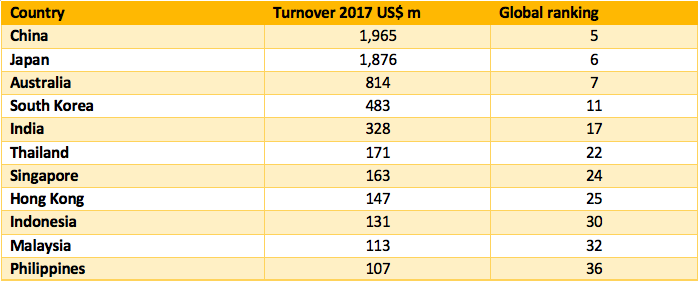

Asia Pacific gathers three of the largest markets for market research in the world – China, Japan and Australia. With growth levels above 1.5% every year, it is the only region to have reported uninterrupted net growth for the last five years along with North America. It also hosts some of the fastest growing markets in the world such as Kazakhstan, Myanmar, Laos, Vietnam, Thailand and China. Its share of global turnover, as reported in ESOMAR’s GMR2018, has been increasing steadily over the years and now accounts for 15% of the total. What lies beyond these significant figures?

Overview

As elsewhere in the world, most countries in Asia Pacific have been experiencing the relentless transformation of the industry and are adjusting to these changes with varying results. According to the respondents of the latest GMR2018, which gathers information on the size, composition and trends of the market research industry worldwide, growth has been, for the most part, aided by economic stability, international openness translated into access to markets and agility when adapting to changes.

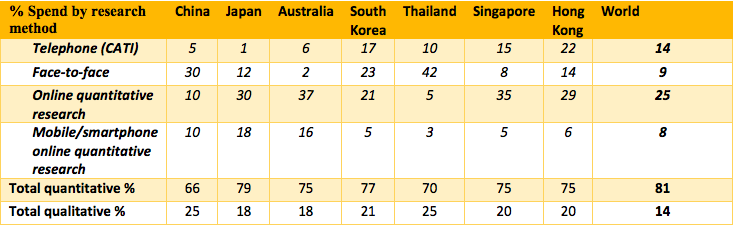

Geographically smaller countries serve as regional hubs of research, as is the case of Hong Kong and Singapore, the latter generating over half of its turnover overseas, and registering substantial shares of international clients as well as projects. The industry in these markets focuses primarily on research methods that are easier to apply remotely, like online quantitative research or telephone interview. And the truth is that, over time, online quantitative research has ascended to become the most widely used research method globally, representing 25% of total research spend.

However, domestic differences in the structure of the markets show the prevalence of more traditional research methods for several countries. Whereas the most developed economies, like Japan, Australia, New Zealand, Singapore or Hong Kong have transitioned to more technology driven and delocalised methods and online quantitative research sits substantially above the global average – countries such as China, Pakistan, Sri Lanka, Thailand, Indonesia and Vietnam still mainly perform research through face-to-face – taking at least 30% of research spend, far above the global 9% average.

A close contest

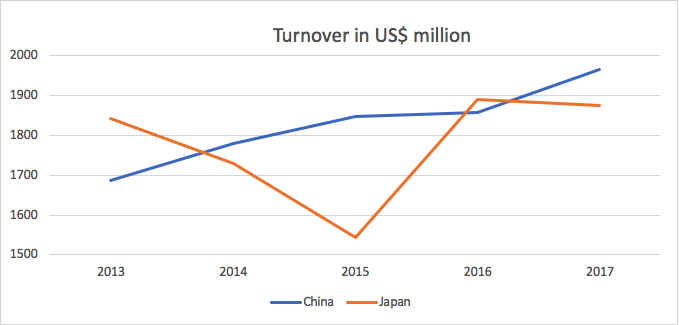

China overtook Japan in 2017, to become thefifth largest market in the world, a position it had held in 2014 and 2015, but lost briefly in 2016 in favour of the latter. The two countries have been reporting similar levels of turnover for the last few years and in 2017 both reported turnover of around US$ 1.9 billion. However, the substantially higher growth rates of China (5.9%) compared to Japan (1.8%) may help the country cement its current position and even challenge France (reporting currently around US$ 2.3 billion but struggling to show positive year-on-year growth rates) as the fourth largest market for market research in the near future.

The race between Japan and China: a 5-year overview of turnover levels

The composition of the Japanese and Chinese industries sheds some light on how each market has and is expected to evolve. Hiroyuki Ichinose of the JMRA (Japan Marketing Research Association) describes the path in Japan towards increased digitalisation, which facilitates certain types of research like smartphone online research. As of today, Japan has one of the highest shares in the world of this type of research, and it is the most prevalent research method within the country. However, he notes that the popularity of smartphone online research “is only a result of internet circumstances in Japan […] based on socioeconomic and technical reasons.” Indeed, the perceived growth saturation of web-based surveys is seen as a weakness of the market. After all, online quantitative research represents almost half of its turnover and is unlikely to sustain further growth – and has pushed the sector to look at big data analytics as a way to pursue continued growth over time.

On the other hand, China, which relies primarily on face-to-face research, has a more emerging level of online quantitative research – a reported 20%. This may imply a much longer way to go for this type of research before exhausting its possibilities. Nonetheless, according to the CMRA (China Marketing Research Association), China is already exploring the opportunities that may arise from the latest research methods such as data analytics, big data or artificial intelligence even though research budgets are shrinking every year – while maintaining high expectation levels. Perhaps knowing the journey other markets have undertaken allows China to transition quicker and adopt the latest trends. One might speculate that this strategy would allow the market to retain high professional standards while being able to compete for smaller budgets by lowering research costs.

So, how will these trends evolve over time? Hiroyuki explains that the vast majority of growth in the Japanese industry during the 2000’s happened through online methods, whereas, he says, “face to face methods have lost their market share and only those methods that cannot be adapted to online platforms remain alive”. This implies that “these methods might not see any further decline, but their market share will shrink slightly every year.” The saturation of traditional survey methods including online quantitative survey have led to their stagnation in terms of expenditure in favour of passive data collection and digital data analytics.

Other markets

As the seventh largest market in the world with a turnover of over US$ 800 million, Australia was able to benefit from its ability to adapt to changing client needs as digital marketing keeps growing. Indeed, the share of online quantitative research, with the largest share of turnover at over 35%, well surpasses the global average. Furthermore, as the AMSRO (Association of Market and Social Research Organisations) explains, notable opportunities have arisen in “advancing more technology solutions, including data analytics, while integrating more advanced methods around areas such as neuroscience.”

The situation in South Korea, the market with the eleventh highest reported turnover, has been more delicate and as the country was fencing off a period of recession, it could not report positive net growth rates. However, as KORA (Korea Research Association) explained, the main strength resided in the “increase of public sector [spend] and an increase of quantitative research such as online research.” In that sense, South Korea dedicates nowadays a similar amount of resources to both face-to-face as it does to online quantitative research, a balance expected to fall in favour of the latter in the upcoming years.

With a healthy growth rate of 3.2% and well placed within the top-20 largest markets, India’s main advantage, according to the MRSI (Market Research Society of India), was its ability to handle global businesses. Indeed, the share of international clients is one of the highest in the region and slightly surpasses the global average – which is heavily influenced by the weight of the USA – along with its share of international projects – comparatively high and about the same as the global average. Should the market manage to reverse the damaging trend of brain-drain, it could expect to continue to report growth as interest in global projects remains strong.

Global ranking of market research turnover 2017

It will be interesting to see how Asia Pacific continues to shape itself as it evolves with the rest of the industry. Whatever the future path of the region, we will be sure to report on it in our yearly Global Market Research Report, one of the many ESOMAR member benefits. For more details on the report please go to ESOMAR Publication page.

To register for ESOMAR’s Asia Pacific conference 2019, taking place in Macau from 22 to 24 May, please go to this page.

Alternatively, if you cannot attend in person, you can register to free online live broadcast of ESOMAR Asia Pacific 2019, broadcasting 23-24 May, via this page.