KEY TAKE AWAYS

- Briggs Nov20 Forecast predicts an end of pandemic in Q3 2021, with a drop in annualized deaths from 875,000 in US and Europe to annualized 1,500 or less.

- Businesses should plan their 2021 budgets with a rough Q1, as infections continue to spread in parallel to vaccine distribution scaling up, but not yet broadly distributed. Q2 will see a slowing rate of infections and deaths as the combination of natural recovery and vaccinations approach ‘herd immunity.’ The back half of 2021 should see a rebound in social business interactions such as travel, tourism and in-store retail.

- The pandemic taught people to buy and interact differently. E-commerce, curbside pick-up and other new habits will become expected conveniences. Businesses should scenario plan for the end of the pandemic in 2021, and consider which changes to consumer behavior may be permanent changes to consumer expectations.

I have been applying the marketing research framework to COVID19 since late January, when I evaluated the model coming out of China that reported COVID19 would peak at 10,000 cases world wide. My calculations suggested the model coming out of China was wrong, and COVID19 would run into the millions of cases. In mid March, I presented my first forecast, which predicted infection rates would be about 15 percent in the US by the end of the year. Now, with strong Phase 3 data from three different pharmaceutical companies, I am updating my forecasts with an expected waning in infection spread in Q2 and an end to the pandemic in Q3.

Mid March & September Forecast:

Compared to my mid March forecasts, vaccines are coming about four months ahead of my original forecast. Therefore, with the successful Phase 3 trial of three vaccines ready for regulatory approval, I am now forecasting the tail end of the pandemic in the US and Europe in Q3 2021 rather than Q1 2022.

2021 FORECAST:

Initially, in March, I forecast we’d see vaccines at record speed, with an achievement of broad immunization in early 2022. This forecast (Briggs3-Nov20) moves up this timeline. Considering the effectiveness rates in the 90% range for both Pfizer and Moderna, and my new calculations that combine the natural immunity with vaccine immunity, I am moving up my forecast of when the US and Europe enter the tail end of the pandemic to mid 2021.

This forecast is somewhat optimistic in that it depends on a rapid scaling up of distribution, which drug companies and government officials have claimed will occur. Anthony Fauci, reported to the USA Editorial Board, “After prioritizing people at risk of infection or severe disease, the healthy general population can expect first doses of a vaccine starting in April and through July if all continues on track.” European countries are mostly on a similar trajectory.

This is somewhat optimistic because similar claims of rapid scaling up of testing were also made, but in many countries, they did not materialize.

The model expects an end to the pandemic in Q3 in part due to seasonality effects (July through August is relatively less advantageous for the virus in terms of temperature, humidity and people congregating indoors) and due to the rate of vaccinations and rate of natural recoveries. The key is to achieve broad distribution of the vaccine before fall 2021 and a third wave of COVID19 deaths.

It Will Get Better – But Not For A Few Months:

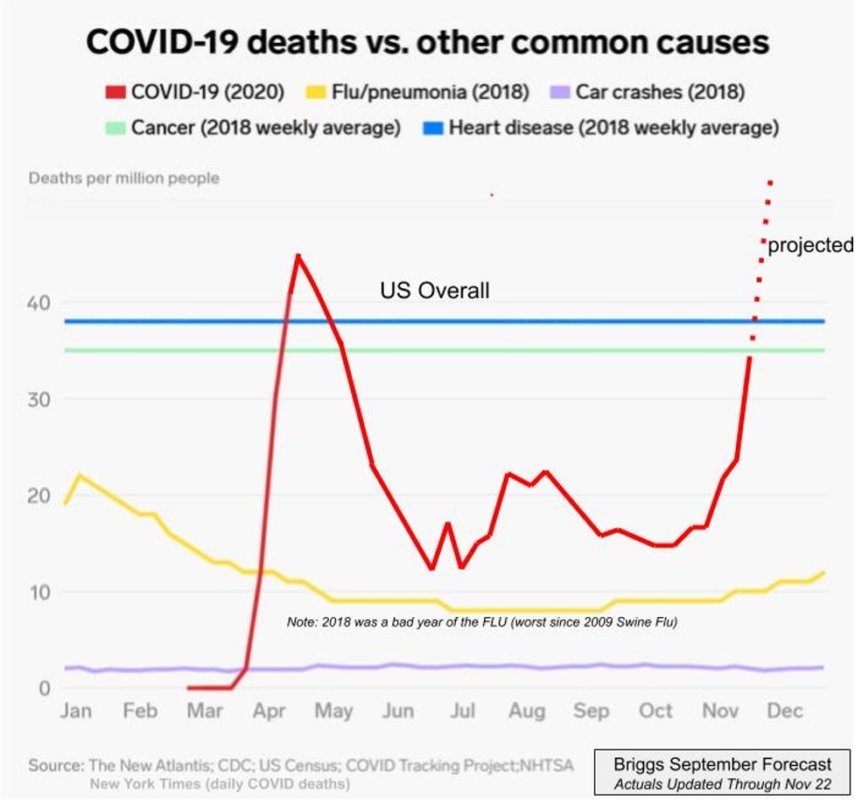

It will get worse before it gets better. My original forecast expected a second wave of deaths starting in Q4 2020, where COVID19 would once again become the leading cause of death in the US, and among the top three causes of death in Europe. In the US, I’m projecting December to be the most deadly month of COVID in US history, surpassing the previous peak in April.

Since there is a roughly three week lag between infections and deaths, consider the influence of increased holiday travel, college students returning home, and hostility among some to masks and other public health measures. It is hard to conceive of a scenario where the virus doesn’t continue to spread and kill at an alarming rate through at least the end of January.

Vaccine To The Rescue:

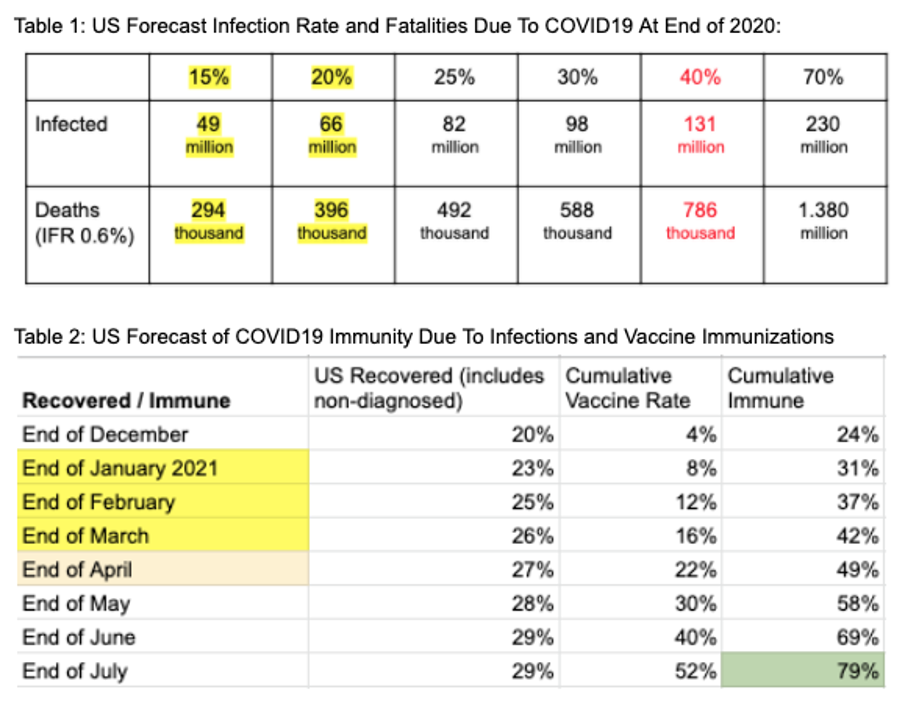

My model estimates that by the end of this year, 15 to 20 percent of Americans have already recovered and developed natural immunity (Table 1). In Europe, serology studies suggest recovery rates vary dramatically by country, from the 30 percent range in Sweden, and under 5 percent in part of Germany. Vaccines will add to the natural immunity to bring the population to heard immunity levels necessary to end the pandemic. Add the natural infection recoveries to an initial wave of vaccinations and the model shows we should see a waning of the spread of the virus in Q2 2021.

My forecast projects we will scale vaccination distribution to 8% of the US population by the end of January (Table 2). This requires about 53 million doses and is also on the optimistic end of the range of possible outcomes. Including Europe’s nearly 750 million people in this calculation, and additional 120 million doses will be needed to achieve 8% vaccination penetration by the end of January. Keep an eye on dose production figures as a leading indicator.

Unfortunately, at the same time vaccinations are scaling up, SarsCoV2 will continue to spread at an accelerated rate due to holiday indoor interactions and more ideal conditions for the virus in terms of temperature and humidity. By the end of February, my model predicts we will hit 25% of the US population infected. In Europe, where most countries have been more effective in flattening the curve over summer, the total infection rate will also increase, but to a lower overall infection rate of around half the US total Infection rate. By comparison, European countries, on average, have about half the number of active cases per 100,000 population compared to the US.

What Table 2 shows is how the vaccine accelerates herd immunity. Whereas herd immunity might have taken several years to achieve (with many more deaths), the vaccine could help us achieve it in about six months in the US. In Europe, where the overall rate in infections is lower, it will take a few more months to achieve herd immunity levels as the vaccine (rather than the virus itself) is doing the vast majority of the immunization. While it will take Europe a couple months longer to achieve herd immunity thanks to the vaccine, European countries will have saved more lives as calculated by the number of deaths per 100,000 population compared to the US.

A key to this successful outcome is an initial focus on vaccinations among the 65+ population, which accounts for more than 80% of COVID19 deaths. In the US, those 65 and older represents 17% of the total population. This older population skews more right-wing. If the vaccine becomes politicized the way masks were politicized in the US, the benefits of the vaccine may not be fully realized, and my forecast may be too optimistic. Certain European countries also have the risk of right-wing push back to a vaccine, but most European countries have the offsetting benefit of a population that has a higher level of confidence in public health information from their health system and government.

In the vacuum of US government leadership at the moment, the Ad Council is planning a $50 million campaign to aid in communications to encourage vaccination.

Notes: (1) In September, I raised my forecast for the US incidence of infections to a range of 15% to 20% (see highlight in table 1). This increased the projected death toll to a range of 294k to 396k.

(2) I am using TOTAL INFECTIONS and INFECTION FATALITY RATE (IFR), not total diagnosed cases, which under counts asymptomatic and mild cases. An explanation of the differences, as well as what I got wrong and right in the original March 2020 forecasts is at www.speakerrex.com

The Vaccine Math of Effectiveness:

Let me break down the math of why the vaccine is such a big deal. Here’s the headline: An effective vaccine could take us from an annualized death toll in the US and Europe of 875,000 to under 1,500.

That is mind blowingly good.

Here’s the math: First, start with the total number of COVID deaths over the last eight months. Annualize it and you’ll find the US death toll from COVID19 is running at about 375,000. For Europe it is about 500,000. Now let’s look at how I expect the vaccine to change this dynamic. If we combine the Pfizer and Moderna tests, there were roughly 47,423 total people vaccinated. Pfizer reports 94 participants contracted COVID with more than 90% effectiveness. Recently they updated this to 95% effectiveness. If we take the lower end 90% figure, it implies about 9 were in the vaccinated group contracted COVID19. Similarly, Moderna reports 94.5% effectiveness with 95 total infections, which means 5 or 6 were in the vaccinated group. To be conservative, I’ll use 15 as the vaccinated and infected out of 47,423 making the infection rate of 0.03%.

If the entire US was vaccinated (330 million people), about 105,000 would contract COVID19 given the current levels of community spread. Using the Infection Fatality Rate (IFR) of 0.6% that I analyzed earlier in the pandemic less than 650 people would die. That’s a total annual death toll that is lower than the current daily death toll. On an annualized basis, that is less than 2 people a day.

In Europe, the math is much better because there is less community spread than in the US. Therefore, the odds of getting COVID19 in the first place are lower. If all the test subjects were in Europe, there likely would have been less than 15 people vaccinated and infected. Accounting for Europe’s larger population (748 million) and lower current infection rate, deaths from COVID19 should fall below 500 among those vaccinated. If the vaccine reduces the severity of COVID19, that too would result in even fewer deaths.

A caveat is that Pfizer and Moderna used a slightly different standard than Oxford/AstraZeneca. Pfizer and Moderna counted those that showed up in the medical system because they were concerned enough to get a COVID19 PCR test whereas Oxford/AstraZeneca tested everyone with PCR. This means there may be some mild or asymptomatic cases after a vaccine that could spread the virus to others, but one would expect it to be proportionately less, similar to the diagnosed cases. It would be helpful for Pfizer and Moderna to conduct serology tests among everyone in their study to report the difference in total infection rate between vaccinated and placebo groups. Another caveat is we don’t know how long natural immunity or vaccine induced immunity lasts. Most believe a year or more, but only time will tell.

Business and Personal Planning:

I don’t think most businesses have absorbed the implications of the incredible effectiveness rate of the Phase 3 trials, and may be budgeting for 2021 too conservatively. Businesses and individuals should plan on a very rough end to 2020 and a difficult start to 2021 as the virus continues to spread. However, the vaccine is a complete game changer. As consumers get their vaccine shots, their behavior will change. Many will start booking travel for summer and fall 2021 in anticipation of getting a vaccine shot, the strength of the Phase 3 clinical results (and articles like this one translating the effectiveness data into more meaningful numbers). Simply put, COVID19 will drop off the list of leading causes of death.

Let’s assume the scenario that the 15 people that were vaccinated and contracted COVID19 are just as severe as if you contracted COVID without a vaccine. Still, this would be a very good outcome. It would mean getting the vaccine carries less than one in half a million chance of death given the high levels of community spread in the US. Even lower risk in Europe. In the US, we get into cars with an annual 1 in 47,852 chance of death.

As fast as the virus shot-up to infect the world, the drop will seem even faster. The pandemic taught people to buy and interact differently. E-commerce, curbside pick-up and other new habits will become expected conveniences. At the same time, there is significant pent up demand for social activities, travel and tourism. If you haven’t scenario planned for a mid 2021 end to the pandemic, now is the time to revisit your budgeting. For a fuller discussion of the pandemic trigger economic cycle see my February Research World Article.

Forecast models aren’t perfect. What models can provide is insight on how different factors influence outcomes and a reference point to compare actuals to the modeled expectations. Forecast models are great for scenario planning and then monitoring forecast vs. actual to decide which scenario to activate. Forecast models like this one can help businesses and individuals plan and take action during these unprecedented times.

To read more about the underlying data and model, I’ve posted a longer whitepaper at www.speakerrex.com