In our overview article on investment in the insights and analytics industry during the pandemic, we highlighted that capital investment in early-stage companies in 2020 surpassed any equivalent totals that we had seen in the past ten years. Which begs a couple of questions: why now and what in our world is exciting investors? In other words, what are they investing in now that we should be looking out for in two or three years as viable new players in our space?

Part of the answer to “why now?” lies in a more general upsurge in venture capital investing across the board. It isn’t necessarily a sign of insights and analytics suddenly ‘catching on’ again among venture capitalists but more that they have been raising new money in record numbers and are looking for places in which to invest it. But that being said, it is true that venture capital has made some good bets in our neck of the woods and that investors are willing to bet that there may be more to come.

What is early stage?

Before diving deeper into what these trends may portend for our future, let’s pause for a moment to define what we mean by ‘early-stage’ companies. Generally, such firms fall into three categories:

- Companies just starting out. There is an idea that is propelling their founders – an idea usually based in a product or service that could prosper among a target set of customers. Maybe there is a business plan to go with the idea and sometimes there is even an early, small stream of revenue. These companies often start out with a small amount of funding, often from family and friends but sometimes sourced from what are termed ‘angel’ investors. These may be individuals or angel funds that seek out glimmers of ideas that they think have a chance of making it. The money that these companies raise at this stage is called ‘seed funding’ and is usually small in amount.

- Early survivors. Nine out of ten new companies do not make it past their first anniversary. Those that do usually have built something that it would appear may have a chance of success, although it may be too early to tell for certain. These firms often seek larger amounts of funding at this stage, usually to continue building and refining their product and technology. The funds that they receive often come from venture capital and are referred to as ‘Series A rounds’.

- Ready to go to market. Once the product or technology is honed and revenue is beginning to come through the door, most companies will seek funding to boost their marketing and sales capabilities. They are ready to take on the market. At this stage, they may receive what are called ‘Series B rounds’. At this stage, they will usually be 3 – 5 years old and will have, in venture capital’s eyes, a fair chance of success.

From the point of view of divining what the data mean for the future of the industry, seed and A-series investments usually point to where investors see potential in the future and are willing to stick their toes into the water. Series B rounds usually show where they are willing to make bigger bets on the basis of early actual performance – so these investments point in some, but not all, cases to a coming wave.

So where was early-stage investment going in 2020?

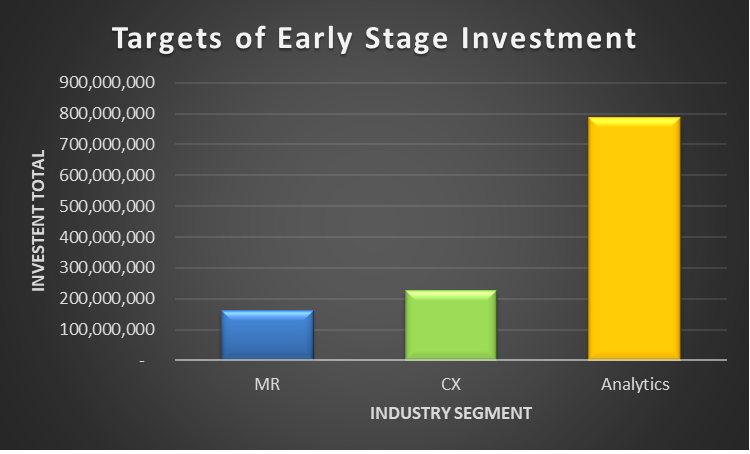

Source: Cambiar Capital Funding Index 2020

To regular readers of these reports, it will come as no surprise that consumer analytics continues to outpace market research in terms of investor interest. The ubiquity and power of behavioral data is something that investors latched onto nearly a decade ago and their enthusiasm for this side of our industry has not waned. What is interesting here, however, is the appearance of CX (Customer Experience). What until ten years ago was considered a part of market research (it was called ‘customer satisfaction research’ in those days) is now viewed almost as a separate industry. Since the advent of technology based CX platforms such as Medallia, however, this is now seen as a different animal. It doesn’t hurt that Qualtrics is also perceived as the major player in this sphere. The degree of early-stage investment into CX in 2020, to the tune of more than $200 million, signals that investors do not feel that this party is yet over.

However, the story is a little more nuanced than this.

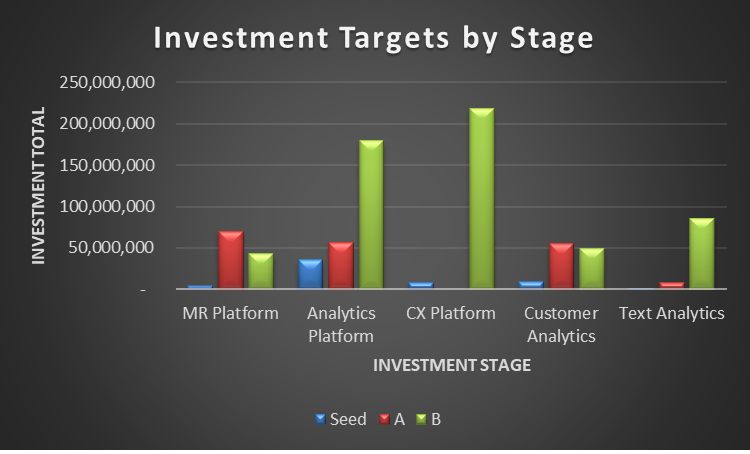

Source: Cambiar Capital Funding Index 2020

From the figure above, we can see that the vast majority of this early-stage funding into CX fell into the Series B category – i.e. these are companies that were founded three to five years ago and are now beginning to make a push for the big time. Very little, if any, Seed/Series A funding went into this segment, suggesting that, for now, the field belongs to existing, not new, players. Note also that the same story seems to hold for text analytics.

The second story that jumps out here is the degree to which MR platforms are receiving Series A funding. In 2020, this even exceeded the money going into analytics platforms – a new phenomenon in the history of this analysis over the last ten years. While the quantum of such Series A funding is not huge ($70 million), it should be remembered that Series A investments are typically smaller than later stage injections. What this seems to suggest is that investors are becoming aware of the degree to which buyers of research are turning to technology-based platforms rather than full-service agencies and are betting that this will turn out to be a similar trend to that which occurred in CX. To a slightly lesser extent, this may also be true where their interest in customer analytics is concerned.

These then are the two areas that we should continue to watch in the coming two to three years. If we see these investments translating into continued funding (Series B and above), it will tell us a lot about the future of the research and analytics industry.

In the next article in this series, we will focus more on the companies that are trending in terms of the funds that they have received, as well as the investors who are backing them.