Scene: A commercial begins with a litter of puppies moving playfully about, in the spacious third row of a new SUV. Who wouldn’t love this? Well actually, not everyone sees this in the same way. Ethnography, more well known as “thick data” suggests that we all have our own stories that are rooted in our past, our current experiences, and the ways in which we perceive the world around us. Tricia Wang, a leader in the ethnography field explains on medium.com (January 20, 2016) that thick data:

- Relies on human learning

- Reveals the social context of connections between data points

- Accepts irreducible complexity.

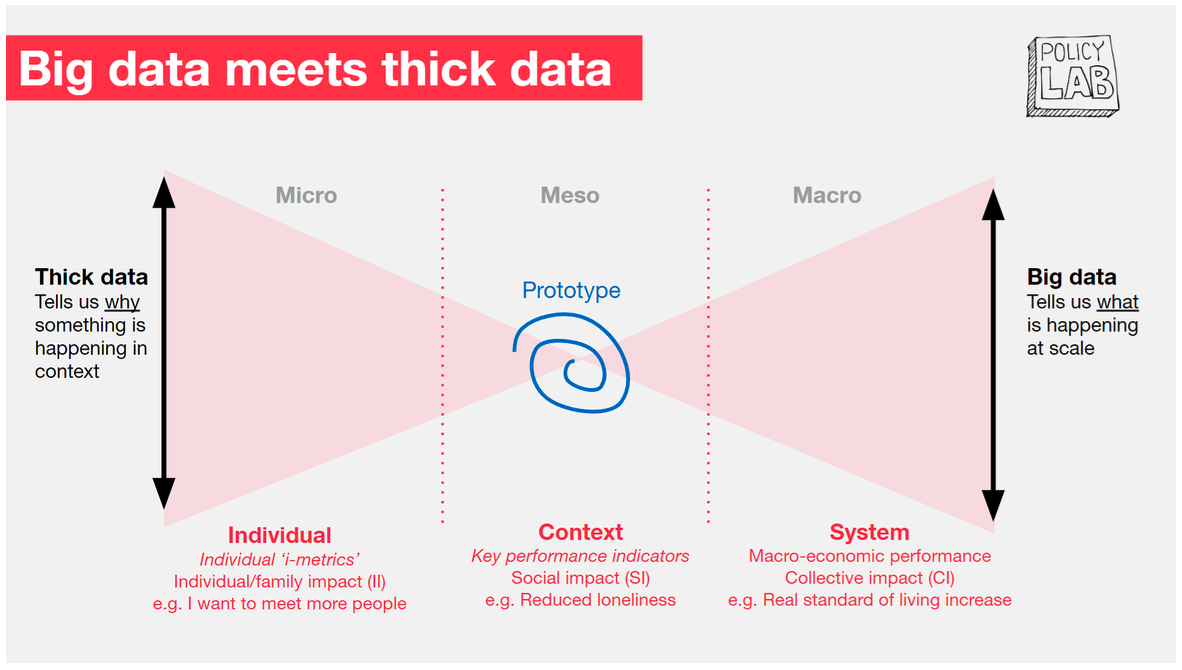

“For businesses to form a complete picture, they need both big and thick data because each of them produce different types of insights at varying scales and depths.”

I have significant experience in the automotive marketing space. My roots are in BIG data, leveraging psychographic, lifestyle and demographic information as a means for connecting with consumers. What makes people buy the car, truck or SUV that they choose? In the NY Daily News (March 4, 2016), it apparently comes down to 10 factors.

- Expected reliability

- Exterior styling

- Previous experience with brand/model

- Reputation/reviews

- Ride and handling

- Price/payment

- Safety

- Fuel Economy

- Quality of workmanship

- 4WD/AWD

But are these 10 factors all there really is to it? Imagine if we could take features/benefits just one step further…not only to understand the depth of stories that exist within and across each feature/benefit (likely tens of thousands)…but to identify NEW and emerging stories that explore additional themes. Automakers could use this approach to leverage thick data to understand critical insights into what consumers truly want.

One obvious path is to create representative groups of consumers who value at least 1 of the 10 features/benefits we know about today…conduct meaningful primary research…and listen closely for emerging themes.

Aren’t most automakers competing at the features/benefits level? When product quality becomes ubiquitous, companies become more reliant on the remaining 3Ps: price, placement (direct to customer delivery) and promotion. However, it doesn’t have to be this way. Enter, the customer experience. In other words, cue the fun ethnography soundtrack. What is important to YOU in shopping for a new or pre-owned vehicle is likely not the same for ME. Certainly there are similarities, but there are a multitude of differences.

And how frequently does consumer opinion change? Beyond product recalls, poor branding or lifestyle marketing decisions, certain products & solutions simply go out of style/fad, and occasionally become obsolete. Sedan sales are a fraction of what they were just 10 years ago. Most marketers are able to deploy social listening to get an early read on these issues.

So how do we address most individuals… where we don’t know their ethnography? Not EVERYONE’S story is well understood. Similar to multi-cultural marketing, this is where many data scientists and analysts make poor decisions by “predicting”, “clustering” and “classifying”. This is where the safer route is to market features/benefits (leveraging “big” data) that resonates amongst larger majorities or populations of customers or prospects. But big data while omnipresent is also known as “thin data”, since it gives less insight into how to break through the clutter. THIS is what makes ethnography a true differentiator. IF YOU KNOW the story that resonates with an individual customer, this can create a deeper connection, one that resonates beyond a feature or a benefit.

In fact, automakers are attempting to connect with consumers during this unprecedented time by going beyond selling automobiles…where we see evidence of manufacturing plants being retooled to produce ventilators (Ford and General Motors), and face shields (Kia). Social sentiment suggests that this is meaningful for some consumers at a core value level. What is also important to note here is that this is likely not meaningful for all consumers. While working at Toyota in the mid-1990s, I will never forget a focus group response from one of our Lexus customers. “Do I feel loyalty to Lexus as a company? Well honestly no. I am barely even loyal to my own dog.” Remember the puppy commercial?

In conclusion, there are substantial opportunities here for automotive (and other industry) marketers willing to invest the time and effort in ethnography:

- To understand how/why the purchase experience becomes personal for an individual shopper. Automakers CAN improve the sales (and service) experience!

- To uncover those themes that are emerging as the most meaningful for your customers. As COVID-19 continues, will anti-bacterial materials become important? How can you get ahead of a competitor with features/benefits that appeal to a large portion of the population? Innovation comes from thick data.

- If you don’t seek thick data, you are forced to guess what matters most to your customers…through techniques like K-means clustering. Using thin data will certainly lead to erroneous conclusions. We must work harder to make every interaction (e.g. website or dealership visit) count!

2 comments

I agree. It is about combining the WHAT, WHEN, WHERE and HOW OFTEN, stemming from Big Data, with the WHY and HOW stemming from Thick Data. Both combined gives you the full Picture and you can make sure that you rely on the Facts and not on the Guess. That’s why Analytics and Market Research should walk hand-in-hand and not in a competitive manner

Thanks Alexander!