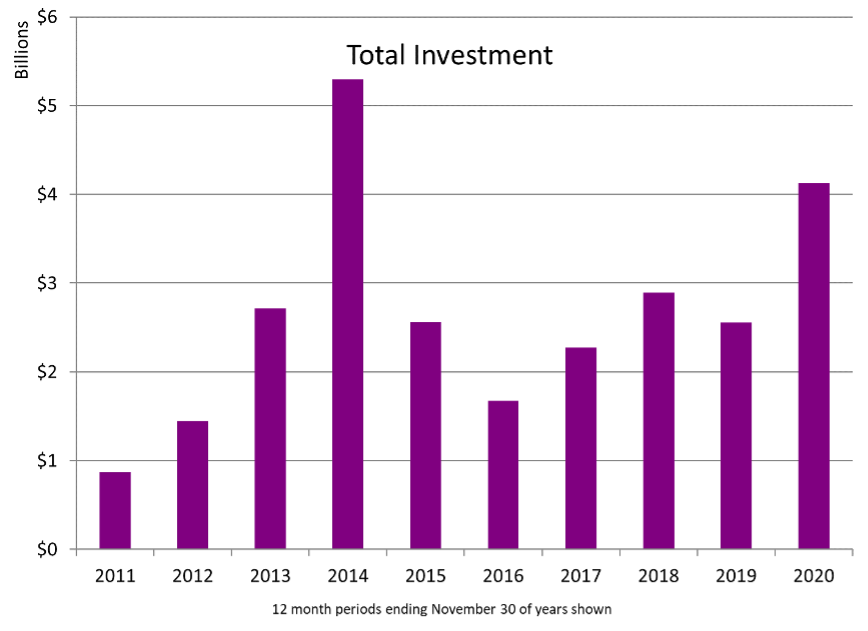

Back in May 2020 ESOMAR predicted a fall in global insights industry revenues of up to 22%. Even if the final result turns out to be slightly better than this, the downturn nonetheless reflected a period of great angst and dread as to the future of our profession. Given this, it would have been quite plausible for us to have expected that investment in the industry would also fall dramatically.

In fact, quite the opposite happened. Venture Capital and Private Equity interest in the insights sector surge during 2020 to levels not seen since the ‘big data’ surge of 2014.

Source: Cambiar Capital Funding Index 2020

Cambiar estimates that just under $5.2 billion of new capital was invested in the market research and consumer analytics industry during the course of 2020[1]. This is a 61% increase over 2019 and the second highest total since the Index began in 2011.

What can we surmise is behind this rush to invest in the sector during a period of severe economic distress and instability? The data suggests that at least four factors were at play:

- A widespread surge in venture investing across a broad range of sectors

- Strong growth in the use of technologies allied to market research and analytics

- Renewed interest in early-stage investment opportunities

- A remarkable increase in investments in European opportunities.

It’s not just the insights industry – it’s everywhere

While the venture capital markets around the world faltered early on during the pandemic, they came back strong in the second half of the year. According to Pitchbook, the final quarter of 2020 was one of the strongest ever recorded and all segments of the market ended up breaking records. In part, this was due to 2020 being the best ever year for raising venture capital, with more large and mega-funds raising more money than ever before. With the resources to invest, fund managers concentrated heavily on technology, services and healthcare ventures seen as fundamental to coping with the ‘new normal’ – and among these were technology and services related to consumer and customer understanding.

Technology as an insights enabler during COVID-19

Corporate consumer insights (CI) functions found themselves in a new world as the pandemic unfolded. Many were pitched into a situation in which they were strategically front and center as senior management tried to understand the impact of changes in consumer behavior and to adjust their strategies accordingly. They needed insight – and they needed it quickly. Even so, budgets remained tight and so, many CI leaders turned to technology solutions to get the insights they needed faster and more cheaply. As a result, many research and analytics platform providers recorded growth in 2020 of 30% or more, creating further interest among investors, many of whom had long been supporters of successful insights ventures in the past decade. The fact that Qualtrics reemerged onto the market with an IPO valuing it at $15 billion did not go unnoticed, either.

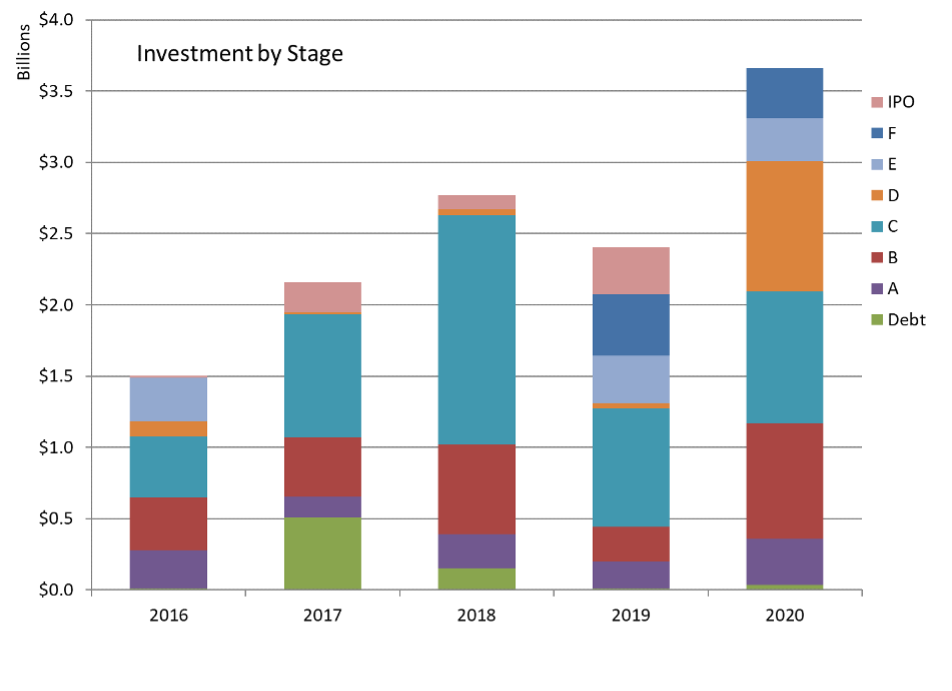

Early stage investing reemerges from hibernation

In the past two or three years, the venture capital market had matured considerably where the insights industry was concerned. As the amount of money invested stabilized, the vast majority of it went to ‘established bets’ – that is, late-stage companies that had already proven their business models and were destined to provide considerable returns on IPO. Interest in early-stage ventures waned as existing funds concentrated on extracting maximum value from the bets they had already made. In 2020, however, all that changed as new funds were raised and new opportunities sought out.

[1] The actual total of investments monitored was $4.1 billion. Since we suspect that we capture only 80% of all transactions (since some are unannounced or do not reveal the amount invested), our estimate is adjusted to reflect this.

Source: Cambiar Capital Funding Index

As can be seen in the above chart, there was still considerable investment in later stage companies (D, E and F) but the amount invested in early stages (A and B) – $1.2 billion – easily surpassed previous totals seen in this study. This reflects not only the availability of new funds but also a renewed interest among investors about what might be next in our sector of the economy.

Funding definitions:

Seed: very early-stage funding, usually at the beginning of a company’s life

Series A through F: sequential rounds of equity funding as the company grows, with “A” being the first in the series; usually these rounds are funded by venture capital or private equity funds which then become shareholders of the company

Debt: funding, often carried out by banks, that injects capital into a company; that capital then becomes a debt obligation for the firm – funders become creditors rather than shareholders

IPO/Stock Issuance: a public stock offering to raise capital.

While this is obviously good news for the future vibrancy of the industry, it does come with a twist – one with a distinctly European flavour.

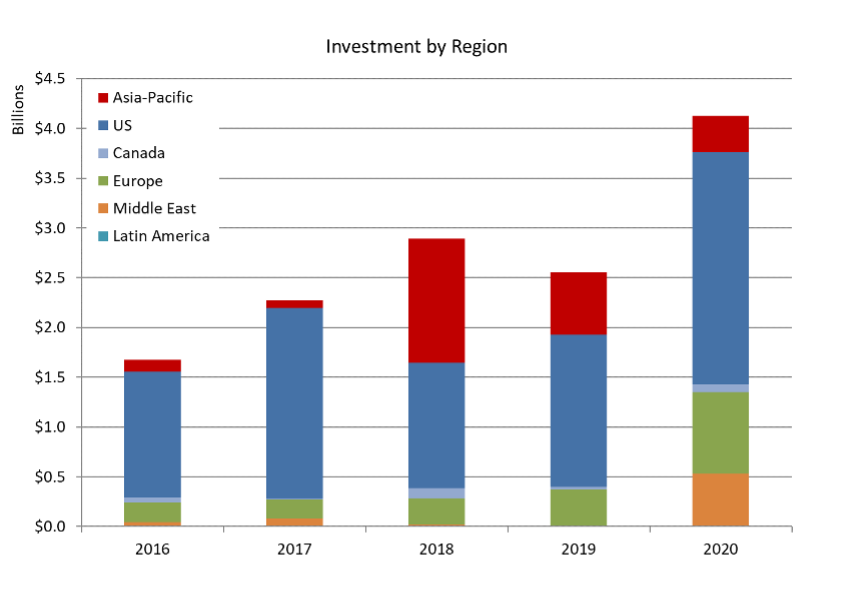

Europe rising

For the first seven years of this Index’ existence, the United States not only led as an investment destination, it dominated. In most years, 90%+ of all monies invested went to firms headquartered in the U.S.A. Rarely, if ever, did that figure drop below 85%. That changed in 2018, when Asia-Pacific started to make itself felt through some spectacularly large investments in the realm of video analytics. In 2020, however, Asia fell back somewhat to be replaced by Europe as the second-most favourable destination for venture capital inflows into the insights industry.

Source: Cambiar Capital Funding Index

Today, America accounts for ‘only’ 57% of inward investment into the industry and, although the amount attracted by U.S firms has increased back to 2015 levels, these are still only half of what was invested in the country in the banner year of 2014.

Europe, on the other hand, has always been the ‘poor relation’ of the three big economic regions where insights venture capital inflows are concerned. That is not to say that Europe has not innovated in this sector – it has. But, as has been noted in this series before, up until now that innovation has come more in the form of Intellectual Property than technological advancement. That seems to be changing rapidly. The amount of funding raised by European insights technology firms in 2020 is more than double what it was in 2019 and four times the average of years prior to that.

As a final footnote (although a very large one), the Mid-East also emerges as a major destination for funding in 2020 – another result not seen before. Over $500 million was invested in companies with headquarters in the region, all of them in Israel.

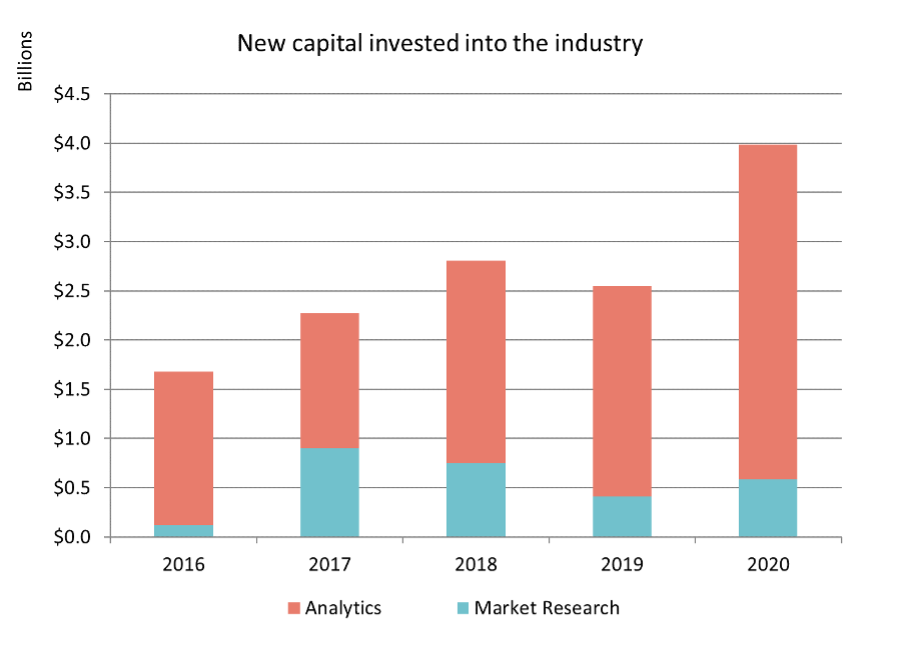

So, what exactly are funds investing in?

In the past, investment in analytics has routinely overshadowed that in market research and 2020 is no different. Investors appear to be interested more in how technology can leverage existing (large) data sets rather than in how data is collected or used.

Source: Cambiar Capital Funding Index

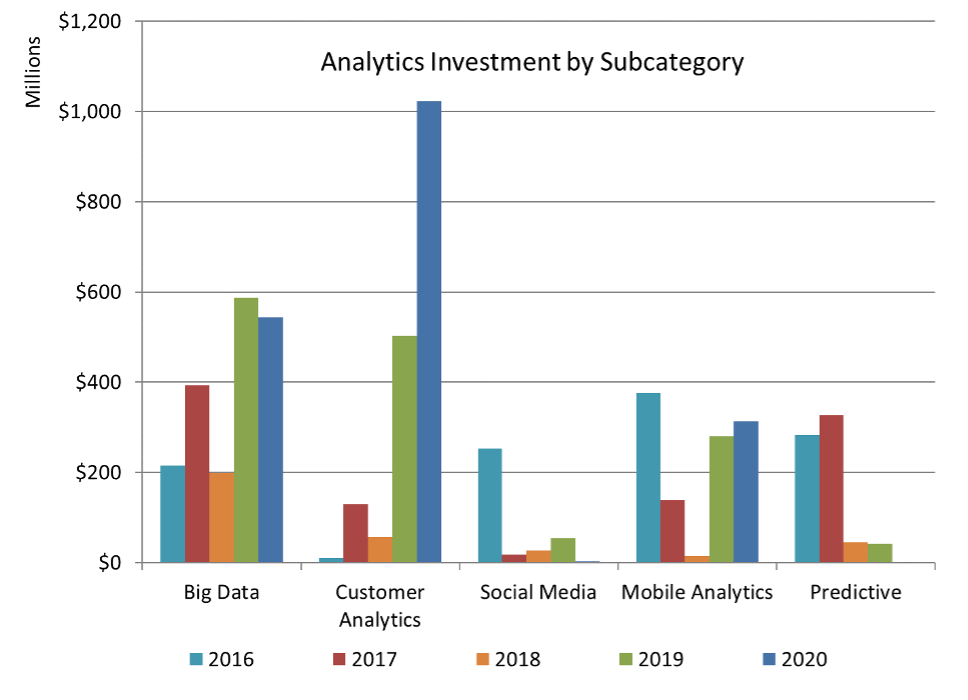

Although some $600 million was indeed invested in market research related enterprises, the driver behind the 2020 investment boom was definitively analytics. And not just any old analytics, but customer analytics. It would appear that both innovators and their investors have taken note of the need for corporations to really understand, analyze and act on changes in consumer and customer behavior – fueled by the pandemic – and are betting on this being a long-term trend.

Source: Cambiar Capital Funding Index

As a related discipline, big data remains a powerful interest as does mobile analytics – not surprising given the centrality of mobile devices in modern day life. Of note is the lack of interest in investing in anything to do with social media or predictive analytics over the past few years.

Where there is investment in market research, it rests almost entirely in data collection platforms – hardly a shock given the success of Qualtrics and SurveyMonkey. Indeed, platforms of all sorts (MR and analytics) account for 20% of all investment in 2020, demonstrating that investors have faith in the future of self-serve data manipulation and democratization. Whether this will create more opportunities for those at the consultative end of the industry spectrum remains to be seen.

What’s next?

This article is aimed at providing an overview of the investment picture in our industry, but much of what this surge in the inflow of funds means for our future lies in the details. Over the coming weeks, we will be diving into these details, trying to determine what they portend for the trends that will determine our professional lives.

[1] The actual total of investments monitored was $4.5 billion. Since we suspect that we capture only 80% of all transactions (since some are unannounced or do not reveal the amount invested), our estimate is adjusted to reflect this.