Simon Chadwick and Peter Milla

Every year there is a handful of industry reports to which the research community looks forward with anticipation: Honomichl, ESOMAR Global Market Research, GRIT and Cambiar’s Future of Research, to name a few. The Confirmit Market Research Software Survey by meaning is one of these. Authored by the very highly respected software consultant and reviewer, Tim Macer, this survey looks at the trends in our industry through the lens of technology. What does technology adoption (or lack of adoption) tell us about the direction in which our industry is heading? This is not just a dry technology report, it reveals interesting (and, in some cases disturbing) nuggets on trends in areas such as methodology and research ethics. In their 2012 survey (the ninth annual edition of this report), the authors highlight some fascinating trends that will be of direct import to not only research company CIOs but their CEOs as well.

Some of these trends point to an industry that is embracing change and moving ahead in the 21st century world of technology that we inhabit. Others, confusingly, point to a lack of willingness to change that brings into question how long traditional market research companies can continue to grow and thrive.

Embracing change

One trend emerges very strongly that suggests an industry moving forward: after years of hype and raised expectations, the survey finds that mobile is indeed now going mainstream. Not only do the majority of research company technology executives (the primary sample for this survey) now consider mobile to be a viable method of data collection and respondent interaction, it is clear that more and more are actually using mobile. This is especially so in Asia-Pacific, which gives credence to the theory that emerging markets are more likely to leapfrog from paper over CATI and online straight to mobile.

Interestingly, as mobile starts to erode paper and CATI (especially the former), so too does CAPI. The study speculates that this may well be due to the acceptance and prevalence of tablets. If so, score another for mobile technology!

The study does not resolve the argument over whether mobile apps or browsers will prevail but suggests that, while browsers are preferred by a slim majority for now, apps will in the end catch up and likely surpass browsers. We see this trend being driven by the types of research that apps can support. These include sophisticated geolocation-based approaches, the use of advanced device capabilities as well as the use of passive data collection. Properly permissioned passive mobile data collection offers a view into consumer behaviour that has only recently been understood in terms of its value and impact.

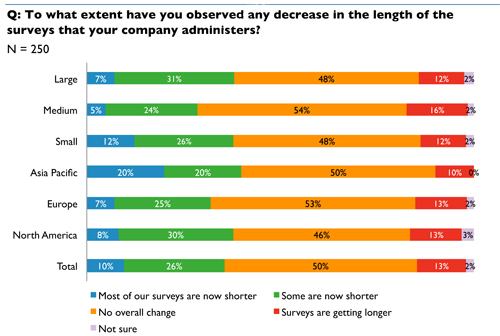

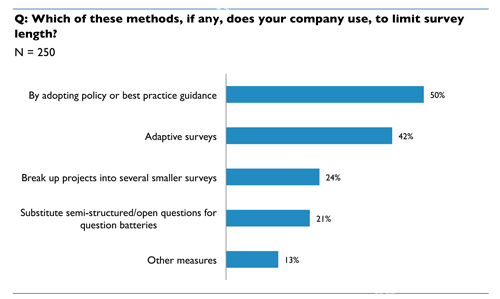

In one of the most frustrating areas of change (or lack of it) in research, the study suggests that research companies are not doing as much as they can to curtail questionnaire length. However, there is some movement towards shorter surveys – 50% of research firms have policies in place to try and keep length to a minimum, while others are beginning to experiment with adaptive surveys to achieve the same result. In our view, this does represent progress of a sort and we will be interested to see what next year’s results will bring in this regard. When asked what the optimum length of survey would be by data collection method, median results were 18 minutes for phone, 15 for web and 7 for mobile. A few crazy outliers thought an hour or more was just fine!

The issue of survey length is one of serious concern. With the continuing evolution of consumer driven technology, we will see more consumers moving their activity from personal computers to mobile devices. This has already manifested itself in the percentage of respondents who attempt to take surveys that are designed for a desktop browser with a mobile device. Industry estimates we’ve seen currently put this at approximately 10% with expectations for it to grow to 20% by the end of 2013. This trend will increase and if not addressed, may put pressure on sample sources and potentially present issues for the accuracy of survey results.

On a final note – analysis and reporting – we find a mix of optimism and despair (at least, those were the emotions that we felt). It seems that larger research companies (defined as $25 million in revenues or more) are beginning to embrace more high-tech reporting and interactive analysis tools. To these larger companies, this must feel as one of the few competitive advantages that they have left – the ability to afford and invest in this type of technology where others cannot. But, as history has taught us, the great god of outsourcing will probably level the playing field within a year or so. We can only cheer the advent of such technologies in an industry that has been far too lackadaisical in improving its ability to communicate insights with impact. That said, the despair we feel comes from the finding that PowerPoint still rules the roost in terms of reporting and shows no signs of dying. Despite a whole host of new alternatives, we are still trapped in the confines of its grip.

We’ll offer that perhaps there is some hope that industry trends, such as the need to deliver results more quickly and the advent of big data, might help drive adoption of visualisation for analysis and reporting. With less and less time and more and more data to analyse, visualisation may offer ROI and practical benefits that can’t be ignored.

Concerns

Despite finding reasons for optimism, the survey does (as evidenced by the dominance of PowerPoint) reveal areas of deep concern – at least for the supply side of the industry. For example, only 29% of research companies polled across the world are using digital fingerprinting as a means of ensuring sample and data quality (35% in North America). Indeed, the survey finds that there is insufficient use of pretty much all of the fraud checking technology that is out there and available to us today.

With this technology widely available and not very costly, how can it be that the majority of research companies are refusing to avail themselves of it? Similarly, there seems to still be a crashing lack of imagination where incentives are concerned. The vast majority of research firms continue to use crude financial or commercial incentives rather than buying into more creative cafeteria-style options or even the “kudos” or “status” types of reward that are so successful in social media. This means that we continue (in online research at least) to insist on making participation in research a commercial activity rather than a social one (for more on this, read Dan Ariely’s Predictably Irrational). Then we wonder why response rates continue to fall and why we get people (and organisations) trying to game the system.

Another source of wonderment is the finding that only 17% of research firms are using or offering online communities – precisely the same as in 2009! (The figure is a little higher in North America). And research companies wonder why new competitors such as Communispace and Vision Critical have been so successful! Indeed, this replicates a finding in Cambiar’s 2012 Future of Research study that found that established research companies have virtually put out the welcome mat to new competition by refusing to provide new modalities in which their clients are interested and with which they want to experiment – mobile being one of them. We see that a change in this attitude is essential in order for research firms to prevent the loss of market share to new entrants.

Finally, there are warnings in here too for the big research software companies: rest on your laurels at your expense. The study finds a big appetite among research companies for changing their core data collection, analysis and reporting software. Often this reflects the desire for new tools and efficiency but also it represents a way of maintaining a competitive edge. Which goes to say that new entrants into this space will find a receptive audience. We respectfully suggest that big research software companies consider the importance of investment in new product development in this. Those that do will see rewards in terms of sales and market position. We are sure that Confirmit, the primary sponsor of this survey, have duly taken note!

Hopes for future studies

We cannot do otherwise but applaud both Confirmit and meaning Ltd for their dedication in providing this survey on an annual basis over the last nine years and we hope that they will continue to do so for a long time to come. If there is one further hope that we have, it is that future surveys might broaden the scope of data collection to include newer entrants into the industry – text and web analytics firms, digital ethnography providers and social media monitoring companies to name but a few. The research and analytics industry is changing rapidly and we need somehow to embrace these new entrants and assess how and to what degree they are going to change our understanding of the world in which we compete and make our living.

Simon Chadwick is Managing Partner, and Peter Milla an Associate at Cambiar. You can download a full copy of the report here.

1 comment

[…] /2013/05/30/what-technology-trends-have-to-tell-us-about-the-state-of-our… […]