Legislation and regulations around data control and usage are rising. Simultaneously, so too is consumer concern and a need for control. This is today’s data privacy and protection reality. People are weary of how organizations and corporations are collecting their data, and are paying close attention when it comes to privacy risks. However, most are early in the journey of taking control of their own data.

The market research industry – a major user of consumer data – is at the forefront of data privacy and control. Traditionally, the industry has offered research participants low incentives for their valuable information. But people are starting to become aware that their data is worth more. Much more.

To help quantify these expectations, and determine the current state of understanding of what data (and its privacy) is worth, we’ve reviewed academic and other research on this area. Two papers in particular stood out: 1) examining the privacy’s value across a number of data types; and 2) an economic analysis of GDPR privacy legislation on websites. While two very different analyses, both point us in the direction of some initial understanding of the value and economics of data and privacy.

Consumers attach specific monetary value levels to certain kinds of information.

“How much is privacy worth around the world and across platforms” by Prince and Wallsten attempts to understand how individuals value their online privacy across six data types across United States, Mexico, Brazil, Colombia, Argentina, and Germany.

The authors examined results from four different survey approaches to see if differences occurred across sharing personal information pertaining to finances, biometrics, location, networks, communications, and web browsing. Their methodology allowed them to place a monetary value on data that was shared. They found that a platform needs to pay users the following amounts to get them to share data with third parties (in USD):

- $8.44/month to share a bank balance

- $7.56/month to share fingerprint information,

- $6.05/month to read an individual’s texts

- $5.80/month to share information on cash withdrawals

- $1.82/month to share their location

Prince and Wallsten found that no matter the geographic origin, people placed the most value on their financial and biometric data. Germany, however, had greater privacy concerns with “strong preferences for keeping financial data private”. This indicates Germans need to be paid double the study average to share this type of data. Latin and South American respondents desired the least payment amount to receive ads. Other demographic characteristics also impacted privacy preferences: women are more concerned than men about privacy and older individuals (over 45 years) were more concerned than their younger counterparts.

These findings don’t necessarily map directly to a 15-minute survey’s value, or the perceived value for an individual to participate in a survey. However, it shows that there are varying levels of value associated with data of varying levels of sensitivity. And increasingly, market research, brands and agencies are requiring new and more demanding (or sensitive) forms of data from individuals to support their decision-making processes.

While most market research price sensitivity is focused around survey length or access to a target demographic, is there something to be learned from this analysis that indicates the model for compensating individuals for data and feedback be revisited? We think so. We can all likely agree that the current models are paying less than this and greater rewards are required to encourage individuals to share data.

Consumers like the idea of greater privacy protections, but aren’t taking full advantage of them

The second paper we reviewed was “The Economic Consequences of Data Privacy Regulation: Empirical Evidence from GDPR” by Aridor, Che and Salz. The authors dove into the impact of privacy regulations on consumer behavior to see if protections actually impacted their behaviors. While this analysis was particular to the online travel industry, an interesting finding in this second paper is that implementation of privacy protocols may actually drive more quality engagement, and in turn, greater potential profitability.

The authors examined GDPR’s “opt in” requirement, and initial results showed that 12.5% of consumers took advantage of it to opt out of sharing their information via cookies. Yet, this statistic was offset by the remaining consumers – ones who opted in – who were 8% more “persistently trackable.” Quite basically, they remained longer in a website, allowing their data and identity to be observed for longer. This is despite the finding that there was a 13.5% drop in the total number of clicks, and decreases in total number of cookies and searches.

From a monetary standpoint, revenue for advertisers remained steady, perhaps due to the makeup of the remaining consumers (more likely to purchase). The authors say that:

“The average value of the remaining consumers to advertisers has increased, offsetting most of the losses from consumers that opt out.”

We interpret this to be an example where adopting privacy protocols leads to improved data quality while protecting an individual’s rights and data, all while having no material monetary consequence to the publisher.

We believe this is a case where everyone benefits from a win-win scenario. We believe that this hypothesis could be implemented and tested within the market research industry. The initial findings indicate that any short-term discomfort that may be experienced by going above and beyond to protect an individual’s data and privacy – while compensating them fairly – will lead to greater data quality and data access for the industry in the long-term.

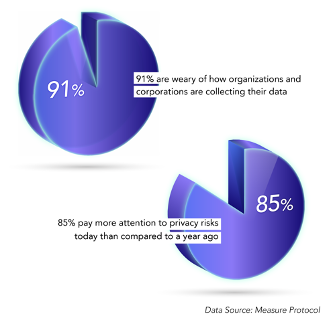

Concerns about data privacy are on the rise

In a study of more than 2,500 individuals conducted across the Measure community in the U.S., U.K. and Canada in November 2020. The highlighted concerns about data privacy and its increased importance:

- 91% are “weary of how organizations and corporations are collecting their data”

- 85% are “paying more attention to privacy risks today than compared to a year ago”

The study also found that those over 40 are more likely than those aged 18-24 to be opposed to sharing data such as cash withdrawals, individual texts, and bank balances stating “there is no value where I’d be willing to share this data.” Interestingly, those aged 18-24 were more likely to be in general agreement with the levels of compensation as found in the paper by Prince and Wallsten. Those aged 18-24 were 57% more likely to state “sounds about right” for $6.05 to provide access to their individual texts versus those aged 40+ However, most of the 18-24 year olds still saw $6.05 as too low of an incentive to access their text message data.

So what will encourage consumers to share valuable data?

The truth is that we just don’t know for certain the exact formula that will encourage data sharing. Industry practices, regulations and consumer awareness are taking the wheel, so understanding the intricacies of data privacy, perceived value and willingness to share is vital. Communicating with consumers and being transparent about topics like privacy protection and rewards and incentives are critical in market research’s evolution. If either of these studies are early indicators, it may indeed be a trajectory where greater privacy, data control and fair compensation is the foundation of participation and success.