By exploring the nuances of the Hispanic and Latin American experiences today, we can understand their future.

Knowing your target audience’s future needs is invaluable for a business to grow. Yet often, our view into the future is murky, and it is challenging to identify the most significant shifts in attitudes, values, and behaviours to determine strategies to implement. Understanding the dynamics of an influential audience like Hispanics, and an ever-changing region such as Latin America, requires a thorough exploration of their past, present and future. It is critical to have this longitudinal perspective in moments of unexpected crisis with unpredictable impacts, such as COVID-19.

Insights from the Cultural Pulse, a research partnership between Univision and GfK, shine a critical light on how US Hispanics and Latin Americans are navigating a complicated world. Facing an unpredictable social landscape, only 21% of Hispanics feel that they can trust the US government to tell them the truth. They are increasingly open-minded while maintaining treasured cultural traditions, seeking to redefine the American Dream.

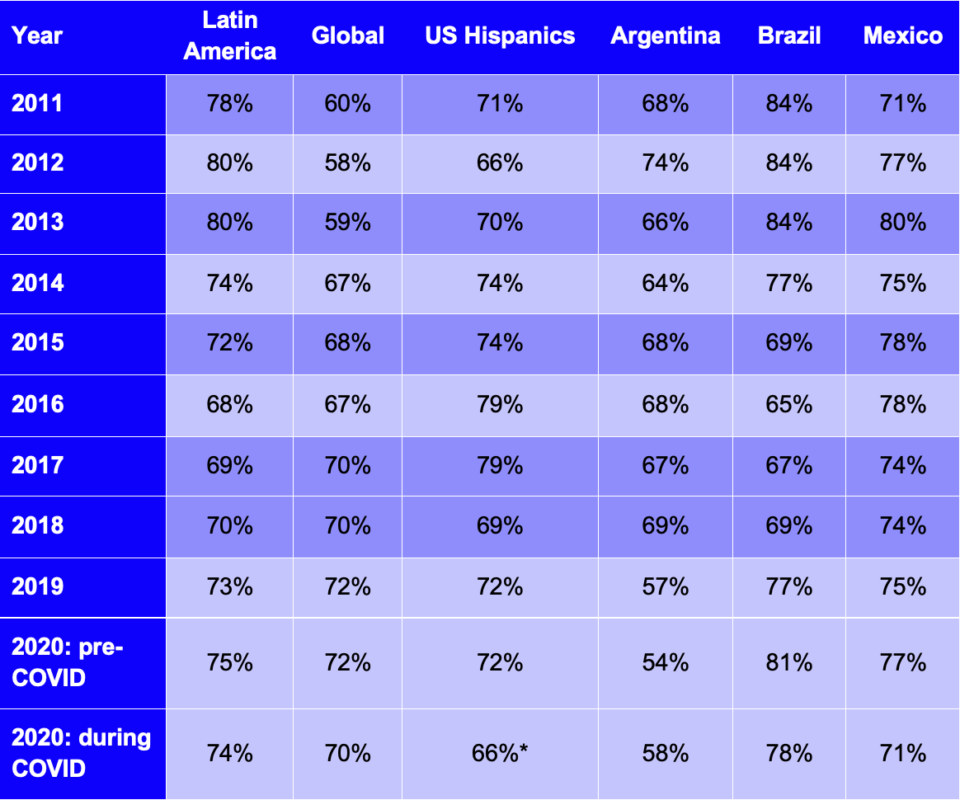

The top three items that Hispanics are optimistic about are: technology’s impact on society, the institution of marriage and family and the quality of life in the US. At the same time, optimism is rebounding with their counterparts in Latin America, despite economic and social instability as well as the uncertainty of the toll that the Coronavirus will have.

Percentage who feel somewhat/very confident that they will be better off in 12 months:

Concerns about safety and security have not deterred Latin Americans from growing more socially tolerant and committing to community improvement.

As a leading authority on Hispanic culture, Univision has to understand how the Hispanic population in the US is evolving, the relationships they have with their heritage, and the dynamics of Latin Americans with whom they share cultural backgrounds. Through extensive research, the company aims to understand the current meaning and evolution of “culture” for Hispanics. For instance: measuring its sentiment, strength and influence; how it is retained and passed on in Hispanic families; quantifying the core values that define their culture; understanding pride in their culture; measuring the impact of culture as it relates to brand relevancy for Hispanics. In addition to these insights, it is also valuable to understand the marketplace forces in Latin America today and how they impact the rest of the world, particularly US Hispanics.

As part of a long-standing partnership with GfK Consumer Life (Roper Reports®), a syndicated trend service fielded in the US since 1973, Univision commissions an annual Cultural Pulse report to maintain a holistic understanding of US Hispanics. The report explores shifts in this demographic’s mindset, aspirations, values, relationships with society and family, as well as in which ways Hispanics stand out in the US. These insights help examine existing hypotheses, guide marketing and programming strategies, support advertiser engagement, and help the company to maintain its thought leadership position on everything Hispanic. Univision also supplemented the Cultural Pulse with custom research on affinity ethnographies with Millennial and Gen X Hispanics and a quantitative study of Hispanics and non-Hispanic whites. Additionally, insights collected by GfK Consumer Life in Latin America annually since 1997 provide trends relevant to the global marketplace and US Hispanic mindset.

Driving our research is the evidence that Hispanics are increasingly an influential part of the US population. This demographic reached a record 61 million residents in the US in 2018, representing 18% of the total US population, which is nearly one of out every five US citizens. Over the next ten years, Hispanics will fuel 54% of the entire US population growth. They are the largest minority group in the 2020 US electorate, and the youngest ethnic group in the US, with a median age of 30. Hispanics also have significant purchasing power, with 18 more years of effective buying power than non-Hispanic whites; they will also account for 78% of labour force growth from 2016-2026. And while the initial economic fallout from the Coronavirus has significantly impacted Americans’ livelihoods, Hispanics remain optimistic about the future. As of June 2020, 48% expect US economic conditions to be better a year from now, a 13-point increase from January.

In Latin America today, the situation looks different. Population growth is on a downward trend, and while economic prospects varied widely depending on the country pre-COVID, economic conditions have worsened dramatically during the pandemic’s rapid spread. As of June 2020, regional economic activity is expected to contract by 7.2%, which would be a far deeper recession than previous financial crises in the region.

Our research uncovered three key insights, each of which carry specific and actionable recommendations for brands:

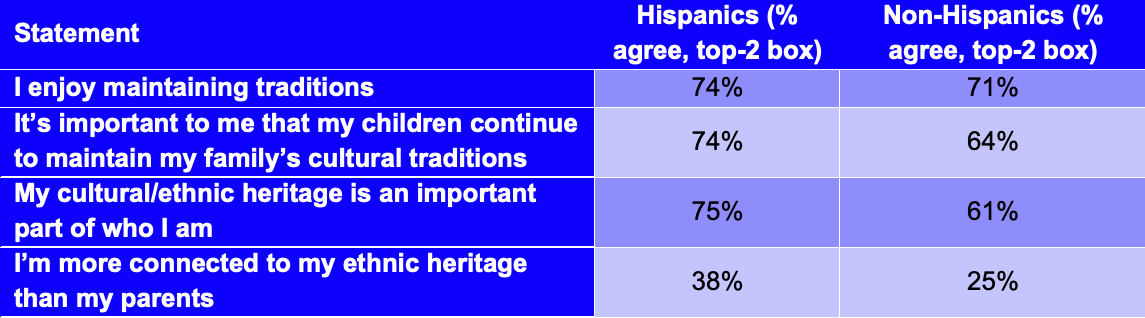

- US Hispanics balance tradition with open-mindedness. Hispanics are proud of their heritage and eager to maintain traditions, yet still show acceptance of other cultures, a desire for equal opportunity and an open mind to evolving gender roles. Brands can maintain relevance by providing opportunities for Hispanics in the US to maintain connections to those who share their heritage in Latin America, such as marketing and branding messages, or online communities that celebrate the traditions of specific countries of origin.

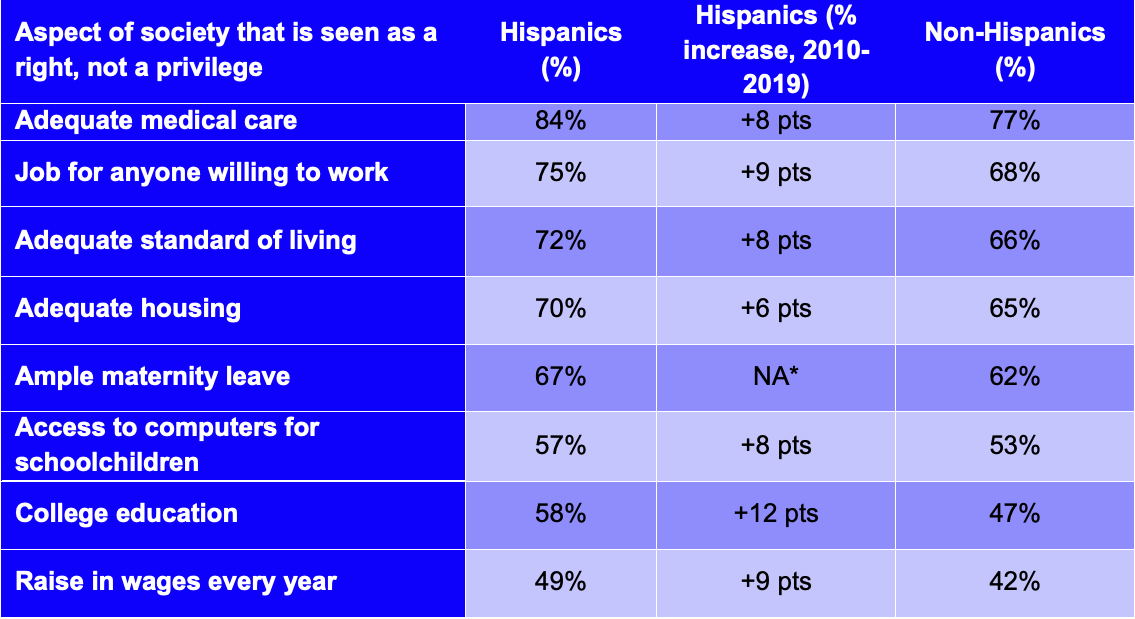

- The “American Dream” is evolving: faith in the US is wavering for Hispanics. With an all-time low level of trust in the government and other institutions, Hispanics feel that the US is on the wrong track, losing its sense of community and not paying enough attention to critical social or economic issues. Brands must empower Hispanics to fight for equal opportunities and social change by keeping them informed on actions they can take to make the world a better place and exemplifying the socially conscious values that matter most to this audience.

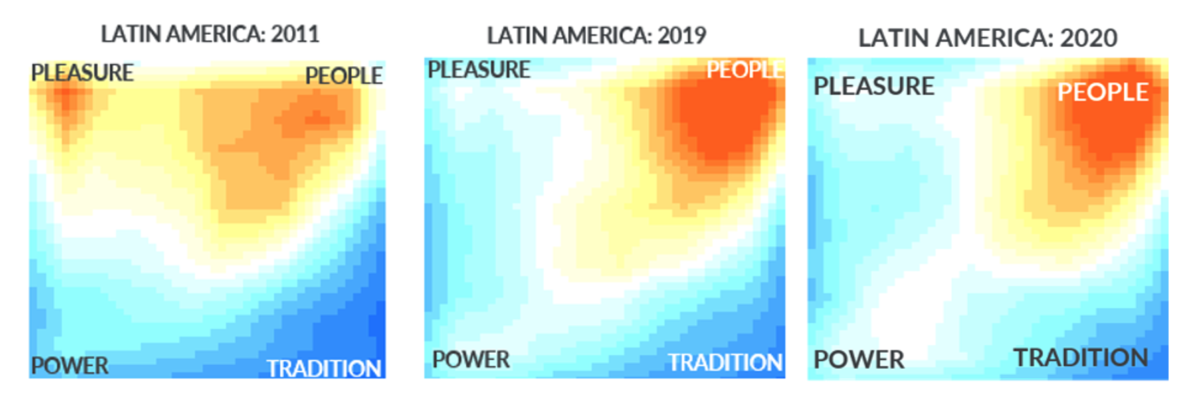

- Finding light among chaos in Latin America. In the face of social and economic volatility, Latin Americans’ confidence is rebounding. Rising tolerance, optimism and willingness to work for social change will define the future of the region despite crisis. Brands must develop creative solutions to ease social and economic strains across different countries in this region, recognizing that each one has a distinct set of circumstances and challenges.

If you are interested in more content on the Latin American region, please make sure to join ESOMAR Latin America Insights Festival broadcast on the 19 – 21 October 2020. (ed.)