Competitor tracking for market research

The data world is currently experiencing a time of unprecedented expansion. New information technologies have allowed the annotation, processing and analysis of new types of information that were not traditionally used. This situation is causing the emergence of new companies specialized in specific areas that, without recognizing themselves as researchers, use the data to facilitate decision-making. These companies compete directly for the companies’ research budget, sometimes offering completely different approaches to those traditionally offered by the sector. Do we really know our competition?

The appearance of Big Data

However, since the middle of the last century, we have been seeing information gathering that did not habitually respond to a predefined objective. Two nearly simultaneous phenomena occurred in the last century:

- The appearance of information technology (IT) departments as business areas in charge of analysing a company’s own data. I believe that for a long time we have understood these departments, particularly in research companies, as computer departments. Meanwhile, they have been carrying out a role that is closer and closer to the boundary of research. As far back as 1958, in an article published in Harvard Business Review, reference was made to these new technologies:

“The new technology does not yet have a single established name. We shall call it information technology. It is composed of several related parts. One includes techniques for processing large amounts of information rapidly, and it is epitomized by the high-speed computer. A second part centers around the application of statistical and mathematical methods to decision-making problems; it is represented by techniques like mathematical programming, and by methodologies like operations research. A third part is in the offing, though its applications have not yet emerged very clearly; it consists of the simulation of higher-order thinking through computer programs.”

Harvard Business Review, Harold J. Leavitt and Thomas L. Whisler

- The second big change has to do with the appearance and consolidation of the World Wide Web, and consequently, with the possibilities provided by data gathering. The first time the words Big Data were mentioned was in 1989 in Harpers magazine. In an article, Erik Larson describes the arrival of unwanted e-mails, and the data use carried out in order to do this activity. This article begins with two statements that have become premonitions of certain current uses:

“The keepers of big data say they do it for the consumer’s benefit. But data have a way of being used for purposes other than originally intended.”

Erik Larson, 1989

If statistics arose with a specific objective, Big Data and the role IT departments are playing have not had such a clear goal. Information was created first, and only after the fact were the potential uses for what could be done with it sought. These two major changes have been giving rise to, while the market research sector developed, in parallel, the creation of other data-based departments and businesses, which never considered research as their focus, but used big data for very similar practices[1] as those carried out in market research.

From market research to the data economy

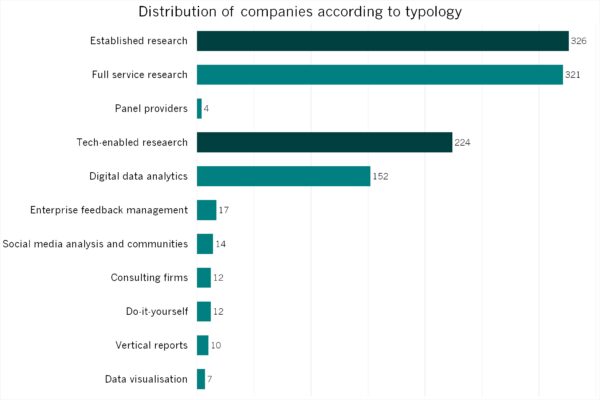

Throughout 2020, in Insights + Analytics, we had the opportunity to carry out research on the Spanish market to understand what the new boundaries for market research are. For this research we carried out numerous in-depth interviews with professionals in the field, analysed already available research, and began creating a new business census. The principal finding of this research is that defining any boundaries is practically impossible: data use has become a norm for companies in nearly all sectors, and most of them do not realize that their work falls within what is considered to be market research. Nonetheless, and following the report published by ESOMAR the same year, we consider that it made sense to prepare an initial classification of these companies by applying the same standards:

- Established research

- Sample panel providers

- Tech-enabled research:

- Vertical reports

- DIY Research Platforms

- Enterprise Feedback Management

- Digital Data Analytics

- Social Listening and Communities

- Consulting firms

- Reporting

Upon classifying the 549 different companies in the census into the new categories, the fact that a large number of them come together in the classification “Digital Analytics” is verified:

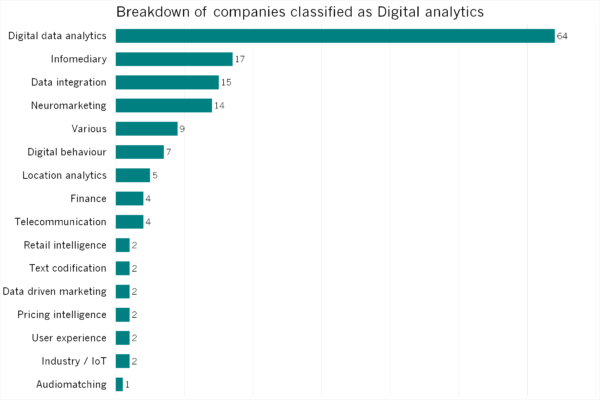

This concentration of businesses in the “Digital Analytics” category led us to create new subcategories that enabled us to understand what companies we were talking about. And so, we propose the following classification for Spain:

- Established research

- Sample panel providers

- Tech-enabled research:

- Vertical reports

- DIY Research Platforms

- Enterprise Feedback Management

- Digital Data Analytics

- Audiomatching

- Text codification

- Digital Analytics

- Digital Behavior

- Finance

- Industry / IoT

- Infomediary

- Data integration

- Location analytics

- Data Driven Marketing

- Neuromarketing

- Pricing intelligence

- Retail intelligence

- Telecommunication

- User Experience

- Various

- Social Listening and Communities

- Consulting firms

- Reporting

This new classification enables us to break down the businesses classified as “Digital Analytics” to obtain the following distribution of companies in each of the following subcategories:

To make it easier to understand these new subcategories, we have included some examples of the companies that would be classified in each of them:

| Segment | Example 1 | Example 2 |

|---|---|---|

| Digital Analytics | DataCentric | Palantir |

| Infomediary | Iberinform | DatoCapital |

| Data integration | ClearPeak | Denodo |

| Neuromarketing | BitBrain | Neurologyca |

| Various | Ciklum | AltoAnalytics |

| Digital Behavior | Google Analytics | SimilarWeb |

| Location analytics | CartoDB | Geoblink |

| Finance | Fintonic | Mastercard Data |

| Telecommunication | Lucca Technologies | Flux Vision |

| Retail intelligence | Claridae | On the Spot |

| Text codification | Bitext | Clarabridge |

| Data Driven Marketing | Zeta Global | Making Science |

| Pricing intelligence | Minderest | Netrivals |

| User Experience | SiteScore | — |

| Industry / IoT | Altran | Tecnalia |

| Audiomatching | Fluzo | — |

This is the first introduction[2] carried out in the Spanish market to define the new sector of companies working in the data economy. The intention of Insights + Analytics is to continue to develop this classification, and the company census, so as to be able to quantify the total volume of business that these companies would have. This is not an end but rather a beginning.

[1] To explore some of big data uses consult the classification of use cases in DataBench Benchmarking Handbook: https://www.databench.eu/wp-content/uploads/2021/01/d4.4-databench-benchmarking-handbook-ver.-2.0.pdf

[2] The full report (in spanish) is available here: https://ia-espana.org/wp-content/uploads/2021/03/La-Economia-de-los-Datos-2020-version-final.pdf