By The GutCheck Team

Oh, mums; where would we be without them? Though it feels sexist to saddle women with the childcare, clothing, and grocery shopping, the reality is that mums are often in charge of these household-related purchases. (She knows best!) But the busy life of a mother is far more than the sum of her purchases, so brands looking to appeal to this often hard to reach target audience must gain a better understanding of how their products fit into the lifestyle, values, and needs of mums everywhere. Below are some of the most eye-opening consumer insights we’ve gleaned from qualitative research targeting parents and moms in particular.

Moms Are Highly Skeptical of Health-Conscious Food Claims

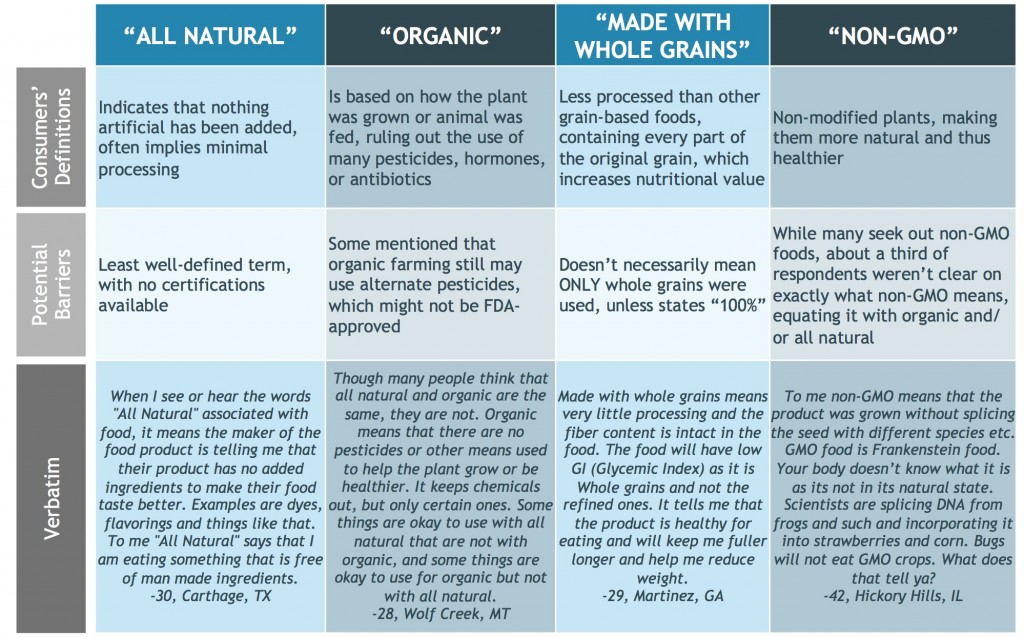

When it comes to eating better, mums are looking out for themselves and their loved ones. In our research targeting women with children in the household, we found that mums define healthy food products most often by what is left out: artificial ingredients, sodium, fat, etc. They’re attracted to packaged food with minimal processing, but reported a lot of confusion surrounding the terminology found on health-conscious food packaging, citing vague terms like “GMO” and “all natural.” Though attracted to the implications of this language, moms place the majority of their trust in nutrition labels, verifying any supposed benefits therein. Though qualities like bright colors and natural imagery help indicate a healthier product, moms agreed that certification or evidence that reinforces claims would help assuage their mistrust of CPG positioning. We compiled moms’ tenuous definitions of health buzzwords, in the table below, and for further implications for food product packaging, read the full report.

And They Prefer Creative Games That Can Grow with Their Kids

Keeping children entertained is tough, and parents are hard-pressed to find a game that’s stimulating, non-violent, and involves brainpower. But that’s what makes Minecraft stand out to parents of children 7-12 years old, who value its customizable experience and intellectual stimulation.

“Both my daughters always pick Minecraft first. They rush to their Kindles as soon as they are allowed.” —Heather, Children younger than 4, 7-9, 10-12

Parents appreciate the game’s focus on collaboration and creativity, and praise it for its lack of explicit violence and promotion of problem-solving skills—qualities lacking in other video games. Minecraft can be played on multiple devices and is constantly being redesigned by the players, making for a game that grows with kids and always feels fresh. Parents want Minecraft to pursue even more customizable experiences—including pricing. Parents shared even more about their attitudes and concerns concerning electronic games in our full executive summary.

Mums Want Toys That Will Last — Like the Ones They Hand Down

In our research of what parents’ toy shopping habits for children 6 and younger, we discovered that oftentimes the best toys actually belonged to parents when they were kids.

“My girls have played with all the toys I enjoyed. I kept many of my ponies and Barbies. Each of my girls has also revived a cabbage patch doll.” – Female, 36, IA, children aged 10, 13, 16

Parents enjoy handing down sentimental favorites and are open to buying newer versions of classics. This aligns with parents’ general aversion to fad toys, preferring original, unique finds that will make for lasting memories. Legos were the favorite of parents and kids alike, namely for their unisex appeal, promotion of imagination, educational stimulation, and staying power.

“I make sure [toys] are age appropriate. I look at how sturdy they are. I do not like to buy plastic junk. Also, whether or not they will outgrow them quickly. I like to buy toys that allow them to use their imaginations and be creative.” – Female, 40, FL, children age 4, 6, 8

When shopping for toys, mums are in it for the long haul: they want something that will last for years and hold their child’s attention, emphasizing creativity, cognitive development, and social interaction. Building blocks, play kitchens, and art sets were mentioned, while dolls/action figures with unrealistic bodies were widely criticized. Parents lament the age of electronics, cheap plastic, and franchising, so brands should keep the standards of those buying the toy—not just playing with it—in mind. To learn more about how parents shop for toys, check out the report summary here.

And They’re Reluctant to Blow Cash on a Halloween Costume

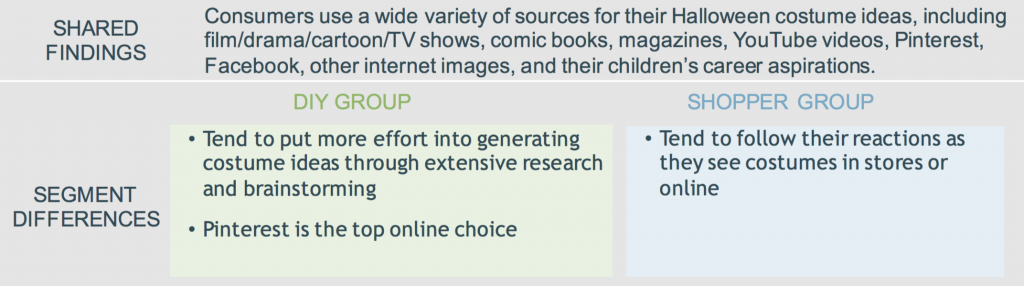

Halloween can be a stressful, expensive nightmare for parents. When we asked them about Halloween costume shopping, most stated that staying in budget is a challenge. Even split between those respondents who DIY and those who shop, all agreed that pre-made costumes from retailers are overpriced.

“Cost is the biggest factor. Typically, if you purchase a pre-made costume, it’s flimsy material (not ideal for Ohio in late October), and pretty costly. I can’t bring myself to spend $30 on an outfit they will freeze in and wear once.” – Female, 32, DIY Group

Each group had pain points specific to their approach. DIYers enjoys creating the costumes, but get frustrated if they can’t find the right supplies, or the end product doesn’t turn out right. Meanwhile, shoppers enjoy hunting for the right costume with their kids, but get annoyed searching for sizes and quality at a reasonable price. But both groups shop online and in-person at big-box stores, Halloween pop-ups, and craft stores, and both draw costume inspiration from a wide variety of pop culture resources.

Overall, parents want to minimize costs as much as possible: DIYers re-purpose items they own, and shoppers diligently compare selections. All respondents desire more money-saving options at retailers, and one suggested a costume exchange. To learn more about parents’ attitudes towards Halloween shopping, check out the full executive summary.

Incorporating the voices of moms into relevant product development may help brands resonate more successfully with this powerful, forward-thinking, cost-conscious consumer force. And if you’re looking to appeal to moms worldwide, check out our handy eGuide to the nuances of cross-cultural market research.

By The GutCheck Team

CPG Food Claims Study:

Instant research group of 33 Respondents

Females age 25 – 45, have kids in household under 18, fully, mostly or shares responsibility for purchasing groceries, purchased groceries in last 6 months, cannot include natural foods

Minecraft Video Game Study:

Instant Research group of 21 respondents

Females 18 -64 in the US, have children in the household age 7 – 12

Toy Shopping Study:

Instant Research group of 31 respondents

Females age 30 – 45, kids in household 3+, childhood included played with toys as a child, nostalgic for childhood toys

Halloween Shopping Study:

Instant research group of 31 respondents

Males and Females 18 – 54, children in the household