In my last article about capital inflows into the research and consumer data analytics industry, I concentrated on those segments receiving ‘early stage’ funding – that is, segments where young companies were attracting attention from Venture Capital investors. Why? Because this can be one indicator of how the industry will evolve in the short- to medium-term.

While the article attracted a lot of attention and discussion, one question kept popping up from readers: “Yes, but who exactly are these companies?”.

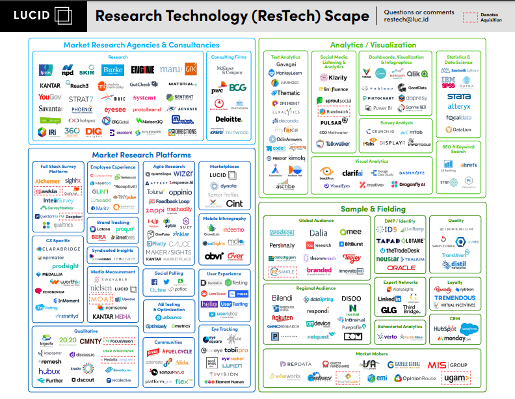

Before I supply the answers to this very reasonable question, it is worth stepping back for a moment and reflecting that our industry – often upbraided for being slow to change – has been evolving very fast indeed over the past few years. Over half of the companies viably competing in the market today were not around ten, or even five, years ago. Nowhere is this more true than in the technology-driven sector of the industry – what Patrick Comer of Lucid has dubbed ‘ResTech’. He recently published a map of the ResTech sector which makes for riveting reading, even though he himself admits that it is an ever-changing landscape and will not remain static for even a couple of months[1].

Courtesy: Lucid

A number of themes pop out of this map:

- A mere thirty (or so) of the companies listed have been around for ten years or more

- While there are a (very) few that are corporately owned or publicly listed, the vast majority are backed by venture capital or private equity – indeed, this is an industry that is now majority-owned by investment funds

- The industry is now hugely more complex than it was a mere ten years ago – the very fact that no fewer than thirty-three segments are identified is staggering.

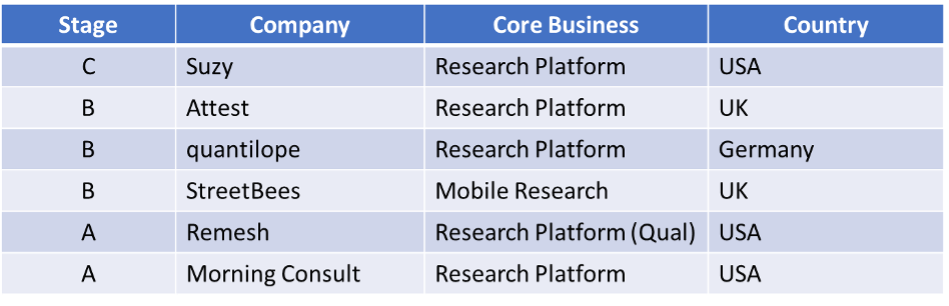

So, who should we be looking out for in the next few years that received early-stage funds in 2020? Some of them are listed above, but others are new, adding to the fierce competition already existing in this space.

Market Research

I pointed out in my last article that, for the first time in the history of the Cambiar Capital Funding Index, market research platforms outpaced their analytics counterparts in terms of the amount of money raised. Investors are betting on the democratization of access afforded by such platforms being as prevalent in the MR future as they are in analytics and CX.

Some of these – Suzy, Attest and Remesh – can be found in the ResTech map, signifying that they have already caught the attention of the market and are well on their way to success. We would suggest keeping an eye on both Quantilope and Morning Consult as well.

As a side note, it is good to see StreetBees powering ahead, given how slow the industry was initially to embrace mobile research and mobile survey optimization.

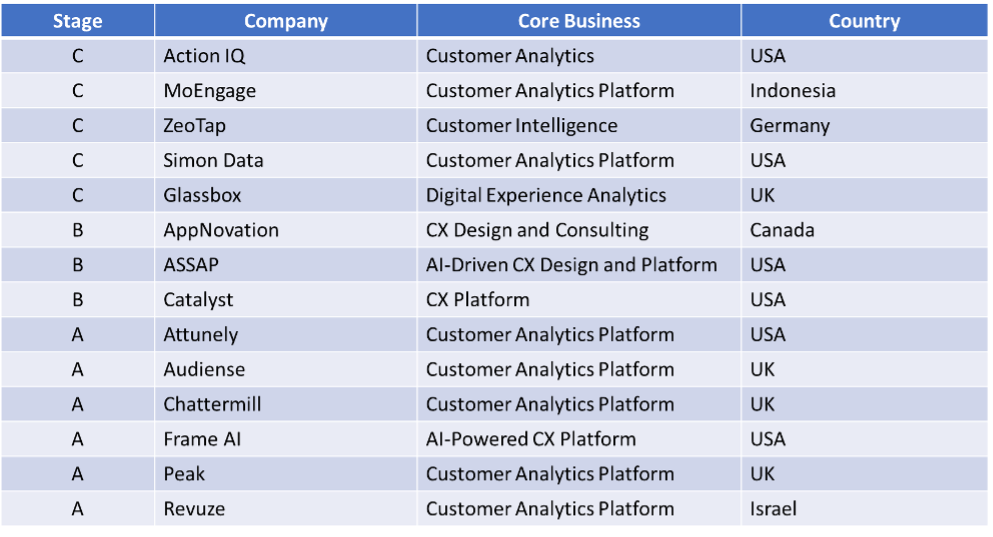

Customer Analytics and CX Platforms

This is an area that has surged in the last three years. 2020 was no different with fourteen companies in this segment receiving early- to mid-stage investment.

Source: Cambiar Capital Funding Index 2020

Clearly, this is an area on which venture capital is betting in a big way. Again, the fact that all but three companies are platforms suggests that VC firms are convinced that this way lies the future of research and analytics. What’s more, none of these companies appear on the ResTech map. Partly, this may be due to space constraints in putting together a map of this nature, but I suspect that much of the reason is that this is now a segment that has become hyper-competitive.

In the CX world – a world that used to belong to the market research industry until technology wrested it away into a separate space – many of the companies listed as having received B- and C-rounds of investment are probably already becoming household words. But pay attention also to those receiving earlier (A) rounds. Not all will survive but it is a good bet that some will rise to prominence.

What is also interesting in this sector is the spread of geographies represented, from North America to Europe, Israel and Indonesia. ResTech technology is no longer solely an American phenomenon as it had been up to about five years ago.

So, what else should we look out for?

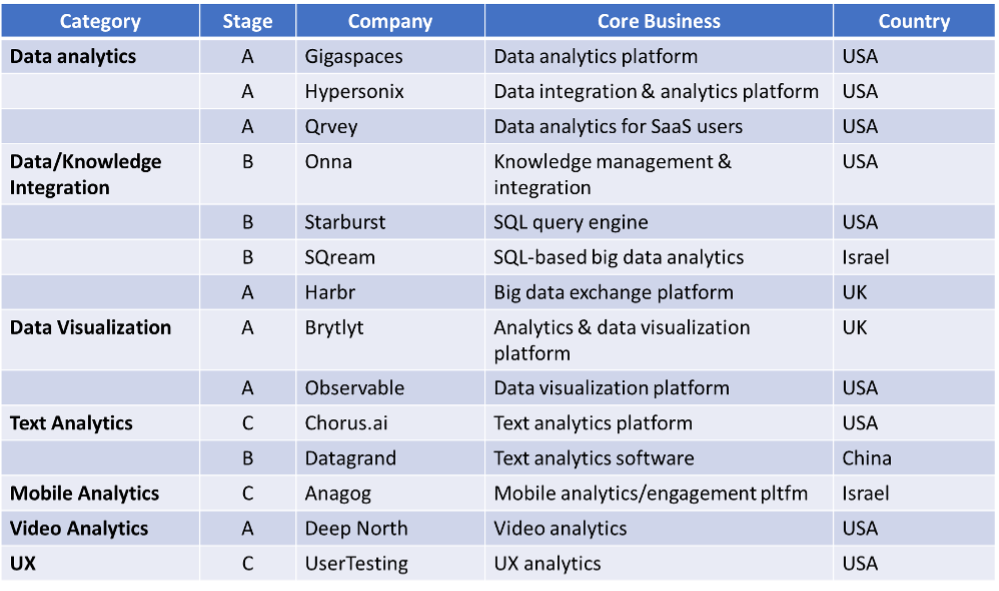

Just because the two segments above were predominant in investors’ cross-hairs does not mean that there are not other interesting developments in the ResTech environment. On the contrary, it would appear that competition may be heating up in a number of other market segments.

Source: Cambiar Capital Funding Index 2020

Data analytics platforms have been a burgeoning segment for some time now, but that does not mean that there aren’t new competitors willing to join the fray. The three above – Gigaspaces, Hypersonix and Qrvey – are all early stage but gaining market recognition.

Data Integration Platforms are of intense interest in many Fortune 500 corporations at present with many, such as InfoTools and Market Logic being prominent in this space. But it is clear that there is a new generation of potential competitors intent on making themselves felt.

Data Visualization is also an area that has gained prominence in recent years, with companies such as Dapresy and Tableau gaining share as insights functions figure out how to democratize their insights in the most effective and impactful manner possible. Now it would seem that there is potential competition such as Brytlyt and Observable joining the fray.

So what does this all mean?

The research technology sector is vibrant, growing and changing the way in which we collect, process, visualize and socialize consumer/people insights. The market is, in some segments, becoming more crowded as new entrants emerge and as investors make bets on this part of our future.

But this isn’t the whole story. While much of the insights industry gravitates to technology, there is an equal movement towards evidence-based consulting, design and activation. This comes in the form of consultative agencies that are increasingly merging research, design, UX and activation into a cohesive package. They may not be receiving the big Venture Capital infusions that we are seeing here, but they are nonetheless a vital part of our future.

I will be shedding light on this part of our profession – and some of the newer entrants into the field – in the next in this series.

[1] For further information on the ResTech landscape, see https://luc.id/blog/restech-and-beyond-the-continued-expansion-of-our-industry-landscape/