Happiness reset

Last week, we launched our 2021 Culture + Trends Report: Happiness Reset, based on a three-part proprietary study conducted at the end of 2020. The report captures 14 consumer trends that define the post-2020 consumer (some of which I will discuss in more detail in this article), as well as examples of brands that are already tapping into the opportunities that these trends present.

But first, our methodology.

Entitled Happiness Reset, the report analyses how the events of 2020 have shaped how consumers seek and attain happiness, and how this is driving new behaviour and expectations towards brands. Last year has unequivocally resulted in a re-evaluation of our lives and the world we live in. At the centre of this ‘reset’ stands the pandemic, of course, which has acted as a catalyst for behavioural change, accelerating slow-moving macro trends as well as creating entirely new ones.

Following the macro environmental analysis, we used our Human Drivers model, which encompasses seven universal drivers of happiness, in conjunction with our global Illume Network of leading-edge consumers. This qualitative exploration phase captures how consumer behaviour is manifesting around the globe, and led to the identification of 14 ‘trends’, i.e. new and visible consumer behaviours.

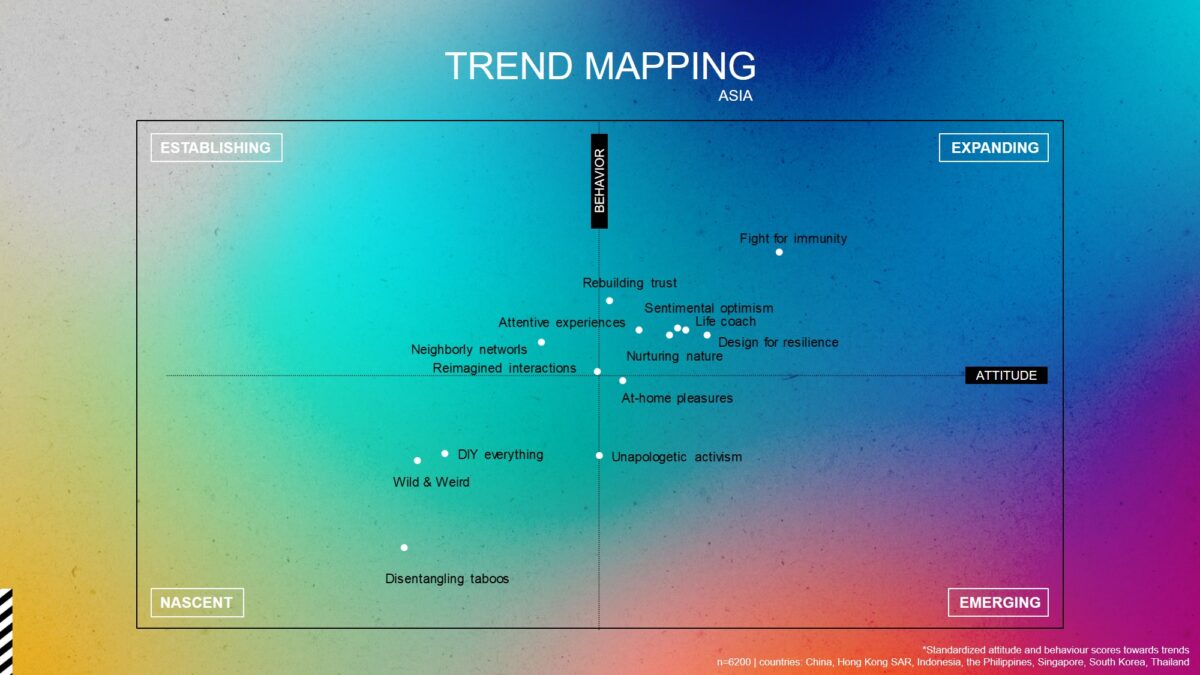

A final stage of quantification (in partnership with Dynata) validated the 14 trends with 15,000+ consumers in 16 markets (Australia, Belgium, Brazil, China, France, Germany, Hong Kong SAR, Indonesia, the Netherlands, the Philippines, Singapore, South Africa, South Korea, Thailand, the UK and the US), providing insight into how each trend ‘scores’ according to consumer attitudes and behaviour in each market.

Defining the post-2020 consumer in Asia

By adding this final quant layer to the approach, measuring consumers’ attitudes towards the trends as well as how they are acting upon the trend when buying brands, we’re able to report trend scores and a global trend mapping.

So, how do we define the post-2020 consumer in Asia?

Generally speaking, 13 of the 14 trends scored more highly with consumers in Asia than in the 9 other markets of the study. Take ‘Reimagined Interactions’, for example, a trend which emerged from the restrictions to physical contact, the rapid rise in home working and the adoption of online appointments, resulting in a change in the way people interact. Consumers who identify with this trend state that they “need new ways to interact with people in their social and professional life”. With a trend score of 76% in Asia (compared to 58% in the rest of the world), this need is already being answered by Thai banking brand SCB, that sponsored healthcare sub-brand Doctor A to Z, an app that offers virtual consultations with medical professionals. Also in the healthcare sector, we witnessed the number of new users on Chinese health services platform Ping An Good Doctor rise by almost 900% from December 2019 to January 2020. In both Thailand and China, we see 80% of consumers identifying with this trend. Scott Lee, Managing Partner based in our Hong Kong office, reflected: “Asian cultures are more collective, with greater focus on shared responsibilities and harmony both within families and across the wider society. What this means is that relationships are critical and are literally a form of currency for Asian consumers. Despite the pandemic, consumers are prepared to take practical steps to maintain those relationships.”

Whilst ‘Reimagined Interactions’ has the largest score difference between Asia and the rest of the world, it is not the highest-scoring trend in Asia out of the 14. The top spot is taken by ‘Fight for Immunity’, a trend that quite obviously is a result of the pandemic; our new familiarity with a range of biological terminology is driving deeper engagement and fascination with personal biology. Consumers who identify with this trend state that they simply “need to boost their immunity”. With a trend score of 91% in Asia (compared to 84% in the rest of the world), this need is already being answered by Japanese fermented-food brand Hakko Shokudo Kamoshika, whose fermentation-kit subscription service enables users to make soy sauce, miso, pickles, Yuzukosho and Amazake at home. Similarly, Singaporean start-up brand POP Store offers a monthly subscription service, where consumers can select 2 to 8 different supplements (vitamins, minerals, fish oil, probiotics, etc.) to be delivered in daily quantities to their homes. Kurt Thompson, Managing Director of our Indonesian office, commented on this trend locally: “Indonesians have thronged ‘jamu’ traditional herbal-drink parlours, believing its ingredients of turmeric and ginger will offer protection against COVID-19. President Joko Widodo even vlogged on his Instagram account about how to make his signature jamu!”

The one trend that scores lower in Asia than in the rest of the world is ‘Disentangling Taboos’, the increasing desire of consumers to understand topics deemed taboo, such as poverty, disability and menopause. Consumers who identify with this trend state that they “feel responsible for challenging taboos, even if they are uncomfortable to talk about”. With a trend score of 57% in Asia (compared to 61% in the rest of the world), there are some markets where brands are willing to break the mould. Chinese lingerie brand NEIWAI, for example, is challenging narrow cultural expectations of Chinese bodies by celebrating the diversity of women of all shapes and sizes. Meanwhile in Singapore, podcaster Nicole Lim tackles topics that may make some squirm, but she has gained a following in socially conservative Asian societies including Indonesia and Malaysia. If we look at the ‘Disentangling Taboos’ data for China and Singapore, we see 51% and 65% of consumers respectively identifying with this trend. Maz Amirahmadi, regional MD based in our Singapore office, added: “Whilst brands in the West can make increasingly bold steps to tackle social issues, brands in Asia will likely need to work with and not against cultural and religious beliefs. Investing, for example, in innovation around women’s needs in these markets, whilst addressing cultural taboos, could produce some impactful solutions.”

The role of brands

It is not surprising that a trend such as ‘Reimagined Interactions’ is predominant in Asia, where collectivity is vital to belong, feel safe and feel protected. Protecting interactions is therefore critical. At a time when social interactions are severely disrupted and also considered to be dangerous, the fundamental need for interaction will be a cause of stress for many. New ways of interacting have obviously been ‘put into place’ at home, at work and even on social media, yet brands can do more by thinking about the channels of interaction, as well as the interactions themselves in terms of values, authenticity and proximity. For future relevance, brands should show how they are uniquely positioned to become part of consumers’ new working and social lifestyles, with tools and spaces designed to keep people connected.

It is also unsurprising that a trend like ‘Fight for Immunity’ scores highly amongst Asian consumers, who naturally desire prevention over treatment, as well as being risk-averse. We know that Asian consumers are curious about microbiomes-based personal care products, ingredients that boost the metabolism and ‘natural’ products, which also taps into this trend. Looking ahead, brands should focus on immunity-boosting ingredients and formats that help build resistance and make tailored recommendations based on specific health needs.

Of course, this is just the tip of the iceberg for how we can define the post-2020 consumer in Asia, with more data and insights available in our full report. Stay tuned, as, exclusively for Research World, we’ll deep-dive into the US and Europe in the coming weeks.