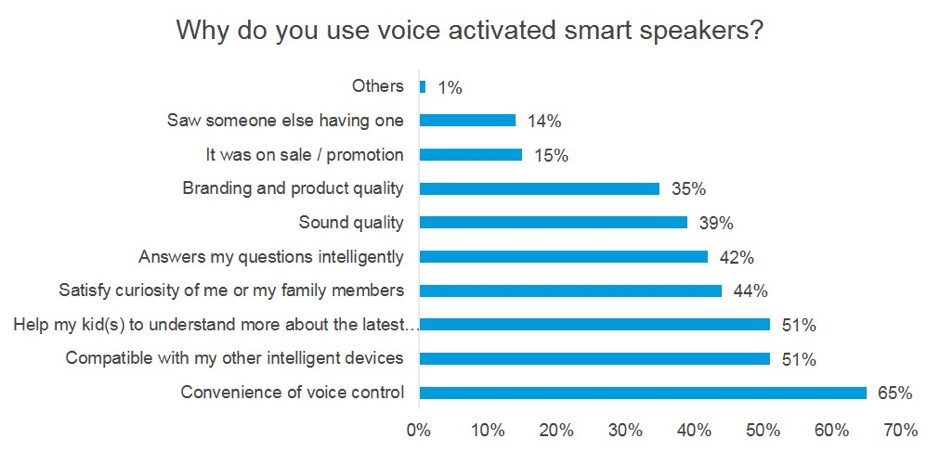

Innovation is impacting every part of our lives, with smartphones making the world available from consumer pockets with a simple click, swipe or voice command. And now Apple HomePod and Amazon Echo, teamed up with Siri and Alexa, are providing direct access to information without the need to reach for a device.

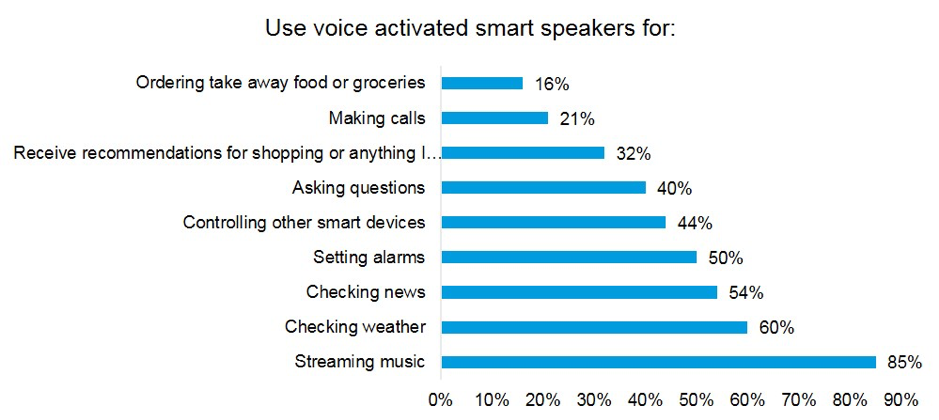

In fact, voice-control products are taking off. According to Kantar’s latest research findings, 21% of people now own a smart speaker or home assistant. Given that the first smart speaker (the Amazon Echo) was only launched in 2014, this indicates that the voice-activated smart device revolution is just getting started. And while these devices become ubiquitous, smartphones are still the central place that consumers store everything, make mobile payments, shop online and more. The momentary panic when you think you’ve lost your device is gut wrenching because of the heavy dependence on them to function even in the most basic sense. And it’s evolving at an exponential rate.

But can the same be said for market research? Technological development in the market research industry is often focused on how a business can create the latest programme or app to benefit their business. However, the fact that technological development is becoming a technological dependence for consumers means market research is already benefiting. Or rather, it should be. The opportunity exists, given access to data from new sources like customer data platforms, conversational AI, and all corners of the internet but now researchers need to tap into this wealth of data to better understand today’s consumers.

Recognising this, Kantar has been exploring what the industry can learn from advances in and adoption of consumer technology, and how to maximize insights and personalise experiences through understanding connected consumers and the digital landscape they’re building.

So, let’s explore some of the opportunities within our industry.

Searching for answers that are already there

We’ve all been there, a conversation at a dinner with friends where we can’t remember the name of the actress in that film or who won the finals last year. It’s tough to imagine what we did in the days when we couldn’t simply “Google it” or ask Alexa for the answer without pause.

Having any and every answer at your fingertips is an efficient, useful tool. If an answer exists, then isn’t it better to know and be able to move on to the rest of the conversation? Think about research in the same way to look for what could already be out there. Researchers are accustomed to creating a survey that covers all the queries they have. However, there is an abundance of data already available from others having asked the same questions. So why not search as an initial step in the research process?

Not only does leveraging collective survey knowledge provide instant answers, it can enable the reduction of questions needed in subsequent surveys – saving research budget and gaining meaningful insight from a more tailored survey that succeeds it.

Being able to tap into data that already exists offers a significant advantage for the marketing industry. This capability allows brands, marketers and researchers alike to leverage audience understanding, quickly and cost-effectively by using real, permission-based data without even asking a question. The beauty lies in the simplicity and speed of searching what’s already been collected and then connecting this into a larger research project or directly into strategic action.

Connecting multiple consumer datasets

Survey research is a critically important method of tapping into the attitudes and opinions of consumers, but respondents have a digital life outside their online panel community – as a consumer, an influencer and a potential buyer.

Consumers are leaving a bigger digital fingerprint that increases exponentially by the minute, if not by the second. It expands by source, by type and size. It is creating an ocean-sized pool of third-party data, which we are still learning how to best utilise in data collection and analysis.

Consumers are leaving a bigger digital fingerprint that increases exponentially by the minute, if not by the second.

How can we connect to and access this ocean of data? How do we link survey data to it for a holistic, enriched view of our customers and non-customers?

Connecting data across first, second and third-party sources is both an art and science. There’s even the concept of zero-party data, a subset of first-party, which refers to attributes a customer intentionally and proactively shares with a brand.

There are three main ways to connect available data sources, privately and compliantly.

1. By person: The first way to match an individual or their household to a data segment or index is via Personally Identifiable Information (PII). Name, address, postcode, mobile number, email address, are all data points that can be used to make the connection. This is called a deterministic match.

2. By tagging: Second in line is cookie drops or pixel tags. This match is done on a device level, where a cookie is dropped on a computer, or a pixel tag is implemented in an app on a smartphone to track behaviour and build a profiling data set around who a consumer is. This is called a probabilistic match.

3. By device: Finally, there is Device IDs. This is a match at a device level and driven by smartphone technology. Every Android and iPhone has a Device ID that is created as part of a Google Account or Apple ID. Originally conceived for delivery of targeted digital advertising, it has become an essential driver in identifying profiles between data sources. It’s still a probabilistic match like cookies and pixel tags, but it reduces uncertainty.

The ability to connect profiles through connection approaches is key to enhancing datasets. Once done, it unlocks richer, more actionable data for targeting or even media activation.

Survey segments for programmatic advertising

“Hey Siri, what’s the address of the airport?” Although we can’t order an Uber to the airport through a survey-based research project, we have seen how innovation in platform connectivity and enrichment has increased the value of the research we are delivering to clients each day.

In addition to the more obvious ways that data and connectivity increase the richness of our research and the speed with which we deliver, we now have more ways of making our deliverables actionable – such as utilising the segments derived through survey research with programmatic advertising.

In the past, the linkage between customer segmentation and media buying or ad targeting was indirect at best. Media planners and media buyers would use proxies such as demographic profiles of their customer segments to indirectly target ads digitally (e.g., “my segment is more heavily weighted to females, age 26-34 in the Northeastern US”).

As programmatic ad buying has become the norm and more data has been introduced into the ad targeting process, we can now more directly use custom segment data to display ads to consumers who are more likely to fall into the segment (or audience) of interest.

So, how does it work?

Survey and segment: Conduct research among respondents who have agreed to participate in this use-case and who are connected into a Data Management Platform (DMP). Use the survey data to define a segment of interest and identify the specific survey responders who are in-segment (usually n=500 to n=1,000).

Scale: Using statistical techniques and the data housed in the DMP, data scientists/modellers will identify many more online profiles that are similar to the survey responders identified via the survey (this larger group is known as a “scaled audience”).

Distribute (target and activate): After ensuring that the survey responders are removed, the anonymous identifiers of the scaled audience (e.g., cookie IDs or mobile ad IDs) are made available to media buyers via the programmatic advertising process. Access to the scaled audience is typically paid for by the advertiser based on the number of ad impressions served.

Measure: Execute brand-lift or sales-lift research to measure the results of the targeted campaign.

Brands are looking for every possible way to make their digital marketing dollars go further, and custom survey-based audience targeting offers this value add. We’ve seen incredible results from custom research-based audience activation across industry verticals, from consumer goods where we have measured a 400% increase in product sales, to a 500% increase in site bookings for a travel industry client, to double-digit increases in brand conversion across other FMCG and specialty retail. By taking action on the wealth of data captured through research projects, brands can now ensure that digital audiences take into account those all-important consumer attitudes about a brand and its products.

Using AI to create a conversation

Research innovation is moving into AI. And the key for AI in market research is in conversation; striking a conversation in an environment where respondents are already familiar and active allows the research to blend seamlessly into the medium so they feel like they are communicating with a friend. By doing this it opens the door to more personal, open and honest responses. Through a dynamic script a question can evolve to build on an idea in real-time and develop a deeper understanding on a topic, allowing a richer view of audiences.

Chatbots are one way to provide the opportunity for respondents to participate in a more interactive, conversational manner than a typical typed response and in turn can deliver deeper understanding and richer data.

For example, imagine conducting a diary study using conversational AI. The respondent can be in the kitchen testing the product as they make dinner and record an in-the moment voice response – a convenient way for them to go about their day while providing brands feedback. And it’s not only about convenience; a qualitative and quantitative hybrid approach like this allows the researcher to obtain greater detail. Not only does speaking a response tend to provide additional information than typing, details can come in the form of images and videos from people in the moment — a self-reporting data enrichment that is particularly useful for diary studies seeking real-life behaviours.

And AI continues to learn and improve, meaning the way we conduct research can too.

Connecting to the innovative consumer and leveraging vast, new sources of data tied to them is key to building richer, more useful audience profiles. As consumers and their tech habits evolve, it’s imperative market research does too – this is something we can learn from Siri and Alexa and from the audiences we are seeking to understand.