By Michalis A. Michael

It took a bit longer than intended to write this next article on social media listening for Market Research. This is a continuation from where we left it in the previous article: “Walking the Talk”. In that article, we explained how we harvested posts from social media for 29 companies in the market research space, how we eliminated the noise, and which topics were most popular.

Now we are finally ready to talk about sentiment for these companies – and by extension, the market research industry – during the period of time covered by the data (Jul 1st – Dec 31st 2015). What we are discovering for the first time is that our industry is one of those that do not actually trigger a lot of strong sentiment:

For all 29 brands: 91% of the posts were classified as neutral, 6% as positive and 3% as negative.

You may remember from the previous article that half of the posts are simply reporting on results of market research projects conducted.

We probably need to clarify that when running social media listening analytics, we have the option to report a) sentiment towards the brands included in the competitive set of the product category we harvest for OR b) the general post sentiment regardless of association with the brands in the category that are being mentioned. In this case, we went for the former: sentiment towards the Market Research brands (companies). If we were to take the ~284,000 posts about published market research results and analyse them completely disregarding the brands, we would probably find more negative and positive sentiment, depending on the results of each research project.

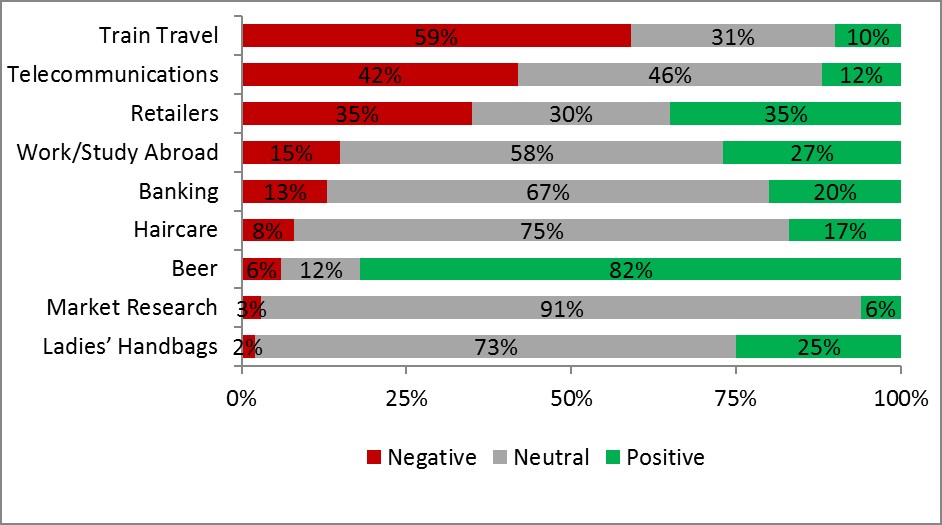

Before looking into differences between market research agencies, let us first check how market research industry compares with other industries when it comes to sentiment. We will use the chart shown in one of the previous articles:

Figure 1: Sentiment by industry

It fares better than most other industries when it comes to the % of negative posts, but it also has fewer positive posts than others.

It is clear that if you are in the luxury goods or alcohol industry, you are more likely to attract a higher share of positive posts. Not surprising, as these industries are dealing in desirable and aspirational products and brands usually associated with fun and having a good time.

On the other hand, if you are in service industries, you are content with being the lesser of many evils… These industries are in an unenviable position – if they are providing the service, there is nothing to post about; that changes quickly when they are failing, especially as our day to day lives depend a lot on them doing their job right.

Coming back to the market research industry and the results of our study:

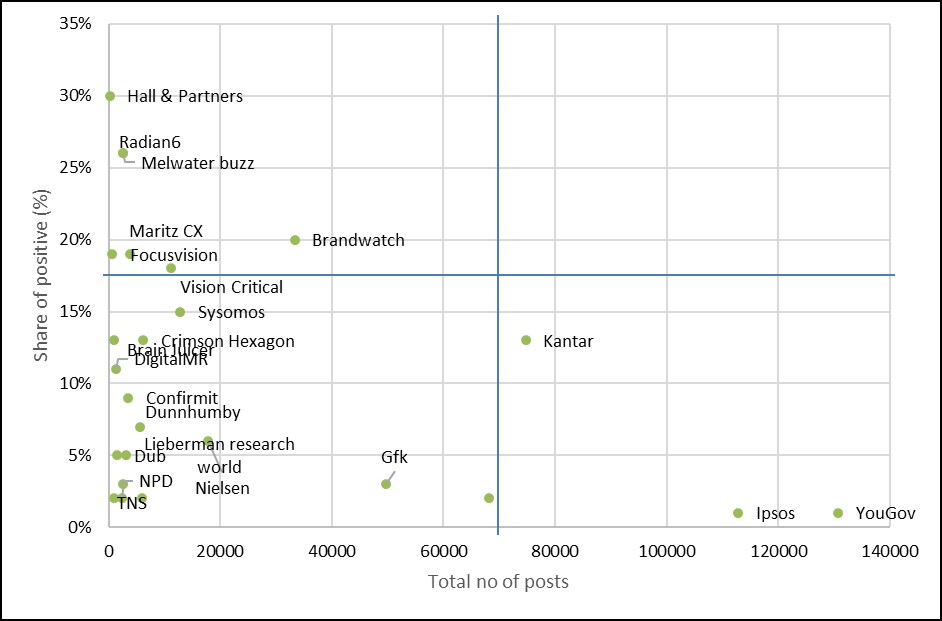

The top brand in terms of positive share of sentiment is Hall & Partners, with 30% positive share, out of a low total number of posts (180) during the 6 months analysed. Looking at the share of sentiment within the total number of posts for a brand can be very misleading if we do not take the total buzz and the share of this brand out of the total dataset into consideration. In this case Hall & Partners is almost irrelevant in online conversations. It is a lot easier to get 30% of 180 posts to be positive than it would be to get 30% of >130,000 – the number of posts that mention YouGov (they have only 1.5% positive share).

Figure 2: Positive sentiment and number of posts by brand (Jul-Dec 2015)

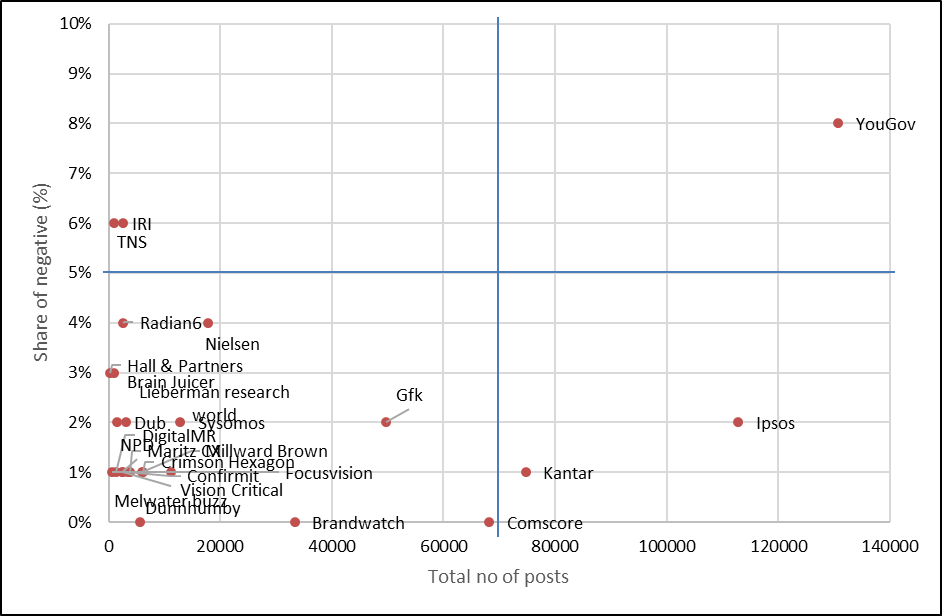

In terms of negative share of sentiment, YouGov is leading the pack with 8%. The opposite logic applies here: the more popular a brand is in online conversations, the more probable it is to receive more negative posts than other brands. Having said that, there are always exceptions to this kind of rules, and it usually depends on the product category, the brand, and their marketing activity.

Figure 3: Negative sentiment and number of posts by brand (Jul-Dec 2015)

When we look at the sentiment by topic discussed, Online Research has the highest positive share with 16%, and Traditional Market Research has the highest negative share with 7%. This is not an unexpected result, at least not to us, since a lot of practitioners have started doubting the applicability of traditional market research in a digital economy. Subsequently, online research is gaining share and popularity among clients and agencies alike.

The biggest question of this analysis is: what can we do as an industry to engage people in conversations online? When we do, we obviously want to evoke positive emotions about the usefulness and merits of market research. Should we be pleased with only being relevant to large businesses or can our industry have a function for smaller companies and households? Maybe social media are offering us a chance to get involved with the consumer, to appeal to them with things like: ‘we can make your voice heard so that products and services that make your lives easier and better will be developed’. If you have a view on whether market research should treat consumers also as its customers – not just as respondents, participants, and contributors – please share it with @DigitalMR_CEO or @DigitalMR and become part of the online conversation.